A new Natural Diamond Council report reveals why record-breaking diamonds operate in a market beyond conventional valuation models

At the very top end of the diamond market, traditional pricing frameworks cease to function. Per-carat benchmarks, standard price lists, and even established scarcity models lose relevance when value is driven not by comparables, but by the willingness of elite buyers to secure assets of extreme rarity.

This rarefied segment is the focus of Record-Breaking Diamonds, a new report by the Natural Diamond Council (NDC), which examines the largest, most valuable natural diamonds ever discovered, cut, and sold. Drawing on mining data, gemmological research, and global auction results, the report offers a detailed analysis of how extraordinary rarity reshapes value within the natural diamond supply chain.

A Century Without a Challenger

One of the report’s most striking observations is the prolonged absence of truly massive diamonds following the 1905 discovery of the Cullinan in South Africa. Weighing an unprecedented 3,106.75 carats, the Cullinan established a benchmark that would stand unchallenged for more than 110 years. Until 2015, no gem-quality diamond exceeding 1,000 carats was recovered anywhere in the world.

That changed with the discovery of the 1,109-carat Lesedi La Rona at Botswana’s Karowe mine. Its recovery marked a turning point. Since then, at least nine rough diamonds weighing over 1,000 carats have been unearthed, including two exceptional finds exceeding 2,000 carats: the 2,488-carat Motswedi in 2024 and a 2,036-carat near-gem-quality rough diamond recovered in July 2025. Both originated from Karowe, with Motswedi now ranking as the second-largest gem-quality rough diamond ever discovered.

Technology, Not Abundance

The increased frequency of such discoveries does not signal a sudden abundance of large diamonds. Rather, it reflects a fundamental shift in extraction technology. The widespread adoption of X-ray Transmission (XRT) technology has transformed diamond recovery by identifying stones based on density before ore enters the crushing circuit. This significantly reduces the risk of fracturing large diamonds during processing.

Lucara Diamond Corp.’s Karowe mine — which installed XRT technology in 2015 and introduced a Mega Diamond Recovery (MDR) system two years later — accounts for the majority of exceptional stones recovered in the past decade. Other operations employing similar systems, including the Cullinan mine and Lesotho’s Letšeng deposit, have also reported a measurable increase in large, high-value diamonds.

Even so, diamonds weighing more than 1,000 carats remain extreme statistical outliers, even with the most advanced recovery methods.

The Superdeep Advantage

Size alone does not define value at this level. Many of the diamonds highlighted in the NDC report belong to the rare Type IIa category, meaning they contain no measurable nitrogen impurities. These chemically pure stones represent only a tiny fraction of global diamond production.

Some Type IIa diamonds form at extraordinary depths — between 360 and 750 kilometres beneath the Earth’s surface, according to the Gemological Institute of America (GIA). These “superdeep” diamonds belong to the CLIPPIR population (Cullinan-like, Large, Inclusion-poor, Pure, Prismatic, Irregular, Resorbed). Formed under extreme pressures in nitrogen-poor environments, they grow slowly and uninterrupted, resulting in unusually large, highly transparent crystals with minimal internal defects.

When Per-Carat Logic Breaks Down

In this ultra-exclusive segment, pricing behaves differently. Per-carat values no longer scale predictably with size. A defining example is Lucara’s 2016 sale of the 812.77-carat Constellation diamond, which achieved US$63.1 million — the highest price ever paid for a rough diamond. Its per-carat value far exceeded any precedent for an uncut stone, reflecting buyer confidence in its exceptional quality and cutting potential.

Colour, Rarity, and Market Psychology

In the polished market, the 59.60-carat CTF Pink Star remains the most expensive diamond ever sold at auction, achieving HKD 553 million (US$71.2 million) at Sotheby’s Hong Kong in 2017. While the headline price set the record, later sales demonstrated that per-carat value is often the more telling indicator of demand.

In 2022, the 11.15-carat Williamson Pink Star sold for HKD 453.2 million (US$57.7 million), equating to more than US$5 million per carat — the highest per-carat price ever achieved by a diamond.

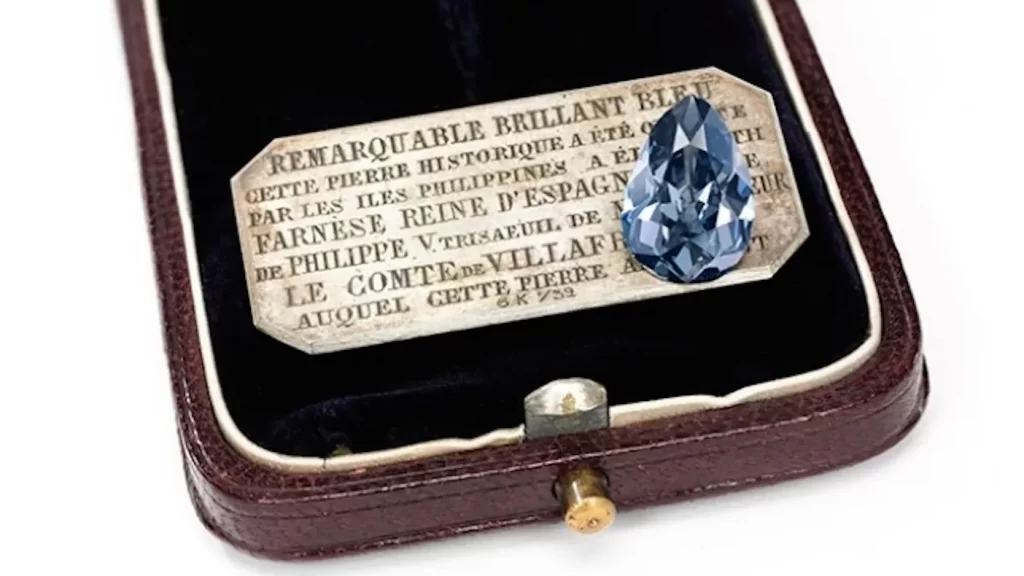

A similar phenomenon is evident in the blue-diamond category. Despite selling six years apart, the 14.62-carat Oppenheimer Blue (Christie’s Geneva, 2016) and the 15.10-carat De Beers Blue (Sotheby’s Hong Kong, 2022) each realised US$57.5 million, underscoring how rarity and desirability can outweigh minor differences in size or clarity.

Yellow diamonds, by contrast, trade at a substantial discount to pinks and blues, even in exceptional sizes. While the leading pink and blue diamonds regularly exceed US$1 million per carat, none of the top five yellow diamonds have reached that level. The highest-ranked example, the 100.09-carat Graff Vivid Yellow, sold for US$16.8 million in 2014 — approximately US$168,000 per carat.

Diamonds Beyond the Market

Not all record-breaking diamonds remain commercial assets. Some are removed from circulation entirely and repositioned as cultural or institutional icons. The 45.52-carat Hope Diamond, donated by Harry Winston to the Smithsonian Institution in 1958, has been viewed by more than 100 million visitors, making it one of the most publicly encountered diamonds in history.

Similarly, the 140.64-carat Regent Diamond at the Louvre serves not as a tradable asset, but as a benchmark of scale, rarity, and historical significance. Such exhibition stones continue to influence market perception, anchoring contemporary record prices within a much longer narrative of natural-diamond rarity.

As the NDC report makes clear, when diamonds reach this echelon, value is no longer governed by price lists or formulas. Instead, it is shaped by geology, technology, history, and the enduring human desire to possess the truly irreplaceable.

Source: DCLA