Rio Tinto is auctioning its final collection of rare diamonds from its closed Argyle mine in Australia and the soon-to-shutter Diavik operation in Canada.

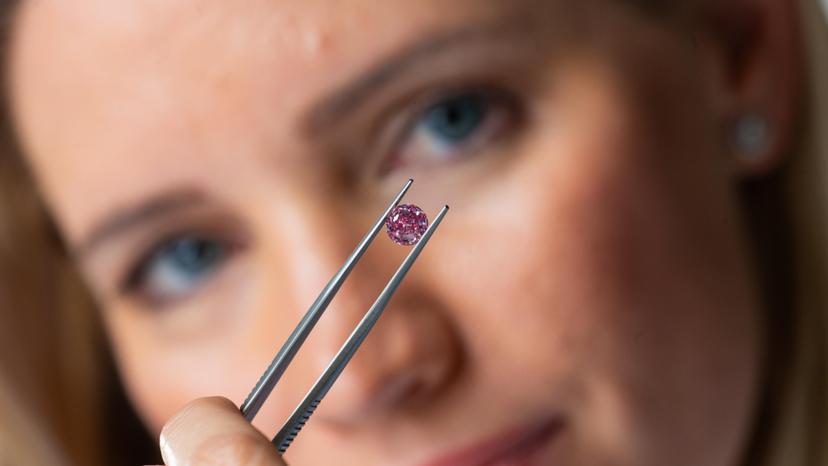

The tender, called Beyond Rare, includes 52 lots totalling 45.44 carats and marks the end of an era for two of the world’s most celebrated diamond mines.

The centrepieces are six diamond sets selected to represent the peak of production from the East Kimberley region of Western Australia and the Northwest Territories of Canada. The tender also features 39 individual stones and seven curated sets.

Rio Tinto Diamonds’ general manager of sales and marketing, Patrick Coppens, called the auction a historic moment. “It is hard to overstate the importance of this final collection,” he said in the statement. “No other mining company in the world has custody of such an exquisite range of diamond colours, shapes and sizes.”

Rio Tinto closed Argyle in 2020, ending production of the famed pink, red and violet stones that made the mine world-renowned. Although Argyle accounted for about 75% of Rio’s diamond output, the impact on the company’s earnings was minimal, with diamonds contributing only about 2% of revenue. Diavik, the miner’s last diamond asset, is scheduled to close in 2026.

The collection includes one GIA Fancy Red diamond, 12 Fancy Violet, and 76 Fancy Pink and Purple-Pink stones from Argyle’s legacy inventory. From Diavik, highlights include two flawless D-colour white diamonds, an emerald cut weighing 5.11 carats and a pear shape of 3.02 carats. Both of them were cut from the same rough stone.

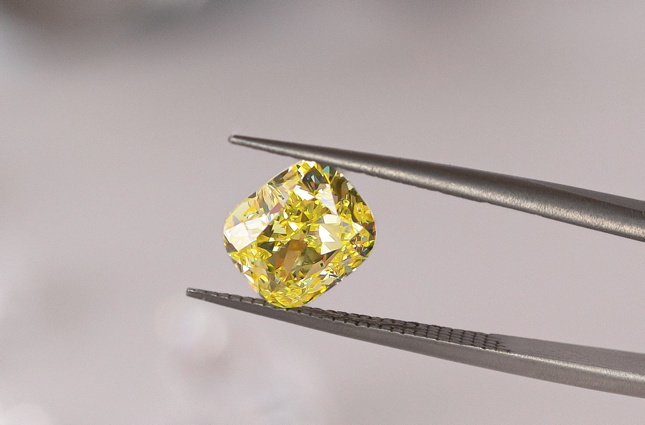

The tender also features a Fancy Vivid Yellow diamond weighing 6.12 carats.

The diamonds will tour Hong Kong, Australia and Antwerp before bids close on October 20. Industry insiders expect strong competition from top jewellers, collectors and connoisseurs.

Source: Mining.com