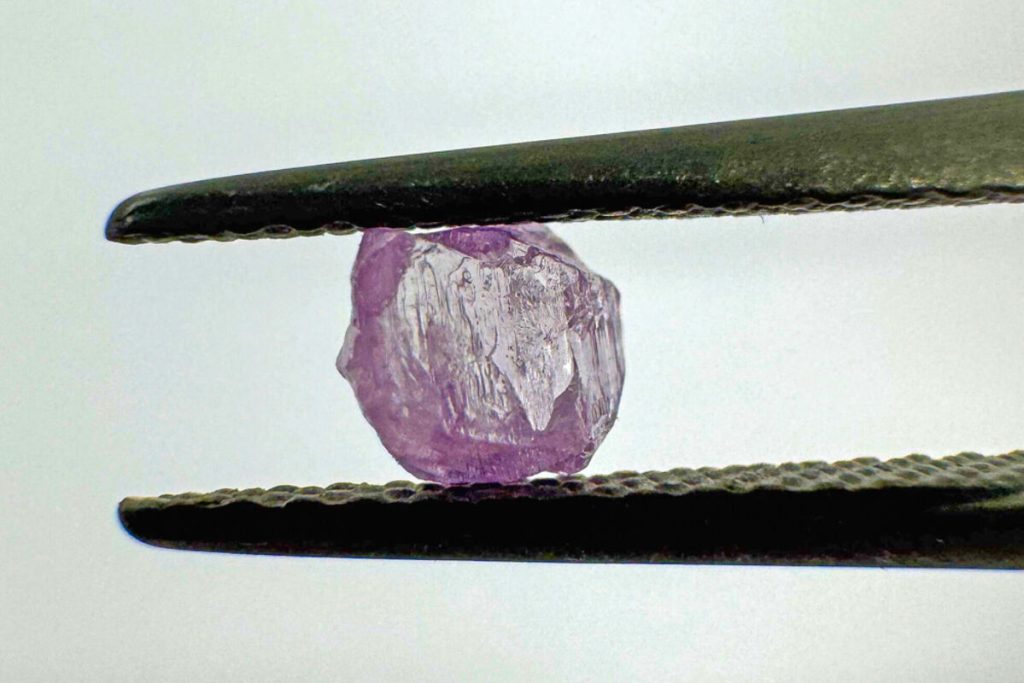

Vibrant 0.45-carat gem adds final flourish to Diavik’s closing years.

Just when it seemed Diavik had given all it could give, a rare purple diamond has been unearthed at the Northern Canadian mine – a 0.45-carat stone that stands out in a region better known for producing predominantly colorless gems and the occasional yellow stone, adding a splash of unexpected color as the operation approaches the final years of its mine life.

The discovery, quietly announced by Rio Tinto via social media, comes just weeks after the recovery of a 158.2-carat yellow diamond and a 50-million-year-old petrified log – both of which drew attention to the remarkable geological and historical treasures still surfacing from the remote subarctic site.

“We recently had a unique discovery at Diavik – a rare purple diamond weighing in at 0.45 carats,” the company wrote in a social media post on LinkedIn.

“Diavik diamonds are typically white, so this came as a pleasant surprise,” the post continued. “The purple colour likely comes from a trace element such as hydrogen or a twist in the crystal lattice structure of the diamond. The shape of the rough diamond is known as a ‘makeable’ which means it will likely be cut into a single diamond.”

Though small in size, the stone is striking for its rarity, with colored diamonds of any kind making up less than 1% of Diavik’s total production over more than two decades of operation.

Among them, purple diamonds are the rarest, their distinctive hue typically attributed to hydrogen impurities or plastic deformation deep in the Earth’s mantle – a result of the intense pressure and heat that alters the crystal structure during formation.

In gemological terms, purple diamonds are often classified under the broader category of “fancy color” stones, though few attain the deep saturation necessary for that label. More often, their shades fall within the purplish-pink or violet spectrum, with pure purple standing as one of the most elusive colors in the diamond world.

For Diavik, the recovery of such a specimen near the end of its mine life serves as both a scientific curiosity and a symbolic capstone.

Since beginning production in 2003, the mine has yielded over 140 million carats of rough diamonds – predominantly colorless, with a handful of exceptional yellow stones including the 552-carat “egg” discovered in 2018 and the more recent 158.2-carat find earlier this year.

Yet, while the occasional yellow diamond has offered moments of brilliance, the purple discovery stands out for its singularity.

While not the first purple diamond recovered from Diavik – industry veterans have noted smaller specimens dating back more than a decade – this 0.45-carat stone ranks among the most notable, particularly for its size, clarity, and timing near the end of the mine’s operational life.

Purple diamonds are so rare that only a few notable examples have surfaced globally, often fetching premium prices far beyond their white or even pink counterparts. Their appearance in the trade is sporadic, and their origin even more geographically restricted – making a Canadian purple diamond an especially uncommon occurrence.

Diavik’s purple gem is expected to be cut into a single polished stone, though no details have been released about where it might end up – in private hands, a high-profile auction, or perhaps a Canadian institution.

Whatever its path, the find adds a final chapter to Diavik’s legacy – a small but vibrant reminder that even in its twilight, the remote Arctic mine remains full of surprises.

Source: DCLA