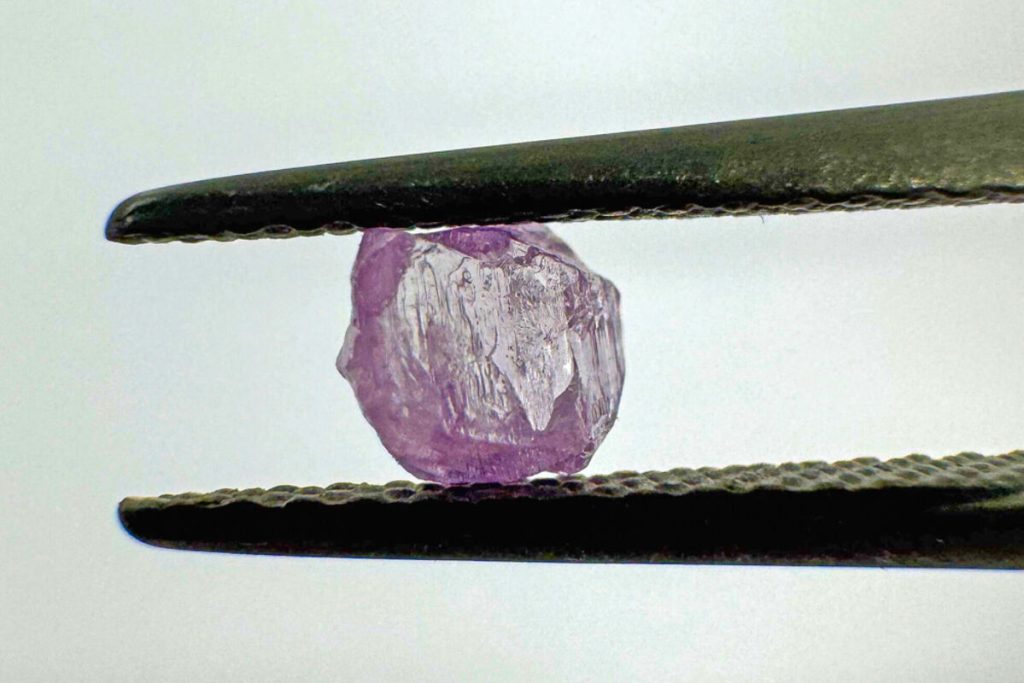

A remarkable two-coloured natural diamond has been discovered in Botswana, astonishing experts with its size and formation. The gem half pink and half colourless weighs an impressive 37.41 carats and measures approximately 24.3 x 16 x 14.5 millimetres, according to the Gemological Institute of America (GIA).

The GIA describes the stone as having formed in two distinct geological stages. Sally Eaton-Magaña, Senior Manager of Diamond Identification at the GIA, explained that the pink section likely began as colourless before undergoing plastic deformation possibly caused by a mountain-forming event millions of years ago. This natural deformation altered the crystal lattice, giving rise to the diamond’s vivid pink hue. The colourless section, in contrast, appears to have formed later under more stable conditions.

Pink diamonds are among the rarest gems on Earth, prized for their beauty and scientific intrigue. Unlike coloured diamonds that owe their hue to trace elements or radiation exposure, pink diamonds result from structural distortions within the crystal lattice. This phenomenon must occur under highly specific pressure and temperature conditions too little deformation and the diamond remains colourless; too much and it turns brown.

“It’s a geological balancing act like Goldilocks,” noted Curtin University geologist Luc Doucet, referencing the fine threshold that determines a diamond’s colour outcome.

What makes this new discovery even more extraordinary is its size. While other bi-coloured diamonds have been documented, they are typically no larger than 2 carats. The 37.4-carat specimen from Botswana represents a significant leap in both scale and scientific importance.

The diamond was unearthed at Lucara Diamond Corporation’s Karowe mine, one of the world’s most productive sources of exceptional diamonds. The Karowe mine has previously yielded some of the most celebrated finds in modern history, including the 2,488-carat “Motswedi” diamond, the second-largest rough diamond ever recovered, and the 62-carat “Boitumelo” pink diamond.

This latest discovery further cements Botswana’s position at the forefront of the global diamond industry and provides scientists with another remarkable glimpse into the complex natural processes that create the Earth’s most coveted gemstones.

Source: DCLA