Lab-grown diamonds are transforming the global jewellery market and Australia is no exception. What began as a value-driven alternative is now a major contributor to sales growth for leading jewellers around the world.

Signet Jewelers parent company of retail chains Kay Jewelers, Zales and Jared recently reported 6% same-store sales growth, largely fuelled by strong demand for fashion and bridal jewellery featuring lab-grown diamonds (LGDs). Today, LGDs represent around 40% of Signet’s bridal diamond sales, proving just how quickly consumer preferences are shifting.

This growth is driven by simple customer logic:

Larger stones. Greater brilliance. Lower cost.

Ethically and environmentally responsible.

Exceptional value at key gifting price points.

Retailers are seeing customers choose bigger, higher-quality stones because LGDs allow them to upgrade without increasing their budget a trend transforming both the bridal and fashion jewellery categories.

The Australian Lab-Grown Diamond Boom

Australia is now one of the world’s fastest-growing markets for certified laboratory-grown diamonds. Engagement ring buyers and fine jewellery lovers alike are turning toward lab-created stones that offer:

Certified quality

Significant savings compared to natural diamonds

A conflict-free, sustainable choice

Access to premium size and sparkle

Demand has risen sharply in the last 18 months as Australians search for better value in a higher-interest-rate economy while still wanting beautiful luxury pieces.

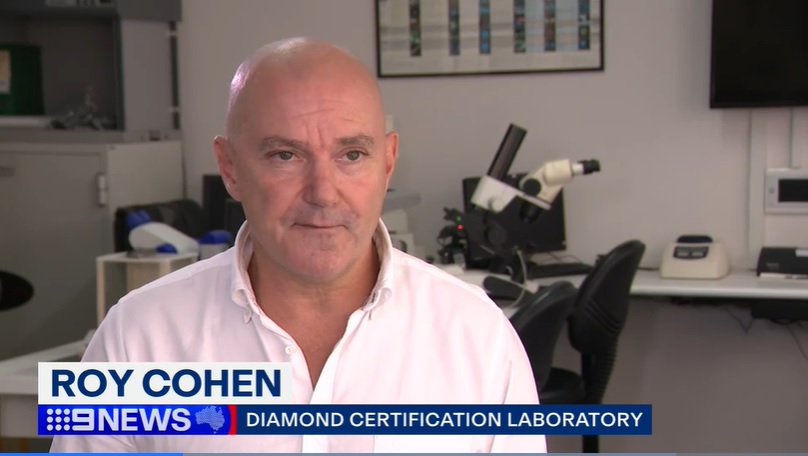

Why Buy Lab-Grown Diamonds from DCLA?

With rapid growth comes the increasing importance of credible certification. This is where the Diamond Certification Laboratory of Australia (DCLA) leads the market.

DCLA is Australia’s official CIBJO-accredited diamond laboratory

Every diamond is independently graded in Sydney

Transparent, trusted certification standards no inflated grades or misleading claims

Through the DCLA Diamond Exchange, buyers can purchase certified lab-grown diamonds directly, ensuring:

Authentic grading from Australia’s most trusted authority

Competitive prices without retail mark-ups

Expert support when selecting the perfect stone

Secure local service and delivery

Whether upgrading to a bigger stone or choosing your first diamond, the DCLA Diamond Exchange offers unmatched confidence, value and peace of mind.

The Future Is Bright and Lab-Grown

As global retailers continue to expand their lab-grown diamond offerings and consumers embrace the beauty and value of LGDs, the category is expected to keep gaining market share particularly in the fast-growing fashion jewellery segment.

Here in Australia, buyers are becoming more educated and discerning. They want quality, certification and true value making DCLA-certified lab-grown diamonds the smartest choice.

Discover Australia’s most trusted source for certified lab-grown diamonds:

The DCLA DiamondExchange Where Quality Comes First.