BHP’s share-swap take over bid for arch-rival Anglo American to create a $185 billion mining giant will struggle to succeed, but if it does there is one arm of the target certain to be sold, the De Beers diamond business.

Despite its century-old reputation and claim to be the custodian of the diamond industry De Beers has become more trouble than it’s worth, under attack from two directions.

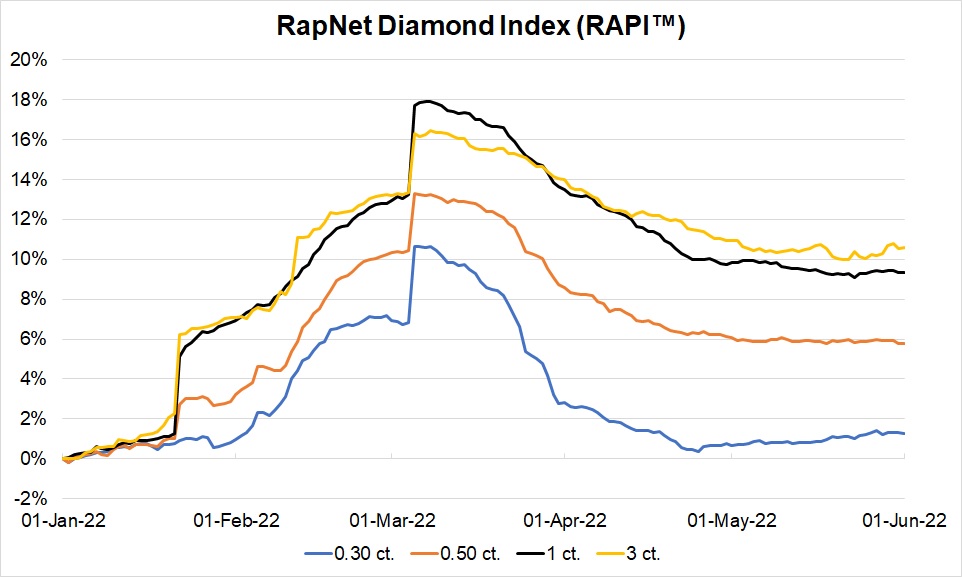

Demand for diamonds is being battered by global economic uncertainty while the problem of slowing sales is being supercharged by the increasing popularity of lab-grown gems which are indistinguishable from mined diamonds.

A third factor which could seal the fate of De Beers is that BHP quit the diamond industry a decade ago after struggling to mix mining, and its basic function of heavy-duty earthmoving, with the fine art of producing and marketing baubles for the rich and newlyweds.

It could get worse for the diamond mining business because prices for lab-grown gems are continuing to fall as a market split widens. High-value jewels remain of interest to a handful of wealthy people, while the lion’s share of the market shifts to lab-grown.

De Beers, which was a pioneer in the business of lab-grown gems via its Lightbox subsidiary, has consistently played down the threat to its traditional mined-diamond business but sustaining that argument became a little harder on Tuesday when it reported a big production fall in the March quarter.

The 23% drop in output caused Anglo American to lower its full year diamond production target from between 29 million and 32 million carats to between 26-and-29 million carats.

Management blamed the decline on the effect of a build-up of inventory of unsold stones with lab-grown gems cannibalising demand for mined stones.

Forbes Daily: Join over 1 million Forbes Daily subscribers and get our best stories, exclusive reporting and essential analysis of the day’s news in your inbox every weekday.It Could Get A Lot Worse

It could get a lot worse if a recent study of the diamond market by a specialist London jewelry firm is a guide.

The video player is currently playing an ad. You can skip the ad in 5 sec with a mouse or keyboard

According to Hatton Jewels, which specialises in handling antique second-hand gems and does not sell lab-grown gems, some lab-grown diamonds are spectacular overpriced with retailers inflating their prices by as much as 1200%.

Rachel Smith, head valuer at Hatton said that in the current landscape, every business pays a similar wholesale price for lab-grown diamonds, regardless of disparities in their retail market value.

“The wholesale price of lab-grown diamonds can plummet to as low as 1% of their natural counterparts’ value,” Smith said in an emailed statement.

Smith cited three retail prices for a two-carat F VS1 (high quality) lab-grown diamond being offered for sale at $11,375, $2730 and $866. A gem of that size and quality costs between $500 and $759 to make.

“While some companies uphold integrity by selling lab-grown diamonds at fair market value, ensuring equitable competition, others exploit the situation for profit.

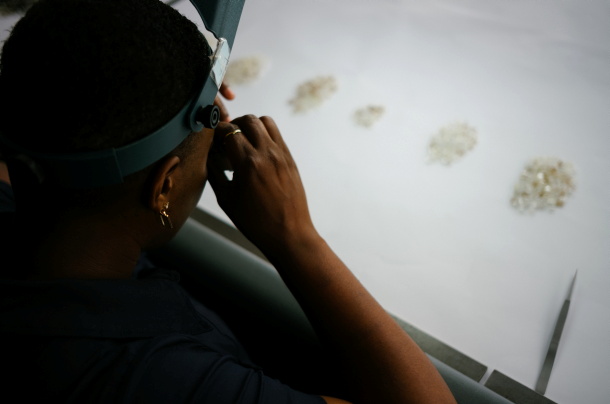

Diamond “growing” machines in India.

“Some retailers inflate prices by as much as 1200%, potentially driven by a desire to maintain the narrative that they are not different from natural diamonds, otherwise they may be considered too cheap and therefore undesirable, or to capitalize on trends at the expense of consumers.”

If Smith is right and lab-grown diamonds are currently being sold at inflated profit margins, the ease with which they are produced will ensure an increase in supply, resulting eventually in a price crash.

When that happens the value of the once-great De Beers business will fade, and the appeal to a mining company like BHP will disappear — if it succeeds in acquiring Anglo American.

Source: Forbes