It’s hard to believe that COVID first hit just over three years ago.

After the original shock that the pandemic caused, especially when lockdowns were put in place in large parts of the world in early 2020, markets, rather than continuing to crash, instead surged higher.

Stimulus programs from both central banks and central governments, which were enormous in scope, were the primary cause of this surge, with the vast quantity of dollars fed into the system leading to one of the biggest rallies in the share market, cryptocurrencies, and even real estate on record.

Since late 2021 it’s been tough going though, with the last twelve or so months particularly challenging for most investors.

Many seemingly don’t know what to do, with survey data suggesting many are stuck in terms of ideas, a subject we discuss below.

There are however always a select group of investors who do get ahead of the curve, recognise changing patterns for what they are, and act accordingly.

We think pink diamond investors fit that mould, and despite the current economic climate and investor hesitance, we’ve seen a continued appetite for pink diamonds first hand.

This is something we expect to see continue across the course of this year, as more and more investors seek exposure to this niche asset class, which has proved quite lucrative for many.

Investor uncertainty in challenging market

In early February, we read an interesting report containing six insights into the way Australians invested their money in 2022.

As we alluded to in the introduction to this week’s update, last year was very challenging for investors, with stock markets plunging quite rapidly at one point (on this note, while the Australian market fell, it fared better than most), cryptocurrencies falling by more than 50% in most cases, and even real estate turning south, with the Australian property market now on track to see its biggest decline in decades.

We also saw the return of inflation, which soared beyond 5%, and in some developed countries beyond 10%, in the fastest pace of consumer price rises seen in decades.

What did investors do in response?

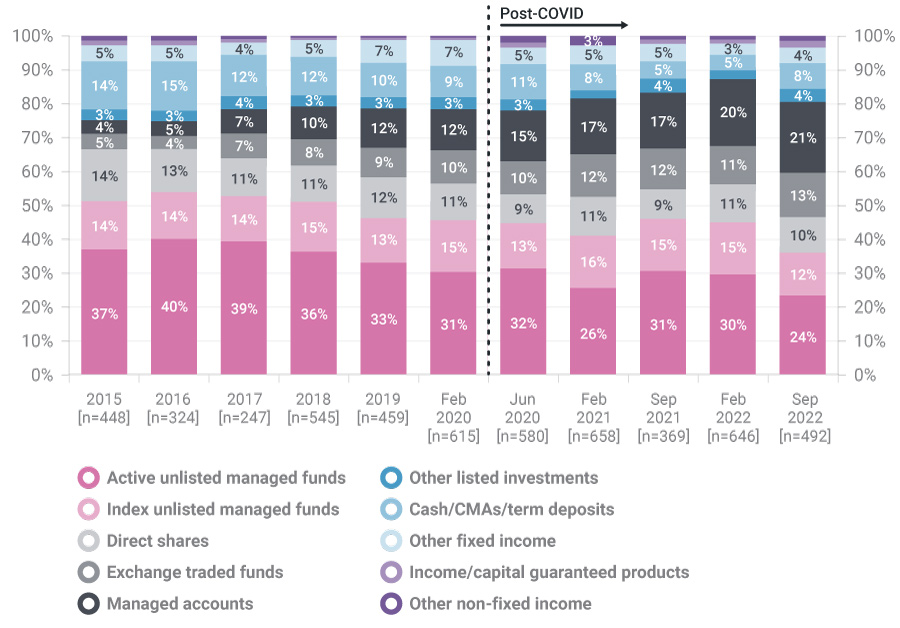

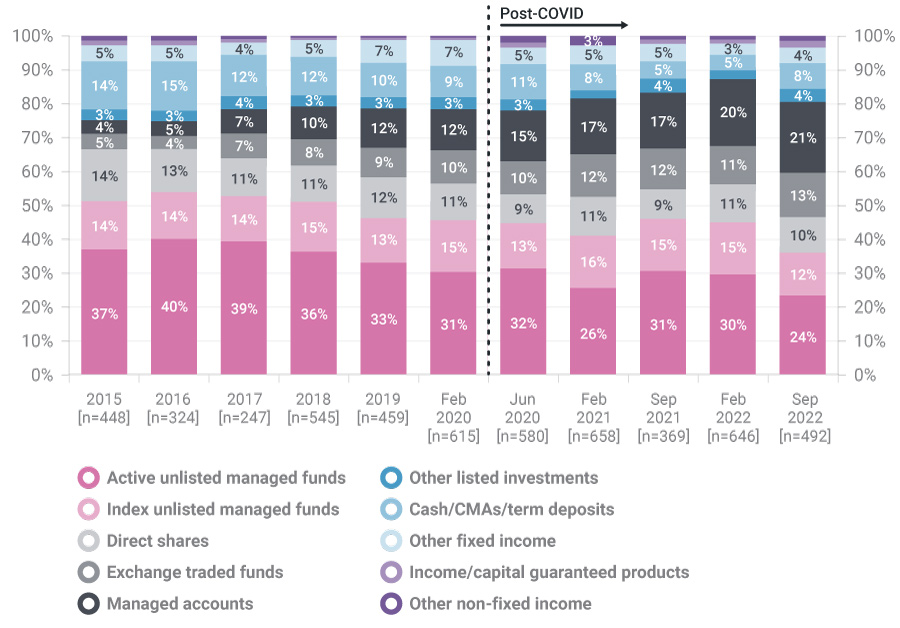

Turns out much of the same, with the following chart showing that despite a few tweaks, they kept investing money in pretty much the same way they always have.

Trend: Allocation of new client inflows

In the last year, roughly what proportion of the new client inflows you advised on went into each category? Averages among financial advisers.

Source: Investment Trends 2022 Managed Accounts Report – Investment Trends.

The only notable change looking at this, and other data in the article was an influx of money into fixed income and cash ETFs, presumably due to the higher interest rates that started to flow through across 2022.

While that’s understandable, given rising inflation, those cash and fixed income assets also lost value last year, failing to act as a safe haven in any meaningful way.

The only investors that thrived last year were those who looked through the conventional wisdom on how to invest (i.e. keep nearly all your money in stocks, bonds and real estate), and instead sought out alternative assets, which can continue to thrive in more difficult environments.

Pink diamonds were obviously one such asset, with prices continuing their steady performance all of last year, helped by the continued focus that this asset class has generated since the closure of the Argyle mine in late 2020.

With prices up more than 50% in the last two years, they are one of the few assets that have prospered throughout the entire COVID era and its aftermath, with strong supply/demand fundamentals set to support pink diamond prices, in 2023 and beyond.

Interest rates continue to climb

The Reserve Bank of Australia (RBA) met for the first time earlier this week, and as most analysts expected, they raised interest rates by 0.25%.

The increase, which marks the ninth meeting in a row that they’ve increased rates, with the official cash rate now sitting at 3.35%.

They likely have a way to go too, with the RBA at pains to point out that higher rates will likely be required to contain inflation rates which continue to surprise to the upside.

Indeed, some commentators now think that the RBA will continue to hike for most of the year, with the cash rate likely to climb beyond 4% before peaking, which will only exacerbate the pain felt by a lot of mortgage holders sitting on large debt piles.

This pain is beginning to show up in both soft and hard economic data, with retail sales now falling, while consumer confidence in Australia is plunging.

It’s also worth noting that given current inflation levels, even if the RBA does hike rates to 4%, the ‘real’ return (i.e. the rate one earns after inflation) on cash is likely to remain negative, for the foreseeable future at least.

This should help be bullish for investment demand for alternative assets, especially with home prices falling, and the share-market struggling.

Pink diamonds are set to be a particular beneficiary of this trend, as indeed they have been for some time, given their extremely limited supply, their strong performance track record, and their inflation hedging qualities, with all of these factors regularly coming up in the conversations that the team at Australian Diamond Portfolio have with our wonderful client base on an ongoing basis.

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Source: DiamondPortfolio