Diamond trading was stable in May despite concerns about inflation, rising interest rates and slumping stock markets. Polished prices initially declined but later steadied as dealers anticipated supply shortages resulting from Russian sanctions.

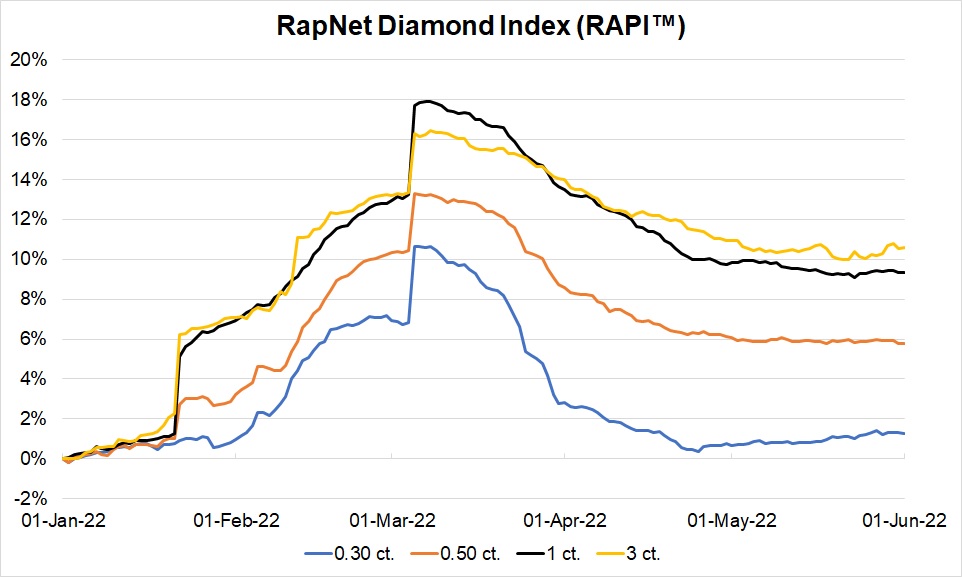

The RapNet Diamond Index (RAPI™) for 1-carat diamonds slid 0.5% in May but was 9.3% higher on June 1 than at the beginning of the year.

| RapNet Diamond Index (RAPI™) | |||

|---|---|---|---|

| May | Year to date Jan. 1 to June 1 | Year on year June 1, 2020, to June 1 2021 | |

| RAPI 0.30 ct. | 0.6% | 1.3% | -0.1% |

| RAPI 0.50 ct. | -0.3% | 5.8% | 8.2% |

| RAPI 1 ct. | -0.5% | 9.3% | 22.1% |

| RAPI 3 ct. | -0.3% | 10.6% | 25.7% |

© Copyright 2022 by Rapaport USA Inc.

US demand is supporting the market even as economic uncertainty sets in. Expectations are rising for the Las Vegas shows, which begin June 8. Dealers hope the positive sentiment will boost trading in the second half of the year. Chinese wholesalers remain cautious as activity resumes after the country’s Covid-19 lockdowns.

Inventory levels are high but have decreased in select categories. The number of diamonds on RapNet stood at 1.8 million as of June 1, up 43% from a year earlier. The quantity of 0.30-carat, D- to H-color, IF- to VS-clarity goods fell 14% in May; 0.50-carat diamonds in the same range declined 11%. Both categories were still significantly above last year’s levels.

While the sanctions on Russian goods have not yet caused notable polished scarcities, shortages are likely in the coming months. Rough supply has dropped since Alrosa canceled its March and April sales. Prices at rough auctions have increased — particularly in the small-diamond category, which Alrosa dominates. De Beers raised prices of small rough at its latest sight from June 6 to 10.

The market is splitting into two segments: Russian and non-Russian goods. Some big cutters are finding ways to buy Alrosa rough in order to serve centers that remain open to buying Russian-origin polished. These diamonds will likely sell at a discount to non-sanctioned ones.

US and European jewelers and brands may have difficulty filling their sourcing requirements in the coming months without Russian supply. This will lend further support to diamond prices.

Source: DCLA

No comments:

Post a Comment