The U.S. Open may be best known for its high-intensity rallies and dramatic tiebreaks, but this year, Tiffany & Co. has ensured the spotlight also falls on sparkle. At the 2025 tournament, the jeweller unveiled an exclusive pop-up installation at the USTA Billie Jean King National Tennis Center, highlighted by a diamond-encrusted tennis racket.

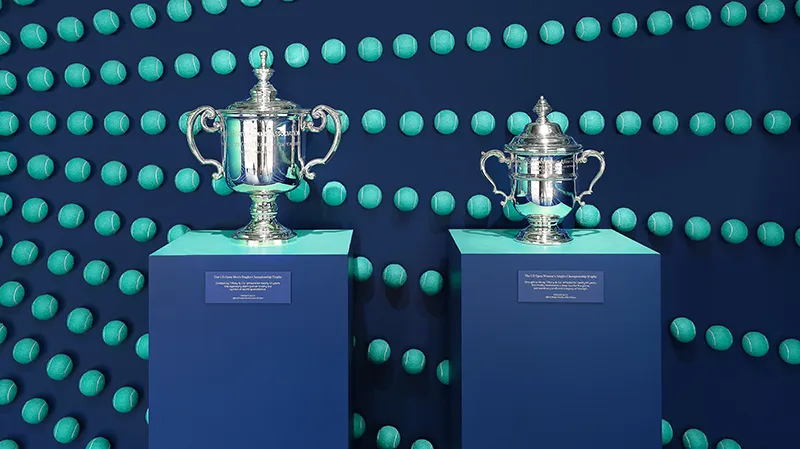

Positioned at Fountain Plaza, the immersive Tiffany space is unmistakable, marked by a striking oversized Tiffany Blue tennis ball. Inside, visitors are met with the U.S. Open Championship Trophies—the Men’s and Women’s Singles Cups—each meticulously handcrafted in Tiffany’s Rhode Island workshop. These sterling silver pieces, produced by master silversmiths since 1987, require approximately six months of labour, with more than 60 hours dedicated to precision engraving and finishing.

The Diamond Showpiece

The centrepiece of this year’s display is the Tiffany HardWear tennis racket, adorned with nearly five carats of diamonds across its face. It is accompanied by a 24-karat gold vermeil tennis ball, embellished with a further seven carats of diamonds. While hardly designed for a match on Arthur Ashe Stadium, the pairing reflects Tiffany’s blend of craftsmanship, innovation, and luxury—an exercise in artistry rather than athletics.

Heritage Meets Modern Spectacle

Tiffany & Co.’s long-standing association with sporting excellence is well established. Beyond its near four-decade legacy of producing the U.S. Open trophies, the house also crafts other icons of American sport, including the NFL’s Vince Lombardi Trophy and the NBA Finals’ Larry O’Brien Championship Trophy.

Yet this year’s U.S. Open activation goes beyond tradition. In collaboration with Meta, Tiffany has introduced an AI-powered digital experience, allowing fans to virtually place themselves at centre court, holding a championship trophy for a keepsake “trophy selfie.”

Diamonds in the Spotlight

The Tiffany pop-up runs throughout the tournament until 7 September, giving both tennis enthusiasts and jewellery aficionados an opportunity to step into Tiffany’s world of diamonds and silverware. The installation serves as a reminder that while the U.S. Open celebrates grit and athletic achievement, glamour and craftsmanship continue to share the stage.

Source: DCLA