Lucara Diamond Corp is moving forward with the underground expansion of its flagship Karowe mine in Botswana, reaffirming long-term confidence in natural diamonds despite a challenging global market backdrop.

An updated feasibility study has confirmed that the underground project is expected to recover approximately 4.5 million carats over a 10-year mine life, extending Karowe’s production through to 2038. The study strengthens Lucara’s strategy to invest counter-cyclically at a time when the diamond industry is facing falling revenues, production suspensions, and intensifying competition from lab-grown diamonds.

Open-pit mining at Karowe is scheduled to conclude before June, after which surface stockpiles will continue to be processed while underground development progresses towards commercial production. Underground operations are expected to commence in the first half of 2028.

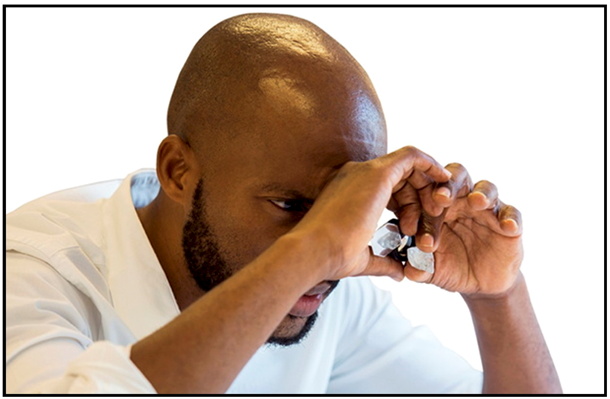

Lucara President and CEO William Lamb said the company remains focused on Karowe’s unique ability to deliver large, high-value stones. “We look forward to continuing to recover large, exceptional diamonds from the underground project,” Lamb said, noting that Karowe is the only diamond mine in the world to have produced nine diamonds weighing more than 1,000 carats.

The underground expansion carries a pre-production capital cost of US$779 million, of which US$436 million has already been invested over the past five years. The remaining US$343 million is expected to be funded through operating cash flow, supplemented by potential equity or debt financing. Lucara is currently engaging with existing lenders and its major shareholder to evaluate funding options.

The project delivers an after-tax net present value of US$432 million, with Lucara forecasting more than US$1.3 billion in net income over the life of the underground operation.

The mine plan targets the highest-value domain of the South Lobe of the AK6 kimberlite, which continues at depth beneath the existing open pit. The underground mine is designed to sustain a 2.85 million tonne-per-year mining and processing operation as surface mining winds down.

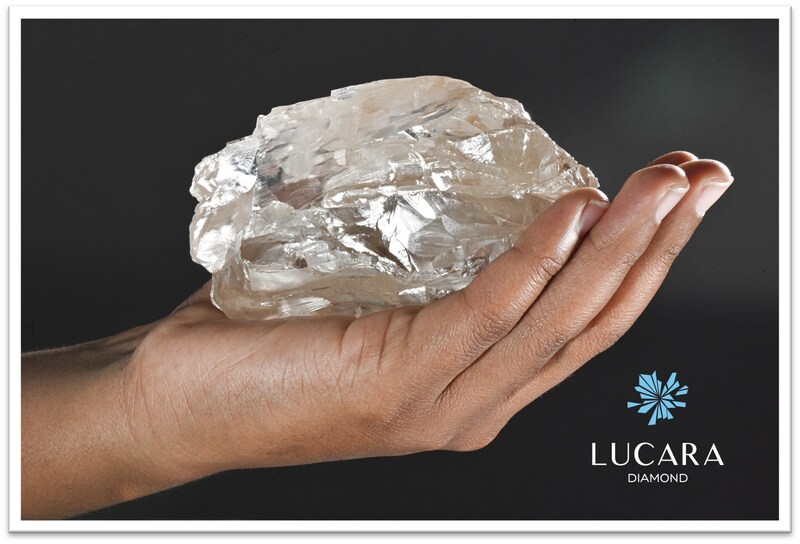

A Proven Source of Exceptional Diamonds

Since production began, Karowe—whose name means “precious stone” in the local language—has established itself as one of the world’s most prolific sources of exceptional diamonds. Notable recoveries include the 1,758-carat Sewelô (2019), the 1,109-carat Lesedi La Rona (2015), and the 813-carat Constellation, also recovered in 2015. The mine has also produced Botswana’s largest fancy pink diamond to date, the Boitumelo.

Despite current market headwinds, Karowe remains one of the highest-margin diamond mines globally, consistently producing around 300,000 high-value carats per year—a distinction that continues to underpin Lucara’s confidence in the project’s long-term fundamentals.