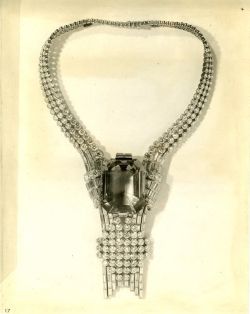

When evaluating contenders for the high jewellery watch category, brilliance alone is never enough. True excellence lies in the seamless fusion of exceptional gem-setting and serious watchmaking, where artistry and mechanical innovation speak with one voice. As a watch-focused publication, the benchmark is uncompromising — and this year, Tiffany & Co. has met it with remarkable confidence.

The Tiffany & Co. Bird on a Flying Tourbillon – Azure Blossom stands as a masterclass in this rare union. At first glance, the eye is drawn to the diamond-set bird, poised delicately on the edge of a flying tourbillon and surrounded by a vivid garden of appliqué lacquered blossoms. While the watch builds upon Tiffany’s inaugural flying tourbillon introduced last year, this Azure Blossom interpretation elevates the concept into the realm of true high jewellery horology.

The timepiece is a showcase of the maison’s virtuosity across multiple crafts: champlevé enamelling, lacquer work, miniature gold sculpture and, most notably, diamond setting — an area in which Tiffany & Co. has long reigned supreme. In total, the watch is set with 771 diamonds in a variety of cuts and sizes, a process that demanded over 100 hours of meticulous hand-setting. Snow setting dominates the dial and case decoration, a technically exacting method that renders the metal nearly invisible, allowing the diamonds to appear as if floating on the surface.

What truly distinguishes the Bird on a Flying Tourbillon – Azure Blossom is its unwavering connection to Tiffany & Co.’s design heritage. The sculpted bird is a direct reference to the legendary Bird on a Rock brooch, created in 1965 by Jean Schlumberger. Handcrafted from 18K white and yellow gold, the bird is set with 70 diamonds, contributing to a total diamond weight of 3.8 carats across the piece.

While Schlumberger’s bird remains eternally poised, the mechanical theatre beneath it is anything but static. The flying tourbillon completes a full rotation every 60 seconds, capped by a wafer-thin sapphire dome that is faceted like a diamond and rotates in perfect synchrony. The result is a hypnotic display of motion, light and depth.

Powering the watch is the Artime Calibre AFT24T01, a movement finished entirely by hand to the highest standards of haute horology. Bevelled edges, satin-brushed surfaces and mirror-polished components are complemented by diamond-set decorative plates. Two high-polished star-shaped bridges — a subtle nod to Tiffany’s iconic six-prong diamond setting — anchor both the tourbillon and the hours-and-minutes display, reinforcing the maison’s visual identity at every level.

Ultimately, the Bird on a Flying Tourbillon – Azure Blossom triumphs not through spectacle alone, but through coherence. Every element — from gem-setting to movement architecture — speaks the same refined language, one deeply rooted in Tiffany & Co.’s heritage. In a category that demands both poetry and precision, this extraordinary timepiece delivers both with rare elegance.

Source: DCLA