Tiffany & Co. hasn’t had any trouble getting men to come shop for the ladies in their lives.

Now the jeweler behind those iconic blue boxes wants them to stay and peruse … for themselves.

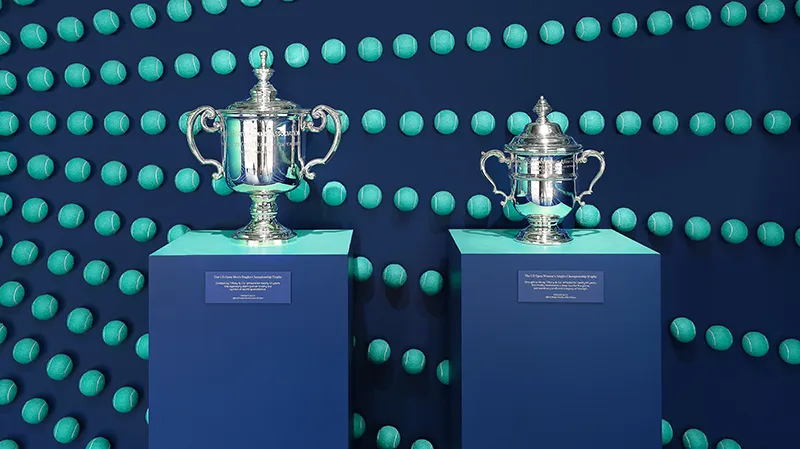

Tiffany is rolling out its first comprehensive jewelry line for men, the company announced Thursday, in a bid to attract younger shoppers and reverse declining sales. Come October, the collection will include nearly 100 designs, some of which will fetch prices as high as $15,000. Tiffany also plans to add home furnishings and accessories, such as ice tongs and beer mugs, with male customers in mind.

But retail experts say it could be a tough sell. The glitz and glamour of Tiffany has long been tied to feminine jewelry (along with Audrey Hepburn’s soft smile and bejeweled neck).

Rolling out masculine designs are one thing. But getting male customers in the door and with themselves in mind is quite another.

“[Men] still see Tiffany as a female-based proposition, just because of its heritage and even things like the color of the boxes,” said Neil Saunders, managing director of research firm GlobalData Retail. “It could be quite difficult for them to really persuade male customers that they have something to offer and that is relevant to them.”

Reed Krakoff, Tiffany’s chief artistic director and who developed the collection, told the Associated Press that the new line will get its own floor space in Tiffany’s 300 stores, rather than being sold alongside other merchandise.

“Men all over the world are wearing jewelry and more accessories as part of a wardrobe,” Krakoff told the AP. “You started to see it on the runways, in social media.”

Krakoff said that men’s merchandise hasn’t historically been a large focus for Tiffany. But the company saw an opening given that half of the company’s global customers are men, most of whom come into Tiffany to buy women’s jewelry.

“We have a captive audience,” Krakoff said.

Mark Cohen, director of retail studies at Columbia Business School, gave credit to Tiffany for trying to become “more relevant” and less reliant on its aging “legacy customer.” That is key when younger shoppers “aren’t responding the way their parents did in terms of their affection for fine jewelry.”

But Cohen was skeptical that there was much Tiffany could mine in the men’s jewelry business. Gem stones and diamonds may glisten on the runway. But they do not carry the same currency for the average Joe.

“I just don’t see it as a meaningful business,” Cohen said. “To think this is going to be some sort of windfall — it’s just not going to happen.”

It is not just a lack of male foot traffic that has unsettled Tiffany. In November, company shares plummeted after Tiffany reported weaker-than-expected sales. Chief executive Alessandro Bogliolo said at the time that tourists, and specifically Chinese tourists, were traveling less, dampening sales in places like New York and Hong Kong. (Bogliolo said business in China was still strong, reaching double-digit sales growth throughout 2018.)

Though the fine jewelry market for men climbed to $5.8 billion worldwide in 2018, according to the market research firm Euromonitor International, it still lags far behind the $33.2 billion women’s market.

Saunders pointed to the athleisure brand Lululemon as a company that successfully pivoted from a mainly female audience and got more men in to shop. But Lululemon’s challenge was, in some ways, simpler to overcome, Saunders said. Lululemon does not carry the same “heritage” as Tiffany and could more easily persuade men to buy comfortable, practically gender-neutral workout clothes — not expensive bling.

Still, Tiffany has at least one major advantage: Even if men are not shopping for themselves right now, they are already inside and at the counter. Alexis DeSalva, a senior analyst of retail and e-commerce at Mintel, said Tiffany does not have to go after an entire new bucket of customers and woo them inside.

Rather, Tiffany can focus its pitch on existing male customers. Better yet, it can spread the word to its female fans who will then talk up the new line to male friends and family.

“Part of [Tiffany’s] legacy is on the service they offer,” DeSalva said. “They need to hone in on that and make sure they’re communicating [to men], ‘Hey, we have something for you too.’”