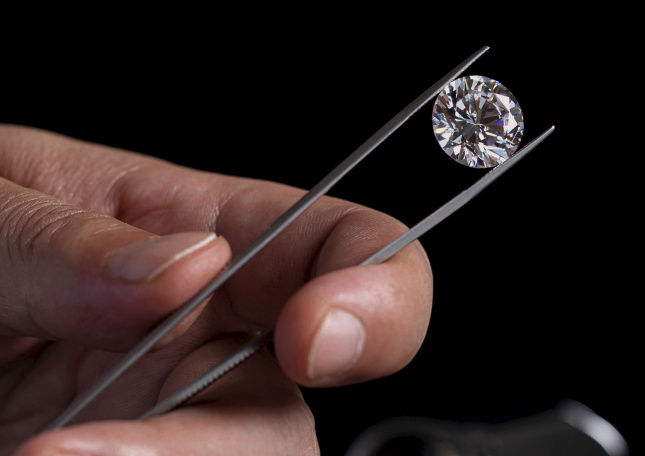

The Chinese diamond market, second only to the US, is showing early signs of recovery, sparking optimism in India’s diamond industry. According to the Gem and Jewellery Export Promotion Council (GJEPC), this shift could reshape the global diamond manufacturing landscape.

China’s economic slowdown and declining marriage rates had severely impacted its diamond market, valued at approximately USD 9 billion. In 2023, diamond sales in China generated around USD 5.7 billion, but analysts project growth to USD 7.2 billion by 2030. Over the past two years, demand has dropped by as much as 50%, with wholesale diamond prices falling 40%. This downturn significantly affected India, which exports nearly a third of its cut and polished diamonds to China.

The impact was evident in India’s February 2024 gems and jewellery exports, which declined by 23.49% to USD 2.42 billion (Rs 21,085 crore), driven by weak demand from both the US and China. To counter this, GJEPC participated in the Hong Kong International Diamond, Gem & Pearl Show (DGP) earlier this month, showcasing 71 exhibitors across 116 booths in categories such as Loose Diamonds, Lab-Grown Diamonds, and Fine Jewellery.

Hong Kong, a key hub for India’s diamond trade, played a vital role in strengthening global ties. GJEPC Chairman Kirit Bhansali noted that stabilising prices and renewed Chinese demand are promising signs for the global diamond industry. He emphasized that India’s strong manufacturing capabilities and adaptability put it in a favorable position for long-term growth.

After a prolonged slump, buyers are now accepting current price levels, leading to steadier sales. GJEPC Vice Chairman Shaunak Parikh believes this renewed demand could shift India’s diamond manufacturing back towards natural diamonds. Industry insights indicate a resurgence, particularly in smaller diamonds, though a full-scale revival is still some way off.

According to Ajesh Mehta, Convener of the Diamond Panel at GJEPC, this year’s Hong Kong trade shows marked the first positive development in four to five years. While Chinese demand hasn’t returned to previous highs, price stabilisation and increased movement in smaller diamonds are encouraging. “Confidence is slowly returning, especially in diamonds below 10 points and dossier sizes,” Mehta said.

A shift in Chinese consumer preferences is also influencing the market. Retailers are now incorporating smaller diamond accents in gold jewellery instead of featuring diamonds as centrepieces. However, Mehta believes this trend is temporary, predicting a gradual return of confidence in larger stones, such as 30 to 50 points.

Beyond China, emerging markets like Cambodia, Vietnam, Brazil, and Venezuela are showing growing interest in larger stones. While they cannot replace China’s dominance, they are contributing to new demand pockets.

Devansh Shah, Partner at Venus Jewel, observed an increase in inquiries at the Hong Kong trade shows from diverse markets, including Europe, Australia, the US, and the UAE. He noted that Chinese and Far East buyers remain highly quality-conscious, with round brilliant diamonds attracting strong interest, while larger fancy cuts and 3-carat-plus rounds were available on an order-only basis.

Although the Chinese market’s resurgence remains gradual, it presents growth opportunities for India’s diamond cutting, polishing, and export sectors. With strategic planning and market adaptability, India is well-positioned to navigate this evolving landscape and sustain long-term industry growth.

Source: DCLA