After three challenging years marked by geopolitical disruption, shifting trade routes, and weakened consumer confidence, the global diamond industry is beginning to stabilise and recover. While price volatility persists in certain segments, demand is gradually rebuilding, particularly across the world’s primary luxury markets. Industry professionals broadly agree that the recovery remains uneven, but the direction is clear: a slow yet meaningful turnaround is underway.

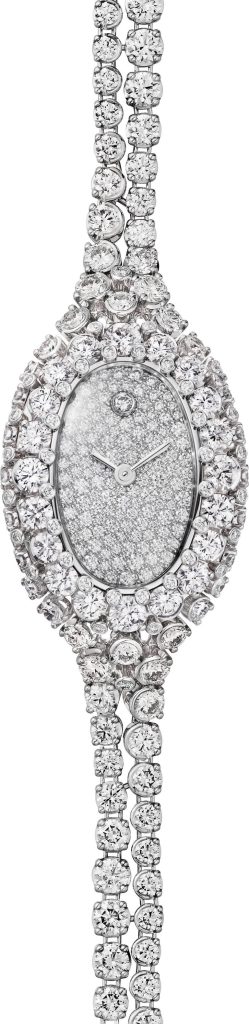

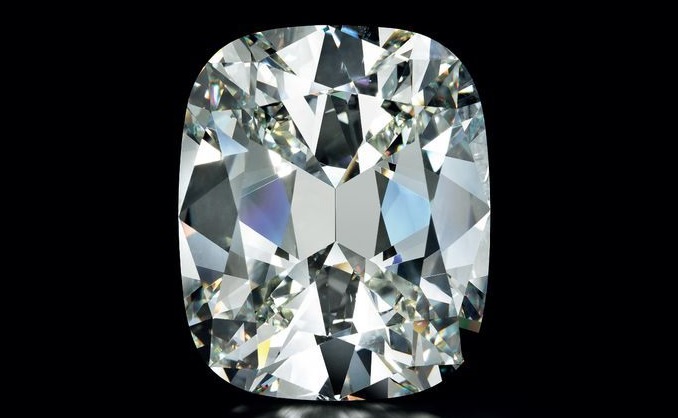

Senior figures within the international jewellery trade point to improving economic sentiment as a key catalyst behind renewed interest in diamonds. Changing consumer behaviour is also playing a central role. Natural diamonds continue to dominate global engagement ring sales, retaining their status as the benchmark for long-term value and emotional significance. However, competition from lab-grown diamonds is intensifying, and the market share gap is narrowing.

In major Western markets, lab-grown diamonds are gaining traction, particularly among younger buyers who place greater emphasis on size, clarity, and price accessibility than on tradition. This generational shift is reshaping purchasing decisions and influencing how value is assessed at the point of sale.

Pricing dynamics underscore this transformation. Over the past year, prices for smaller natural diamondsespecially those under one carat have experienced notable declines. At the same time, lab-grown diamond prices have fallen even further, driven by rapid technological advancements and expanding production capacity. Together, these opposing movements have redefined the competitive landscape, prompting consumers to compare value propositions more closely than ever before.

While challenges remain, the combination of stabilising demand, evolving consumer preferences, and market-driven price realignment suggests the diamond industry has entered the early stages of recovery, with long-term implications for both natural and lab-grown sectors.

Source: DCLA