Gem Diamonds has become the latest casualty in a deepening crisis engulfing the global diamond industry, announcing sweeping cost-cutting measures as the market buckles under falling prices and the growing popularity of lab-grown alternatives.

The Africa-focused diamond producer reported a 43% drop in revenue to $44.7 million for the first half of its financial year. Carat sales fell 22% to 44,360, while the average price per carat plunged 26% to $1,008.

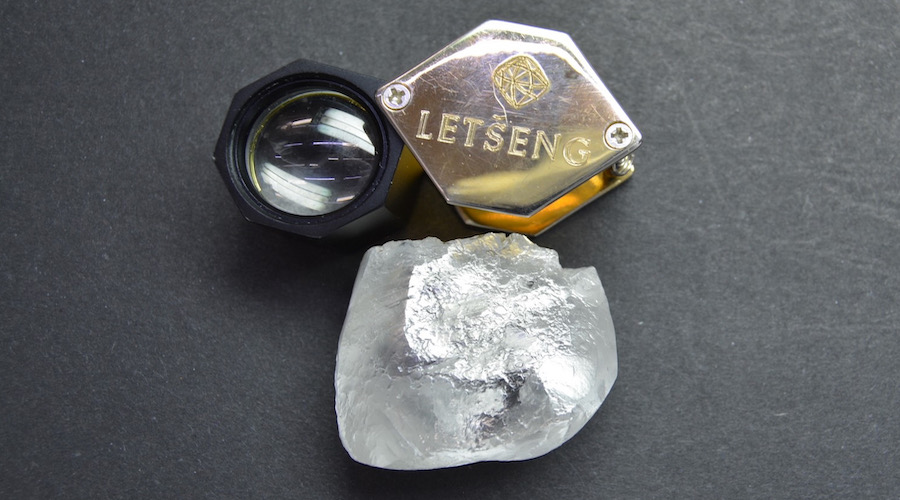

In response, it said it would reduce operating costs by $1.4 million to $1.6 million per month and cut around 250 jobs, or 20% of its workforce, at its Letšeng mine in Lesotho. Executives have also taken voluntary salary reductions.

“Considering the prolonged weakness in global diamond prices, compounded by a weak dollar and ongoing US tariff uncertainties, Gem has implemented decisive measures to conserve cash and protect shareholder value,” the company said.

Despite meeting production targets, Gem Diamonds admitted it has not been shielded from sustained pressure on rough diamond prices and adverse currency movements. Investors reacted accordingly, with the company’s shares falling more than 20% in early trading on the London Stock Exchange. They partially rebound to 5.5 pence in late trading, valuing the company at £7.7 million ($10 million).

Gem Diamonds’ measures mirrors those of its peers. just last week, Burgundy Diamond Mines (ASX: BDM) halted open pit operations at its Ekati mine in Canada’s Northwest Territories, triggering mass layoffs.

All three operating diamond mines in the region — Ekati, Diavik and Gahcho Kué — are now facing eventual closure, with Diavik scheduled to close in 2026 and Gahcho Kué expected to cease operations by 2030. Ekati’s long-term future remains uncertain.

Getting worse

Signs of a worsening crisis in the diamond sector were already clear in the first three months of 2025. De Beers, the world’s largest producer by value, saw a 44% drop in revenue in Q1 and is sitting on $2 billion in unsold inventory. It plans to cut over 1,000 jobs at its Debswana joint venture in Botswana.

Russia’s Alrosa, hampered by sanctions, reported a 77% plunge in profits and has halted production at key sites.

Petra Diamonds (LON: PDL) is fighting to survive after a 30% drop in sales and the sudden departure of its CEO.

Lucapa (ASX:LOM) entered voluntary administration in Australia, and Sierra Leone’s Koidu Limited shuttered operations and laid off more than 1,000 employees after losing $16 million to labour strikes.

Even Lucara (TSX: LUC), which operates in both Botswana and Canada, has flagged a “going concern” risk despite hitting production records.

All eyes are now on De Beers. Once synonymous with manufactured scarcity and aggressive branding, the company is up for sale. Parent company Anglo American (LON: AAL) has cut its valuation by $4.5 billion in just over a year. No buyers have emerged, but Botswana is reportedly pushing to take a controlling stake.

Source: DCLA