For more than two decades, global policies aimed at restricting the flow of diamonds from conflict zones most notably through the “blood diamond” narrative have reshaped the way diamonds are traded. These measures were intended to protect vulnerable communities in Africa from exploitation and violence. But today, the ripple effects of those same restrictions are being felt thousands of kilometres away, exposing the fragility of a supply chain that depends on the livelihoods of millions.

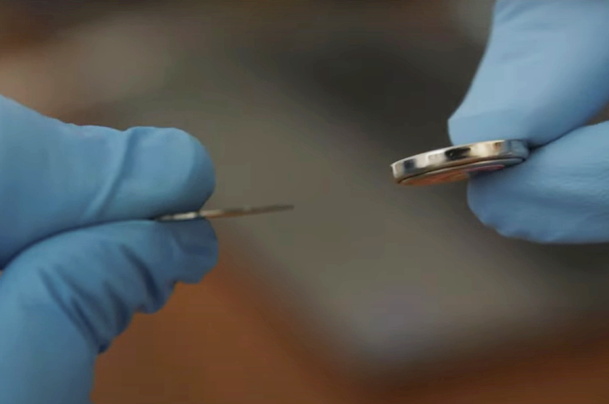

In India’s diamond capital of Surat, where an estimated 80% of the world’s diamonds are cut and polished, workers like Alpesh Bhai once saw diamonds as a pathway out of poverty. The industry offered stability, income, and, for the first time, the promise of private education for their children.

That progress has since been jeopardised.

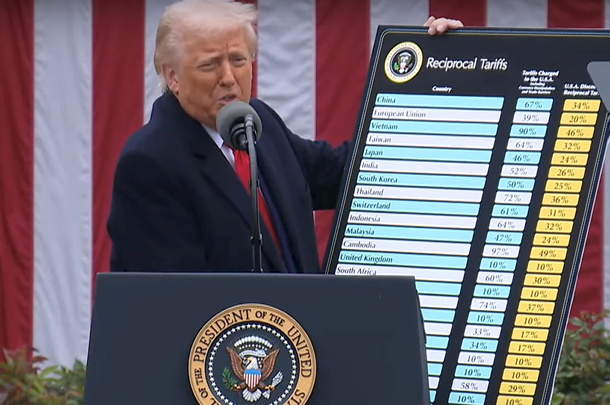

A Perfect Storm of Restrictions and Sanctions

First, sanctions targeting Russian rough diamonds disrupted supply a supply which, for India, had been essential. Then came the imposition of 50% United States tariffs on polished diamonds, compounding the downturn.

The intention behind these measures from conflict-diamond controls in Africa to punitive trade tools against Russia has been to hold powerful actors accountable. Instead, the burden has fallen hardest on those with the least power in the chain: cutters, polishers, and their families.

Alpesh, once earning enough to support education for his two young daughters, saw his salary cut nearly in half before losing his job altogether. Private schooling quickly became unaffordable. He withdrew his children and moved them into a public school where learning opportunities are significantly limited.

“I’ve come back to where I started,” he said a sentiment now echoed across Surat.

The Human Cost Behind Supply Chain Pressure

Surat’s diamond sector employs over 600,000 people, many migrants from rural Gujarat who rely entirely on this trade. Layoffs, pay cuts, and reduced working hours have affected close to 400,000 workers.

Families are leaving the city. Children are dropping out of school. In the most tragic cases, mounting financial pressure has led to a rise in worker suicides.

Community leaders describe the situation as unprecedented. “The industry was always a ladder out of poverty,” one union representative explained. “Now that ladder is shaking for many, it’s disappearing.”

A Stark Reminder for the Diamond World

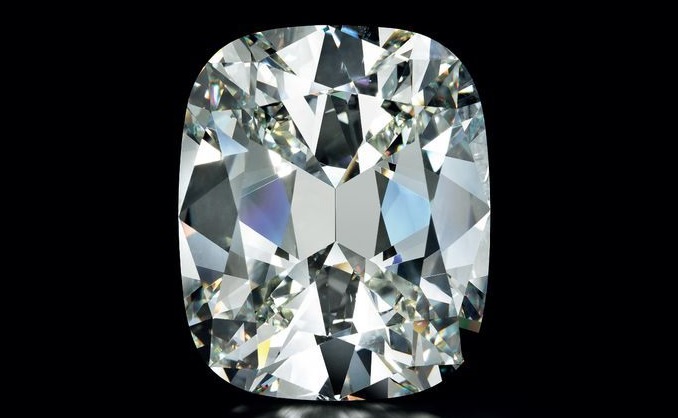

Conversations about responsible sourcing must include responsibility to all those in the value chain including cutters and polishers who transform rough diamonds into the beautiful stones valued globally.

Policies crafted to protect African workers from exploitation have, ironically, become a new form of harm both in Africa, where mining communities still struggle, and now in India, where workers are paying the price for geopolitical decisions far beyond their control.

As the global diamond market continues to evolve, one thing is clear:

DCLA Transparent Certification and Shared Responsibility

_updates.jpg)