Diamond producer Lucara Diamond Corp sold 76 387 ct of diamonds, generating $41.3-million in revenue, during the second quarter ended June 30.

The company recovered 92 419 ct of diamonds at a grade of 12.9 ct for every 100 t of direct milled ore.

Additionally, 8 349 ct were recovered from processing historic recovery tailings. The company recovered 206 special diamonds, defined as rough diamonds weighing more than 10.8 ct, representing 6.9% by weight of the total recovered carats from the second quarter’s processed ore. This aligns with the company’s expectations, Lucara said.

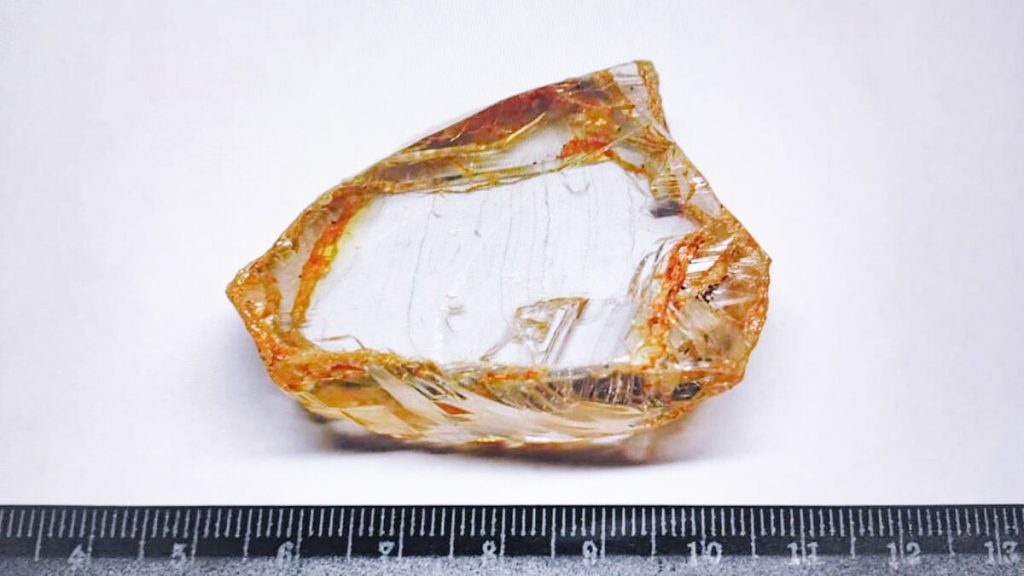

Noteworthy recoveries during the period included a 491 ct Type IIa diamond, a 225.6 ct Type IIa diamond and a 109 ct Type IIa diamond.

Significant progress was made in shaft sinking for the ventilation and production shafts during the second quarter, with the critical path ventilation shaft ahead of the July 2023 rebase schedule. By the end of the quarter, the production and ventilation shafts had reached depths of 557 m below collar and 550 m below collar, respectively.

Operational highlights from the Karowe mine for the quarter included ore and waste mined of 700 000 t, with ore processed totalling 700 000 t.

Financial highlights for the second quarter revealed operating margins of 67%, compared with 59% in the second quarter of 2023. This strong operating margin is attributed to robust pricing for the company’s larger stones and cost reduction initiatives, supported by a strong dollar.

The operating cost was $26.32/t processed, a 6% decrease from $27.97/t in the second quarter of 2023 and consistent with the $26/t in the first quarter of this year.

Lucara believes the impact of inflationary pressures, particularly in labour, was well-managed by the operation, with a strong dollar offsetting a slight increase in costs compared with the previous period.

Adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda) were $18.8-million, up from $16.5-million in the second quarter of 2023, driven by increased revenue and lower operating expenses.

During the second quarter, the company invested $11.2-million into the Karowe Underground Project (KUP), excluding capitalised cash borrowing costs. The ventilation shaft sank 128 m, and development of the 470-level station, located at about 550 m below collar, began.

Production shaft activities included the sinking of 104 m and the completion of three probe hole covers, with no water being intersected. A total of 26 m of lateral development on the 470-level, along with the 470-level station development, was completed.

As of June 30, Lucara reported cash and cash equivalents of $21.9-million and working capital of $21.7-million. The company had drawn $165-million on the $190-million project facility for the KUP, with an additional $25-million drawn on the $30-million working capital facility and a cost overrun reserve account balance of $37.5-million.

The Karowe mine registered no lost-time injuries during the second quarter, taking the mine to more than three years without a lost-time injury.

“Lucara’s performance this quarter reaffirms our position as a leader in the diamond industry. Our . . . safety and operational excellence [record] continues to drive our success, with both our openpit operations and underground construction progressing admirably. The Underground Expansion Project, in particular, is advancing well, with shaft sinking progress surpassing our expectations,” Lucara president and CEO William Lamb said on August 12.

Lucara noted that, in the diamond market, the long-term outlook for natural diamond prices remains positive owing to improving supply and demand dynamics, largely driven by long-term reductions from major producing mines.

However, the market for smaller-sized diamonds remains soft, impacted by a weak Asian market and the rise of laboratory-grown diamonds.

Lucara said demand for larger diamonds over 10.8 ct remained robust, as reflected in the company’s sales.

However, the G7 sanctions on Russian diamonds over 1 ct, effective March this year, have caused some trade delays owing to new regulations requiring these diamonds to be processed through the Antwerp World Diamond Centre for origin verification.

Lucara, with its established operations producing Botswana diamonds, stands to benefit from this heightened focus on origin verification.

Sales of laboratory-grown diamonds increased steadily through 2023 and into this year, with many smaller retail outlets increasingly adopting these diamonds as a product.

In the second quarter, diamond producer De Beers announced that it would cease creating synthetic diamonds and focus on selling natural diamonds. This decision aligns with several major brands confirming they would not market laboratory-grown diamonds.

Lucara said the long-term impact was expected to support the natural diamond market, with a bifurcation between the natural and laboratory-grown diamond markets expected in the medium term.

The company believes that the longer-term market fundamentals for natural diamonds remain positive, as demand is expected to outstrip future supply, which has been declining globally over the past few years.

Source: DCLA