Mumbai, 8th January 2026: Forevermark Diamond Jewellery marked a defining milestone in its India journey with the grand opening of the world’s largest flagship store by De Beers Group in Mumbai. Located at Crest Link, Khar West, at the heart of Linking Road, the nearly 5,000 sq. ft. store reflects the brand’s long-term commitment to Indian consumers seeking meaningful, design-led luxury.

The marquee launch was celebrated with an exclusive evening that brought together Mumbai’s most influential tastemakers, jewellery connoisseurs, creative voices, socialites, celebrities, and leading creators. Hosted within the flagship itself, the event offered guests a first glimpse into the brand’s stunning universe, featuring a fashion showcase and immersive experiences that seamlessly blended craftsmanship with contemporary style.

The evening unfolded with enthralling performances including live music and a spectacular fashion showcase, complemented by interactive installations and AI integrations around the Mine to Finger journey, branded photo moments, innovative tarot readings and displays of the new collection, creating an atmosphere of modern luxury and timeless elegance. Guests explored the store’s full portfolio, from refined everyday diamond jewellery to statement and high jewellery pieces, all designed to celebrate life’s most meaningful moments.

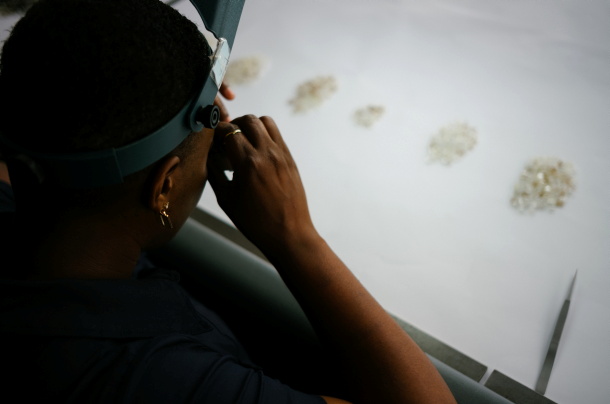

Every Forevermark Diamond Jewellery piece is crafted from some of the world’s most beautiful, rare, and responsibly sourced diamonds, each bearing a unique inscription, a promise of authenticity, integrity, and exceptional quality. This philosophy comes to life with the launch of the all-new Forevermark Icon Collection, inspired by the North Star as a symbol of clarity, direction, and confidence. It features versatile everyday diamond jewellery styles, striking statement pieces, and iconic designs across rings, earrings, necklaces, and bracelets.

This collection launch is also accompanied by the brand’s new campaign titled ‘My Guiding Light’ that celebrates four iconic women who represent modern Indian excellence across diverse fields. Manu Bhaker, professional shooter and double Olympic medallist; Diana Penty, actor; Masaba Gupta, designer, actor, and entrepreneur; and Princess Gauravi Kumari of Jaipur, social entrepreneur, each embody individuality, strength, and purpose, sharing their personal stories and perspectives through mini digital videos on Instagram. Together, they reflect the belief that confidence and direction come from within, perfectly aligning with the spirit of the Icon Collection.

All four of them were also in attendance at the event, bringing glamour and gravitas to the evening and reinforcing the store’s position as a landmark destination in Mumbai’s luxury retail landscape. The evening was further elevated by the presence of Mumbai Indian Cricketers Amelia Kerr, Milly Illingworth and Sajeevan Sajana, whose stories of resilience, precision and perseverance echo the enduring strength of natural diamonds.

Commenting on the launch, Sandrine Conseiller, CEO, Brands & Diamond Desirability, De Beers Group, said: “India is central to the future of the natural diamond category. The opening of our largest Forevermark store in Mumbai reflects both the strength of consumer response we are seeing and our long-term confidence in the market. As luxury consumption in India becomes more considered and value-driven, Forevermark is well positioned to build relevance through trust, craftsmanship, and enduring desirability.”

Shweta Harit, Senior Vice President, De Beers Group and CEO, Forevermark, added: “Mumbai marks an important next chapter in Forevermark’s India story. Following the encouraging response to our New Delhi store, this flagship reflects the scale of opportunity ahead. As our largest store globally, it brings together our brand vision, retail ambition, and commitment to the Indian consumer. This opening is also a key step toward our longer-term plan of building a network of 100 Forevermark stores in India by 2030.”

The new Mumbai flagship blends Forevermark’s contemporary international design with local sensibilities. The spacious store offers an immersive experience, showcasing everyday diamond jewellery, statement and high jewellery pieces, and iconic designs in a setting that reflects the brand’s commitment to thoughtful, experience-led luxury.

About Forevermark Diamond Jewellery

Forevermark Diamond Jewellery is the signature diamond jewellery brand from De Beers Group, the world’s leading diamond company, a name synonymous with more than 135 years of expertise and heritage in the world of diamonds. Every Forevermark Diamond Jewellery creation celebrates life’s most meaningful moments, featuring natural diamonds that are beautiful, rare and responsibly sourced. Every Forevermark diamond bears a unique inscription, ensuring authenticity and making each piece deeply personal.

Formed over billions of years deep within the Earth, Forevermark diamonds are hand-selected for their exceptional quality, graded beyond the 4Cs in the pursuit of absolute beauty. Responsibly sourced and carefully cared for along their journey, they reflect the brand’s commitment to creating a positive impact on the people and places its diamonds come from. Expertly crafted by master designers, Forevermark Diamond Jewellery combines modern artistry with timeless elegance. Each piece elevates the brilliance of its diamond while embodying the brand’s enduring values of beauty, rarity, and responsibility.