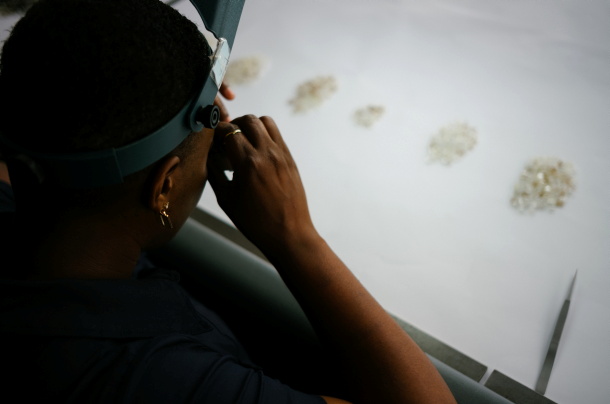

De Beers sold $700m worth of rough diamonds across its two sights in the three months to 30 September – more than tripling the $213m recorded during the same period last year.

In the third quarter of 2024, the company held only one sight, having cancelled the August session due to weak demand.

During the Q3 2025 sights, specific assortments were offered at discounted prices. De Beers no longer provides sight by sight updates.

It noted that trading conditions “continued to be challenging,” although consumer demand for natural diamond jewelry remained broadly stable, particularly in the US.

The company said progress seen in the first half of 2025 was hindered by newly imposed US tariffs on diamond imports from India, according to its production report published on 28 October.

However, it welcomed the recent exemption granted for natural diamond imports from countries participating in “aligned partner” trade agreements, announced last month.

Meanwhile, quarterly production increased year-on-year by 38 per cent, to 7.7m carats, although it is down 5 per cent for the year to date (17.9m carats).

Production guidance for 2025 is unchanged at 20 to 23m carats.

Source: IDEX