The global diamond industry is facing its most severe downturn in decades, with De Beers posting a staggering $511 million EBITDA loss for 2025 — a dramatic collapse that underscores mounting structural pressures across the natural diamond market.

Despite generating approximately $3.5 billion in revenue, profitability deteriorated sharply, highlighting a widening disconnect between stable turnover and collapsing margins. The downturn reflects a perfect storm of falling realised prices, swelling inventories, rising operational costs and intensifying competition from laboratory-grown alternatives.

This historic loss signals more than a cyclical slowdown — it marks a structural turning point for the global diamond sector.

Why Did De Beers Record a $511 Million Loss?

The scale of the financial decline is unprecedented. The company’s EBITDA performance deteriorated nearly 2,000% year-on-year, shifting from manageable losses into industry-defining deficits.

Key Drivers Behind the Collapse:

- Lower realised rough diamond prices

- Inventory accumulation throughout the midstream

- Production cuts impacting fixed-cost absorption

- Asset impairment charges reflecting weaker long-term pricing assumptions

While revenues remained broadly stable, margins compressed dramatically — revealing that demand weakness is affecting pricing power rather than transaction volume alone.

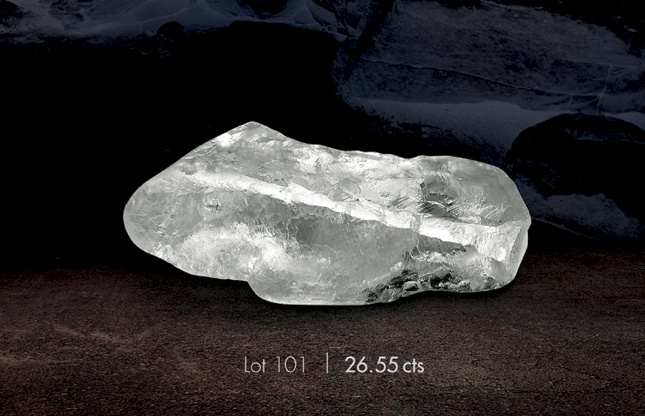

Production Cut by 12% as Supply Is Calibrated

In response to deteriorating market conditions, rough diamond production was reduced by 12% to 21.7 million carats in 2025.

Unlike gold or oil markets where production cuts can rapidly rebalance supply, the diamond sector operates through a complex value chain involving mining, cutting, polishing and retail distribution. Inventory build-ups in 2025 forced disciplined output reductions designed to:

- Preserve cash flow

- Prevent further price collapse

- Protect long-term reserve value

- Stabilise global supply

However, elevated stockpiles remain a major overhang for 2026.

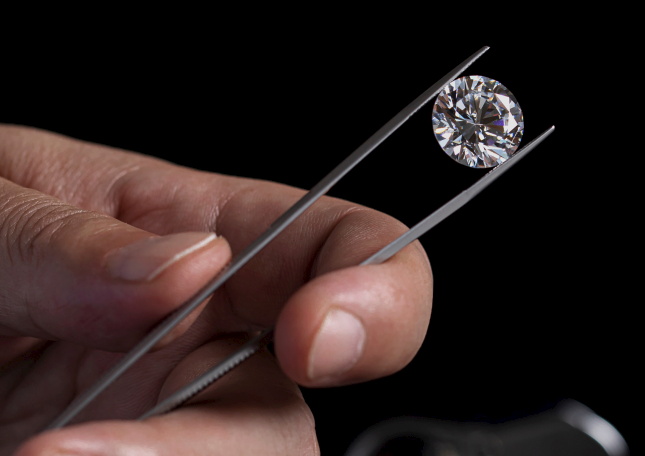

Lab-Grown Diamonds Accelerate Structural Disruption

Laboratory-grown diamonds continue gaining market share, particularly in engagement rings — historically the most valuable segment of natural diamond demand.

These synthetics are chemically identical but typically sell for 60–80% less than natural stones.

Competitive Advantages of Lab-Grown Diamonds:

- Lower retail prices

- Ethical and environmental positioning

- Consistent quality

- Rapid scalable production

Millennial and Gen Z buyers are demonstrating increased price sensitivity and different value priorities compared with previous generations — a demographic shift that is reshaping long-term demand dynamics.

China’s Luxury Slowdown Hits Diamond Demand

China, once a powerful growth engine for premium diamond jewellery, is experiencing reduced luxury consumption.

Key contributing factors include:

- Slower GDP growth

- Property market weakness

- Lower consumer confidence

- Currency sensitivity to imports

With Chinese buyers representing a significant share of high-end global diamond demand, the slowdown is having a disproportionate impact on producers.

US Tariffs Disrupt Indian Diamond Processing Hub

Trade policy has compounded the crisis. India processes roughly 80% of the world’s rough diamonds, and new US tariffs on Indian polished stones have created additional cost pressures and uncertainty.

The impact includes:

- Higher landed costs for US-bound diamonds

- Supply chain bottlenecks

- Planning uncertainty

- Competitive distortions

Even if tariff relief emerges later in 2026, industry participants remain cautious about near-term recovery.

Anglo American Takes $2.3 Billion Impairment

Parent company Anglo American recognised a $2.3 billion impairment related to its diamond division, reflecting revised long-term price expectations.

This writedown signals a structural reassessment of the sector rather than a temporary cyclical dip.

African Economies Feel the Pressure

Diamond-producing nations such as Botswana face heightened economic vulnerability. Diamond revenues contribute substantially to:

- Government income

- Foreign exchange earnings

- Employment

- GDP

Production discipline across Southern Africa reflects both market necessity and economic sensitivity.

What Happens Next? Recovery Scenarios for 2026–2028

Industry forecasts suggest cautious optimisation in 2026, with gradual recovery potentially emerging through 2027–2028.

Key variables include:

- Inventory normalisation

- Stabilisation of Chinese demand

- Trade policy resolution

- Lab-grown market share plateau

However, structural competition from synthetic diamonds is likely permanent, meaning natural diamond producers must reposition strategically.

What This Crisis Reveals About Luxury Commodity Markets

The diamond downturn highlights broader lessons for luxury commodities:

- High income elasticity creates sharp downturn risk

- Supply chains concentrated in single regions amplify vulnerability

- Technological disruption can permanently reshape pricing structures

- Inventory cycles in opaque markets create extended recovery timelines

Unlike transparent commodities such as gold, diamond pricing lacks a centralised exchange — increasing volatility during stress periods.

Investment Perspective

For long-term investors, sector distress can present contrarian opportunities — but risks remain elevated.

Favourable characteristics may include:

- Low-cost producers

- High-grade deposits

- Strong balance sheets

- Vertical integration

Nevertheless, structural shifts in consumer preference require careful risk-adjusted evaluation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Commodity investments carry substantial risk, including potential loss of capital. Readers should conduct independent research and consult qualified financial professionals before making investment decisions.

DCLA News will continue monitoring developments in the global diamond sector as the industry navigates one of the most challenging periods in modern history.