Kodak never saw it coming either.

Since early 2022, the price of polished natural diamonds has fallen approximately 40% and the industry is being buffeted by negative economic headwinds, an excess of mine supply and too much stock in the cutting centres. However, there is one statistic that cannot be ignored: around 50% of Diamond Engagement Rings purchased in the United States now contain a Lab Grown Diamond (LGD). Is this just another cyclical downturn or are we in the middle of a major structural change?

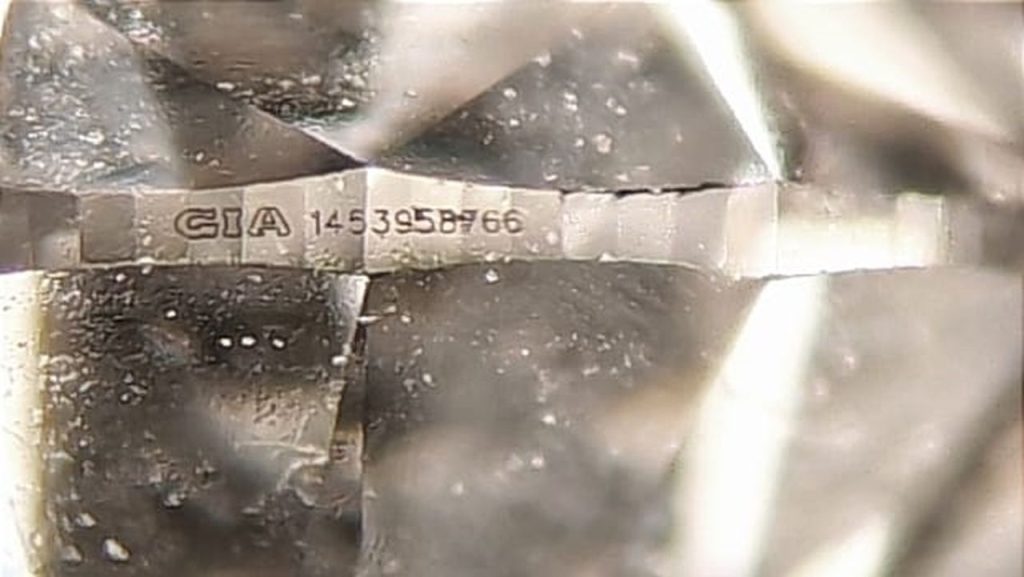

Diamonds were once the preserve of royalty and the uber-wealthy, but the diamond market has evolved over the past 80 years into more of a mass market product with democratisation of the diamond consumer. Since the late 1970s most polished diamonds below 5 carats were priced against the 4 ‘C’s’ (carat, clarity, colour and cut), which led to standardised pricing in the form of polished diamond pricing lists. Up until the turn of the century these lists were primarily available in the wholesale market, but the arrival of internet pricing soon gave the consumer access to that same standardised pricing. In a world where everyone knows the price of everything, branding is the only differentiator. Without a differentiator, commoditised products end up selling for the lowest price.

It was why one of the questions that De Beers tried to answer when it changed its business model 25 years ago was: “How do you take a necessity (the diamond) priced like a commodity and market it as a luxury priced like a brand?”

Unfortunately, that question remains unanswered. The industry did create hundreds of so-called ‘brands’; origin, cut, settings, etc; the problem was that very few of them were real “brands”. If something does not sell at a premium, it’s not a brand, and most natural diamonds sell at a discount, yet the more that the industry was unable to achieve a premium, the more it becomes fixated with talking about the “product” when the luxury world has spent the last 25 years talking about “values”.

The challenge for most jewellers is not making a sale, it is making a reasonable margin. Ask a jeweller what they are selling and if they reply “VS1, G-H colour, loose polished, 1-caraters” then the most relevant word in their business will be “discounting”, because what they are selling is a commoditised version of “crystallised carbon.” There is no differentiator.

The LGD industry realised that to succeed it simply needed to persuade consumers that natural diamonds and LGDs were the same – “optically, physically and chemically”, but to also position them as “slightly cheaper”. They could then ride on the back of 80 years of De Beers diamond advertising differentiate themselves by claiming that LGDs were “conflict free”.

A larger “ethical” LGD for the same money as a natural diamond or pay less for the same size, created a money printing machine for everyone involved. And it’s no surprise that LGDs real success has been in the United States, because historically America has always been a “discount market”, and “larger for less” plays to that tune.

If all you want in a diamond is the sparkle, then they are in essence the same. Except there is a very real difference between the two, which is why some LGD executives insist on calling natural diamonds “earth mined” diamonds, because “natural” is exactly what differentiates them. The story of their age, rarity, origin; their social and economic contribution but above all, their “social purpose”. It was the failure of the natural diamond industry to tell that story which opened the door to LGDs.

When LGD production exploded, wholesale prices collapsed to around a 95% to 98% discount to their natural diamond equivalent. Prices vary according to quality, but anecdotal evidence suggests that today in the wholesale market, it is possible to buy a single polished LGD for $150 a carat, buy in volume and its possible to pay as low as $80 a carat.

Many retailers have also dropped their LGD prices, but by no means as far, and even pricing LGD at a 20-40% discount to their natural diamond equivalent can still leave a very significant margin. Pandora will sell you a 1-carat LGD ring for $1,950. Helzberg Jewellers (a Warren Buffet company) will sell you a similar LGD for $1,999. It’s very likely that some in the LGD industry are making a gross margin of 200%, some much more for a product that Signet Jewellers sensibly cautiones it customers “Their relative abundance may not ensure the value will hold over time”.

Whatever happens to future LGD retail prices, the category has got itself into the American consumer psyche and that won’t easily change, although there are also two sides to this story. I heard of a jeweller who was recently asked by a HNWI to make a replica of her 8-carat natural diamond ring so she could wear it travelling. The original ring cost $500,000 but he sourced an equivalent LGD for $5,000, and apparently she was absolutely thrilled with it. The question is, will she buy natural again? On the other hand, if in the future a consumer could buy (for example) a 2-carat LGD engagement ring for below $200, how pleased would their fiancé be to receive it – Walmart recently had a 2-carat LGD ring for sale for only $257. How romantic!

The US bridal market (size over quality) is dominated by larger, lower quality diamonds. Since similar sized LGDs are cheaper (or you get a much better quality LGD), either that market disappears, or demand only reappears aner prices have fallen sharply (already happened). It is also likely that LGDs will replace small, lower quality natural diamonds in fashion jewellery – as they may replace the smaller stones in high-end pieces of natural diamond jewellery. Diamond mining companies whose profitability rely on these categories of diamonds probably need to find a new value proposition, or their days may be numbered.

For those in the natural diamond industry who can adapt, there is huge potential. For those that don’t, as the saying goes, “Kodak never saw it coming either”.

Except Kodak did see it coming; they just didn’t know what to do about it. Kodak was killed off by digital photography which ironically, they invented, patented, but didn’t know how to exploit it, so they franchised the technology and made a fortune until their patents expired, and then went bust. Have LGDs done the same to natural diamonds? “No”, the opposite; their success is forcing a complacent industry to change. Have they changed the paradigm? “Completely”.

Source: DCLA