Sarine Technologies has launched a new platform enabling manufacturers to tap its automated grading systems and issue a report in-house to support the needs of jewelers.

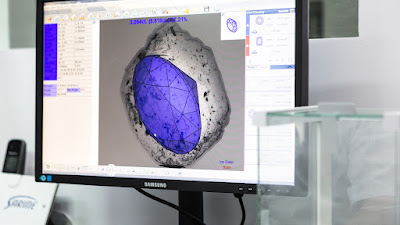

The company this week introduced its eGrading innovation via a video campaign on YouTube claiming the concept would “change diamond grading forever.” It allows manufacturers to self-execute third-party grading of the 4Cs — cut, carat weight, color and clarity — along with other personalized parameters required by the jeweler, without having to send the diamond to a grading laboratory.

“We believe the market is moving in this direction and our technology is now mature enough to make that happen,” CEO David Block told Rapaport News in a briefing at Sarine’s innovation center in Hod Hasharon, Israel.

“The digital aspect opens up the possibility to customize the report, which is difficult for a lab to achieve,” Block explained. “Once you grade the diamond at the source, the manufacturer is now responsible for its own destiny.”

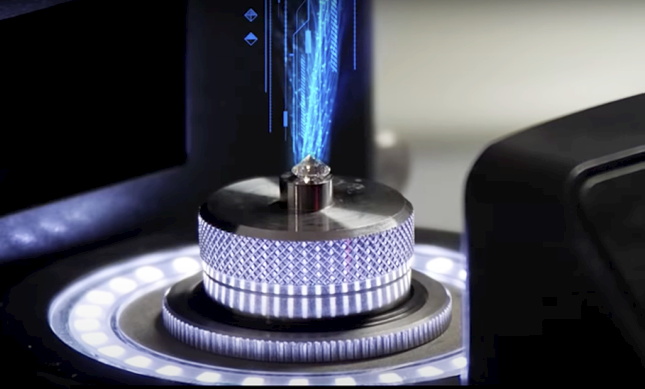

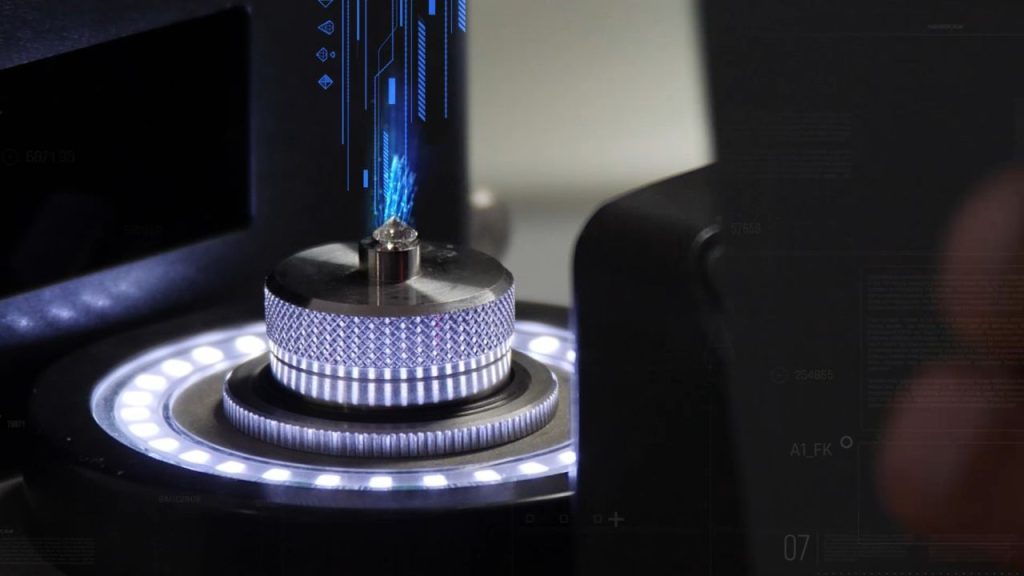

The initiative builds on Sarine’s automated grading systems, with the company first announcing its ability to automate the grading of color and clarity, and therefore all the 4Cs, in 2016. It uses artificial intelligence (AI) machine learning to assess the grading results of tens of thousands of diamonds to arrive confidently at its color and clarity decision.

Empowering the manufacturer to execute the report enables it to provide a more personalized service to the jeweler. Block believes eGrading will improve efficiency for manufacturers, since they don’t have to send the stone out to the lab, while still using third-party verification. This saves on the time, expense, and opportunity cost of not having the diamond available to sell. And the retailer benefits from being able to tap the right goods from its supplier in a shorter period.

Netflix vs. Blockbuster

He drew on the experience of the home-video market as an indicator of how eGrading could improve a jeweler’s sourcing capability.

Netflix can suggest movies you might enjoy based on your past viewing history and allows you to watch the trailer before deciding what to watch — from the comfort of your home. That’s a stark contrast to the Blockbuster model, where you had to go to the store and choose a movie you might not like, Block noted.

“Diamond grading is still in the Blockbuster days, where I need to send my diamond to the lab and wait for them to finish grading. They decide what goes in first and I get the stone back with certain criteria that are generally not good enough for me as I go out and sell the diamond,” he added, explaining that lab certificates are too generic.

While the retailer might want to emphasize other parameters such as the stone’s fluorescence, or different types of inclusions, among others, Block asserts it is difficult and expensive for the labs to go into the required level of detail.

Market ready

Sarine claims its technology will provide those details as the system evolves, using the same AI machine-learning principles in other parameters as it applies for color and clarity grading.

In that sense, its eGrading program isn’t a finished product, and probably never will be, because Sarine’s systems are constantly evolving and improving, according to Block. “We’re presenting our vision for where the market is heading and we have developed the technology that we believe makes this possible,” he stressed.

The company expects to reach several new milestones in 2020 as it rolls the program out to the market, Block assured, without divulging what those might be.

He believes the industry is more than ready to embrace the cultural change the company is proposing, observing that the “the midstream is very tech-savvy.”

A means to an end

Block also recognized that others may be entering the same space. Representatives from De Beers and the Gemological Institute of America (GIA) joined Block in a panel discussion at the Dubai Diamond Conference in September by asserting that automation of diamond processes will come “sooner than you think.” Each independently stressed that they’re ready to propose a solution.

Sarine is confident it can lead the way in the diamond industry’s “tech revolution,” given that technology is its core competency. Other companies that develop technology are also focused on other areas within the diamond pipeline. Technology, he emphasized, is going to play a big part in bringing about dramatic changes in the diamond industry.

In that spirit, the objective of Sarine’s eGrading initiative is to realign the emphasis currently placed on grading reports, Block added.

“Diamond grading is not a goal in and of itself. Rather, the objective is to help price a diamond and to help source what you’re looking for,” Block said. “We’re looking at how we can improve the process to get to that goal of how to source the diamond. How people source diamonds will change. It’s natural that the industry will shift in this direction.”