A diamond is a solid form of the element carbon in which the atoms are arranged in a crystal structure known as diamond cubic. In this structure, each carbon atom is bonded to four others in a rigid tetrahedral arrangement (sp³ bonding), forming one of the strongest natural materials known.

In its pure form, diamond is:

- Colourless

- Odourless and tasteless

- Extremely hard

- A poor conductor of electricity

- Insoluble in water

- Chemically inert under most conditions

Although graphite is the stable form of carbon at room temperature and pressure, diamond is metastable and converts to graphite at an almost negligible rate over geological time.

The Physical and Optical Properties of Diamond

Diamond possesses extraordinary properties:

- Highest hardness of any natural material (Mohs 10)

- Highest thermal conductivity of any natural substance

- Extremely high refractive index (~2.42)

- High optical dispersion, creating the “fire” in gemstones

- Very low thermal expansion

- Exceptional chemical resistance

- High electrical resistance

Because the crystal lattice is extremely rigid, only very small amounts of impurities can enter the structure. These trace elements or structural defects create colour:

- Nitrogen → Yellow

- Boron → Blue

- Crystal defects → Brown

- Radiation exposure → Green

- Plastic deformation → Pink, red, purple

How Natural Diamonds Form

Most natural diamonds are between 1 and 3.5 billion years old.

They formed deep within the Earth’s mantle at depths of 150–250 km, and occasionally as deep as 800 km, under extreme pressure and temperature. Carbon-bearing fluids replaced minerals with crystallised carbon.

They were later transported rapidly to the surface via volcanic eruptions and deposited in igneous rocks known as:

- Kimberlite

- Lamproite

Historically, diamonds were first mined in ancient India along the Penner, Krishna and Godavari rivers, and have been known for at least 3,000 years.

The word diamond comes from the Ancient Greek “adámas”, meaning unbreakable or invincible.

The Discovery That Diamond Is Carbon

In 1772, Antoine Lavoisier demonstrated that when a diamond burns in oxygen, it produces carbon dioxide.

Later, in 1797, Smithson Tennant proved that diamond and graphite release the same gas when burned, confirming that both are forms (allotropes) of pure carbon.

Laboratory-Grown Diamonds

Synthetic diamonds are created using two main methods:

1. HPHT (High Pressure High Temperature)

Replicates natural mantle conditions using pressures above 5 GPa and temperatures above 1,300°C.

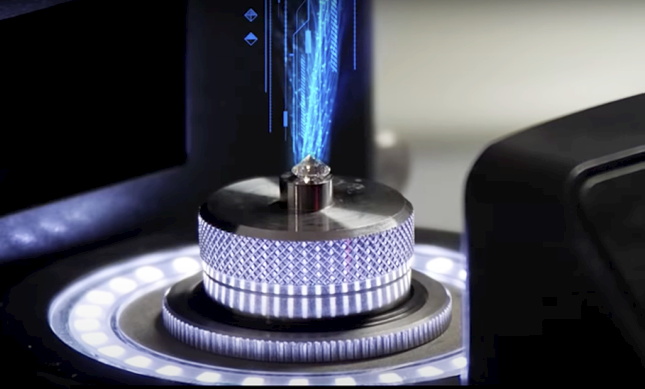

2. CVD (Chemical Vapour Deposition)

Carbon-rich gases are broken down in a plasma chamber, allowing carbon atoms to deposit layer by layer onto a diamond seed crystal.

Chemically, physically and optically, laboratory-grown diamonds are the same as natural diamonds. Both are pure carbon in the diamond cubic structure.

They are distinguished using advanced gemmological techniques such as:

- Spectroscopy

- Growth pattern analysis

- Inclusion study

- Thermal conductivity testing

Hardness, Toughness and Durability

Diamond is the hardest known natural material, but it is not indestructible.

- It has excellent resistance to scratching.

- It has cleavage planes, meaning it can split if struck in certain directions.

- Toughness (resistance to breakage) is good for a ceramic but lower than many metals.

Its durability makes it ideal for engagement rings and daily wear jewellery.

Natural vs Laboratory-Grown Diamonds: Pricing Comparison (2026 Market Overview)

Although structurally identical, pricing between natural and lab-grown diamonds differs dramatically due to rarity and supply dynamics.

Natural Diamonds

- Finite geological supply

- Mining costs, exploration, labour and environmental compliance

- Graded and traded based on rarity

- Price stability linked to long-term scarcity

In today’s market, a high-quality 1.00 carat natural diamond (G colour, VS clarity) typically trades wholesale in the range of USD $4,500–$7,000, depending on cut quality and certification.

Premium stones (D–F colour, IF–VVS clarity) command significantly higher prices.

Laboratory-Grown Diamonds

- Mass-producible in controlled environments

- Increasing global production capacity

- Rapid technological efficiency gains

- No geological rarity

The same 1.00 carat equivalent (G colour, VS clarity) laboratory-grown diamond now trades between USD $300–$600.

Retail prices decline as production scales.

Why the Price Gap Exists

The key difference is not chemistry — it is rarity and supply economics.

Natural diamonds:

- Formed over billions of years

- Limited global deposits

- High capital-intensive extraction

Laboratory diamonds:

- Manufactured within weeks

- Scalable production

- Compete with industrial cost structures

As production increases, laboratory diamond pricing behaves more like a manufactured product than a rare natural asset.

Investment and Resale Considerations

Natural diamonds retain secondary market value more effectively due to:

- Limited supply

- Established global trading networks

- Long-term historical demand

Laboratory-grown diamonds currently have minimal resale value in secondary markets due to continuous price decline and expanding supply.

A diamond, whether natural or laboratory-grown, is one of nature’s most extraordinary materials — a crystal of pure carbon arranged in a tetrahedral lattice that produces unmatched hardness, brilliance and thermal conductivity.

However, while they are chemically identical, their market dynamics are fundamentally different.

Natural diamonds derive value from geological rarity and billions of years of formation.

Laboratory-grown diamonds derive value from technology, efficiency and accessibility.

Understanding this distinction is essential for anyone buying, selling or investing in diamonds today.

Source: DCLA