The Farnese Blue occupies a rare position among historic natural diamonds. It is not merely a gemstone with provenance, but a silent participant in more than three centuries of European political power, dynastic ambition, revolution, and exile. For most of its existence, it remained known only to a small circle of royal descendants, absent from public record and scholarly examination.

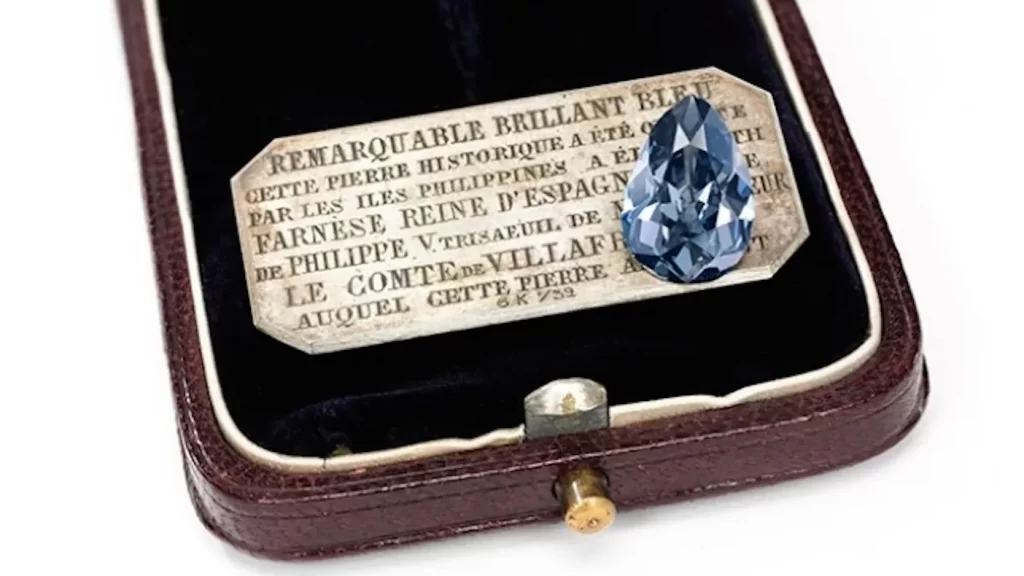

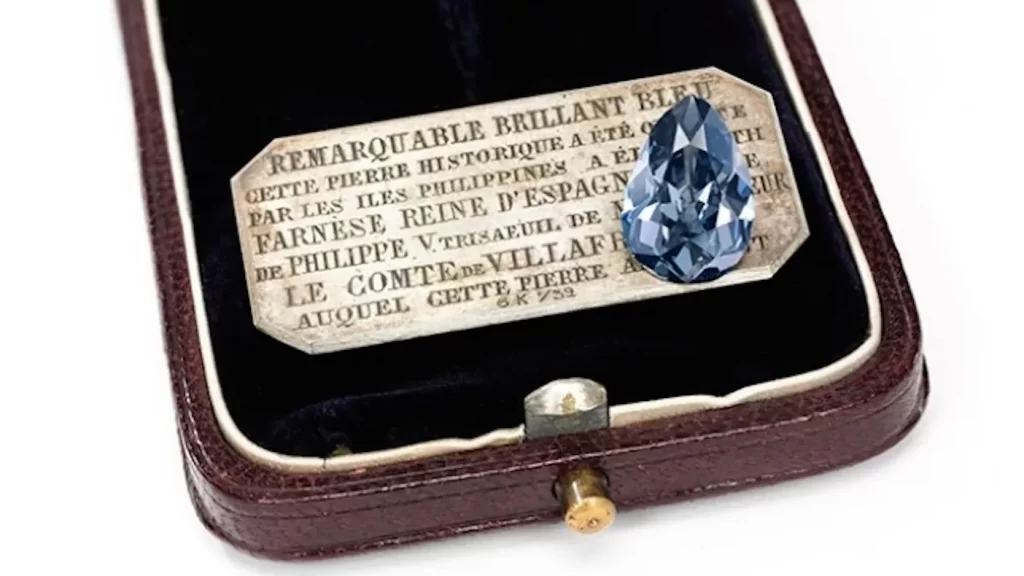

That secrecy ended in 2018 when the 6.16-carat pear-shaped natural Fancy Dark Gray-Blue diamond appeared unexpectedly at Sotheby’s Geneva. Its emergence stunned historians and gem specialists alike. Offered publicly for the first time in its recorded history, the Farnese Blue achieved USD $6.7 million—well above estimate—before being acquired by an anonymous buyer. With that sale, one of Europe’s most historically significant diamonds passed from royal custody into the modern market.

A Golconda Diamond of Exceptional Origin

The Farnese Blue originated in the legendary Golconda mines of India, the world’s most important diamond source for over a millennium. Long before Brazil or South Africa entered the diamond trade, Golconda supplied every known diamond in existence. The Hope Diamond, the Koh-i-Noor, the Regent, and the Wittelsbach-Graff all share this same geographic origin near present-day Hyderabad.

Golconda diamonds travelled ancient trade routes linking Asia and Europe, where merchants competed for stones prized for their exceptional clarity, colour, and crystalline structure. Their rarity and value ensured they were acquired almost exclusively by royalty and the most powerful figures of their time. The Farnese Blue belongs firmly within this elite lineage.

A Queen Without a Dowry: Entry Into Spanish Royal History

The Farnese Blue first entered recorded European history through Elisabeth Farnese, Queen consort of Spain. In 1715, King Philip V of Spain grandson of Louis XIV required a new queen. The political climate demanded a bride of royal blood, but without excessive dynastic influence.

Elisabeth, a princess of the Duchy of Parma and a descendant of Pope Paul III, met these requirements precisely. However, Spain’s finances had been devastated by the War of the Spanish Succession, and her father was unable to provide a traditional royal dowry.

To compensate, Spain turned to its global colonies. In August 1715, the so-called “Golden Fleet” departed Cuba carrying gold bullion and precious gemstones gathered for the royal wedding. A hurricane in the Gulf of Florida destroyed nearly the entire fleet, consigning its riches to the sea.

One extraordinary diamond survived.

The governor of the Philippine Islands presented a pear-shaped blue diamond to the new queen. That stone would become known as the Farnese Blue.

Three Centuries in Royal Exile

From that moment onward, the Farnese Blue passed quietly through Europe’s most powerful royal houses. Elisabeth Farnese bore seven children and worked tirelessly to secure dynastic influence across the continent. The diamond was likely entrusted to her son Philip, founder of the House of Bourbon-Parma.

It subsequently passed through successive generations: to Ferdinand, to King Louis of Etruria, and then to Charles Louis (King Louis II), who mounted the diamond as a tie pin. Political upheaval forced him into exile under the title Comte de Villafranca, yet he retained the diamond throughout his life.

Upon his death in 1883, the Farnese Blue passed to his grandson Robert, the last ruling Duke of Parma. After losing his throne, Robert sought refuge with his cousin, Emperor Franz Joseph of Austria, taking the diamond with him.

The stone later passed to Prince Elia and his wife, Archduchess Maria Anna of Austria. Her meticulous jewellery inventories proved invaluable to history, preserving the diamond’s provenance with remarkable clarity. Among her collection was a tiara containing diamonds once owned by Marie Antoinette. She incorporated the Farnese Blue still set as a tie pin into that tiara and wore it frequently.

Reemergence at Sotheby’s: From Royal Secrecy to Public Record

Following the collapse of the Austrian Empire in 1918, the Farnese Blue disappeared once again from public view. For decades, it remained absent from scholarship and gemological examination.

Its reappearance in 2018 marked a pivotal moment. Now mounted within a colourless diamond halo on a detachable pin, the Farnese Blue was examined and graded by the Gemological Institute of America for the first time. It received an official classification as a natural Fancy Dark Gray-Blue diamond with SI1 clarity.

That same year, Sotheby’s offered the stone at auction for the first time in its three-hundred-year history. The result confirmed what experts already understood: a natural diamond of exceptional rarity, when paired with uninterrupted, well-documented royal provenance, transcends its material value.

The Farnese Blue stands today as one of the most extraordinary surviving diamonds of European royal history an enduring witness to the rise and fall of empires, preserved through centuries by those who understood its significance long before the modern world was permitted to see it.