De Beers, which almost single handedly created the allure of diamonds as rare, expensive and the symbol of eternal love, now wants to sell you some party jewelry that is anything but.

The company announced today that it will start selling man-made diamond jewelry at a fraction of the price of mined gems, marking a historic shift for the world’s biggest diamond miner, which vowed for years that it wouldn’t sell stones created in laboratories. The strategy is designed to undercut rival lab-diamond makers, who having been trying to make inroads into the $80 billion gem industry.

De Beers will target younger spenders with its new diamond brand and try to capture customers that have been resistant to splurging on expensive jewelry. The company is betting that it can split the market with mined gems in luxury settings and engagement rings at the top, and lab-made fashion jewelry aimed at millennials at the bottom.

“Lab grown are not special, they’re not real, they’re not unique. You can make exactly the same one again and again,” Bruce Cleaver, chief executive officer of De Beers, said in an interview Tuesday.

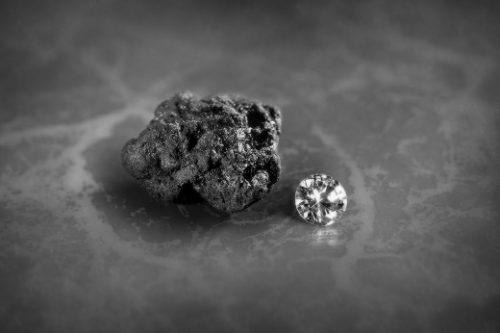

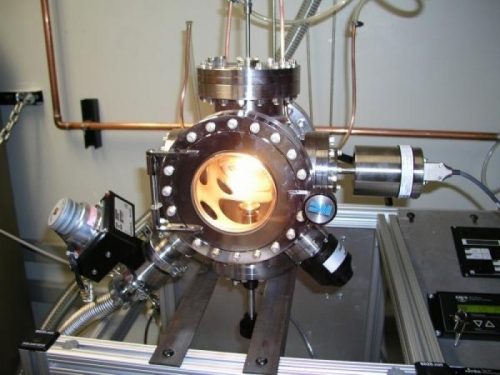

Unlike imitation gems such as cubic zirconia, diamonds grown in labs have the same physical characteristics and chemical makeup as mined stones. They’re made from a carbon seed placed in a microwave chamber and superheated into a glowing plasma ball. The process creates particles that can eventually crystallize into diamonds in weeks. The technology is so advanced that experts need a machine to distinguish between synthesized and mined gems.

A host of lab-grown diamond makers and retailers have sprung up in recent years. Diamond Foundry, one of the biggest producers, grows diamonds in a California laboratory and has been backed by Leonardo DiCaprio. Warren Buffett’s Helzberg’s Diamond Shops Inc. also sells the stones.

Customers are currently “confused” by the difference between mined and lab-produced diamonds, Cleaver said. De Beers is hoping to create big price gap with its new product, which will sell under the name Lightbox in the U.S. A 1-carat man-made diamond sells for about $4,000 and a similar natural diamond fetches roughly $8,000. The lab diamonds from De Beers will sell for about $800 a carat.

Lowest Cost

Still, De Beers says that its move isn’t to disrupt existing lab-diamond producers, but create a small, profitable business in its own right.

“Given we are the lowest-cost producer, we can make a good business out of this,” Cleaver said. “We have the tools, why wouldn’t we do this?”

De Beers is so adamant that the man-made diamonds are not competing with mined stones that it will not grade them in the traditional way. That’s a stark contrast to current man-made sellers who offer ratings such as clarity and color, replicating terminology used for natural stones.

“We’re not grading our lab-grown diamonds because we don’t think they deserve to be graded,” Cleaver said. “They’re all the same.”

The pricing strategy will also be different. De Beers plans to charge $200 for a quarter-carat, $400 for a half and $800 for a carat, another sharp break from natural stones that rise exponentially in price the bigger the diamond gets.

While De Beers has never sold man-made diamonds for jewelry before, it’s very good at making them. The company’s Element Six unit is one of the world’s leading producers of synthetic diamonds, which are mostly used for industrial purposes. It has also been producing gem-quality stones for years to help it tell the difference between natural and man-made types and to reassure consumers that they’re buying the real thing.

Man-made gems currently make up a small part of the diamond market, but demand is increasing. Global diamond production was about 142 million carats last year, according to analyst Paul Zimnisky. That compares with lab production of less than 4.2 million carats, according to Bonas & Co.

De Beers has been researching lab-made diamonds since the end of World War II and accelerated its work after a Swedish company synthesized the first diamond in 1953. The company has focused on lab diamonds for industrial uses, but also kept investing in technology for jewelry-grade gems.

The shift to lab-diamond jewelry comes at a sensitive time for De Beers and its relationship with Botswana, the source of three quarters of its diamonds. The two have a sales agreement that lets the company market and sell gems from Botswana, giving De Beers its power over global prices. The deal will soon be up for negotiation and Botswana is likely to push for more concessions.

On Tuesday, De Beers said it had extensive talks with Botswana about the decision to sell man-made diamonds and the country supports the move.

Source: bloomberg.com