In 2018, the FTC permitted “a mineral consisting essentially of pure carbon crystallized in the isometric system” to be described as a “diamond,” whether naturally occurring or man-made. Ever since then, the jewelry establishment has been erecting barriers of entry for lab-grown diamonds into their lucrative $84 billion global market.

The Natural Diamond Council established the official party line, declaring “Crafted by nature over millions of years, natural diamonds are inherently valuable, rare and precious.” Lab-grown diamonds, by contrast, are cheap manufactured substitutes whose value is “tied strictly to the cost of production” and therefore have no lasting value.

With the most to lose, luxury brands, including Bulgari, Cartier and Tiffany (now an LVMH brand), stood firmly behind that barrier and held only natural diamonds were luxury.

But now the walls have been breached with LVMH Luxury Ventures, along with other investors, having completed a $90 million investment round in Israel-based Lusix, a pioneer in the lab-grown diamond (LGD) industry.

Lusix joins MadHappy, Gabriella Hearst, Versed and Stadium Goods in LVMH Luxury Venture’s portfolio. Its investment priorities are clear: seek out brands at the forefront of emerging trends and innovation in the luxury market.

Specifically, it invests in “Iconic luxury brands, recognized for their distinctiveness and the quality of their products and services, with significant growth potential.”

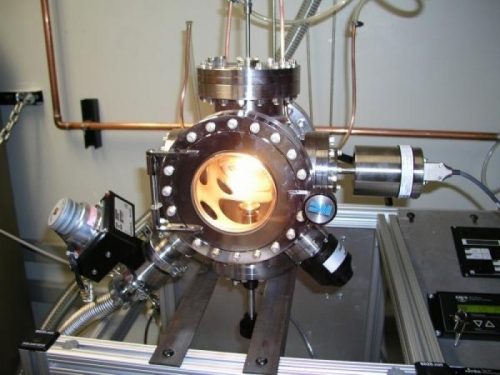

Lusix fits the bill. It is the LGD industry’s first 100% solar-powered diamond producer with its stones sold under the “Sun Grown Diamond” brand. It can grow both clear and custom-colored rough stones in its large-scale reactors and it is one of the industry’s leading producers of premium-quality diamonds.

“LVMH’s investment in the lab space is a statement that lab-growns are going into luxury in a big way,” shared Marty Hurwitz, founder of The MVEye, a research firm specializing in the jewelry market.

“Right now demand for lab-grown diamonds is through the roof and the only thing holding it back is supply. LVMH investment in Lusix will give them secure access to premium-quality supply,” he continued.

Lusix’s technology edge made it particularly attractive to LVMH. The company was founded by Benny Landa, who made his name advancing digital printing technology with his Indigo Printing Company which was eventually sold to Hewlett-Packard in 2002.

He then formed Landa Group, and under that Landa Labs, to explore nanotechnology research and applications. Lusix was spun-off in 2016 as a separate business headed by Landa and co-founder Dr. Yossi Yayon with a Ph.D. in physics and post-graduate work at the University of California, Berkley.

The $90 million investment will be used to bring a second 100% solar-powered facility online this summer.

Landa said in a statement, “We are thrilled and proud to welcome such high-profile investors, most notably LVMH Luxury Ventures, bringing their financial support and valuable industry insights. Their help will contribute greatly to our company’s success while the implications of this investment, both for LUSIX and for the lab-grown diamond segment, are profound – and so exciting!”

Without a doubt, this is exciting news for the entire lab-grown diamond industry which today is estimated to total just under $6 billion and before this announcement was predicted to double in size by 2025.

With LVMH now giving its official luxury imprimatur to lab-grown diamonds, it is safe to bet it will grow even faster than that.

“Lusix is going to double its production by 2023 which will accelerate the market even faster,” Hurwitz shared.

In a final note, Frédéric Arnault, LVMH CEO Bernard Arnault’s 27-year-old son and head of its Tag Heuer brand, was likely instrumental in getting his father to take a closer look at LGDs. Earlier this year, Tag Heuer introduced its first watch featuring lab-grown diamonds at the super-luxury price of $360,000.

“It’s not about replacing traditional diamonds with lab-grown diamonds,” he shared with Vogue Business. “We use what’s different and inherent to this technology, allowing us new shapes and textures.”

Frédéric understands what the next-generation luxury consumers want and that is being given the choice between natural diamonds with their attendant environmental challenges and lab-grown diamonds that are renewable and can be produced without the high environmental price tag.

Plus, consumers can get a bigger and often better quality stone at a lower price. That’s the kind of choice everyone wants.

Source: DCLA