The Antwerp World Diamond Centre (AWDC) has publicly expressed frustration over the stalled $100m-plus global campaign to promote natural diamonds, agreed in Angola almost four months ago.

It says there is no time to waste in implementing the breakthrough Luanda Accord, in which African diamond producers pledged one per cent of their rough export sales to fund promotions by the Natural Diamond Council (NDC).

They call on producer nations, the NDC, and industry partners worldwide to take the next decisive step: to release the pledged funds, to activate the agreed framework, and to begin the campaign.

“Luanda was supposed to be the turning point,” say AWDC chairman Isi Morsel and vice chairman Ravi Bhansali (pictured) in a hard-hitting open letter published today (9 October). “It can still be – but only if we move from promises to action.

“The agreements are signed. The budgets are pledged. Yet implementation has stalled. The funds have not been transferred. The campaign has not begun. And the clock is ticking.”

The Luanda Accord, described as a potential turning point for the sector, aims to rebuild consumer trust and interest in natural diamonds over lab growns, by emphasizing their origin, authenticity, and community impact.

“We understand that bureaucratic processes take time,” say Morsel and Bhansali in their letter. “But time is exactly what we do not have. Every delay weakens the credibility of the commitment we all made together.

“Let us be clear: this is not about assigning blame. It is about living up to a collective commitment. We therefore urge all signatories to the Luanda Accord – producer nations, the Natural Diamond Council, and industry partners worldwide – to take the next decisive step: release the pledged funds, activate the agreed framework, and begin the campaign.”

Full text of the letter:

Luanda Was a Breakthrough. But Diamonds Can’t Wait Forever.

By Isi Morsel and Ravi Bhansali – Chairman and Vice Chairman, Antwerp World Diamond Centre (AWDC)

A few months ago in Luanda, something remarkable happened.

For the first time in decades, our industry stood united – producers, manufacturers, traders, and policymakers. Africa’s leading diamond nations. India’s powerful trade bodies. Belgium’s leadership. The UAE’s dynamic hub. We came together, and we signed.

The Luanda Accord was not just another declaration. It was a concrete commitment to act – to protect and promote the story of natural diamonds through a global, African led marketing initiative. Producer countries pledged to contribute 1% of their rough export revenues to a collective fund, exceeding $100 million, to be managed transparently by the Natural Diamond Council. The goal: to educate consumers, inspire the next generation, and clearly distinguish natural diamonds from synthetics.

That day in Luanda, there was real momentum. Real hope. For once, words were turning into action.

But today, four months later, that momentum is fading.

The agreements are signed. The budgets are pledged. Yet implementation has stalled.

The funds have not been transferred. The campaign has not begun. And the clock is ticking.

We are entering the most crucial season of the year – the global gifting season – when the world looks for symbols of love, authenticity, and permanence. If we don’t act now, we will miss this moment. And in our industry, missed moments don’t just mean lost sales – they mean lost livelihoods.

Because natural diamonds are not just luxury products. They are the economic backbone of producing nations. They build schools in Botswana, fund hospitals in Angola, feed families in Namibia, and provide opportunities for thousands of polishers and artisans from Surat to Johannesburg.

That is the real story of natural diamonds – a story of people, pride, and purpose. A story no laboratory can replicate.

But the world won’t hear that story unless we tell it.

While we hesitate, lab-grown diamonds are flooding the market with billions in advertising. Algorithms are replacing emotion with price. Influencers — often uninformed — are redefining the narrative in ways that undermine everything our industry stands for.

Luanda was supposed to be the turning point. It can still be – but only if we move from promises to action.

We understand that bureaucratic processes take time. But time is exactly what we do not have. Every delay weakens the credibility of the commitment we all made together.

Let us be clear: this is not about assigning blame.

It is about living up to a collective commitment.

We therefore urge all signatories to the Luanda Accord – producer nations, the Natural Diamond Council, and industry partners worldwide – to take the next decisive step: release the pledged funds, activate the agreed framework, and begin the campaign.

Luanda can still stand as a true milestone – the moment when our industry turned unity into action.

Because the diamond story is, above all, a human story. And the world needs to hear it – now.

Yours Sincerely,

Isidore Morsel

President AWDC

Ravi Bhansali

Vice President AWDC

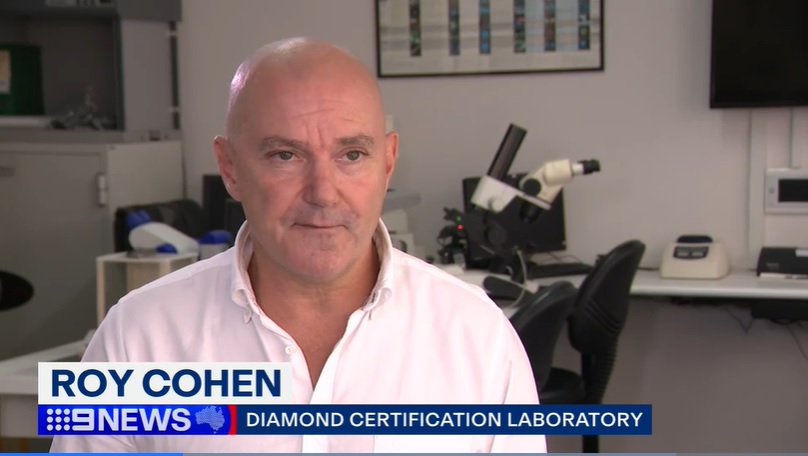

Source: DCLA