The legendary Rainbow Collection more than 300 fancy coloured diamonds amassed over four decades by the late Eddy Elzas sold for just above its low estimate at Christie’s Geneva on 11 November, achieving $2.19 million against a pre-sale estimate of $1.98 million to $2.98 million.

Comprising around 350 carats and spanning the full colour spectrum, the collection was once hailed as one of the world’s most extraordinary private assemblages of fancy coloured diamonds. Over the years, press reports placed its value between $60 million and $100 million.

Elzas, affectionately known as “The King of Coloured Diamonds,” famously declined a lavish offer from a Saudi prince who reportedly wished to purchase the collection as a wedding gift for Prince Charles and Lady Diana.

A true pioneer in the fancy colour diamond trade, Eddy Elzas was instrumental in elevating global recognition of coloured diamonds during his 40-year career. He passed away in November 2021 at the age of 79.

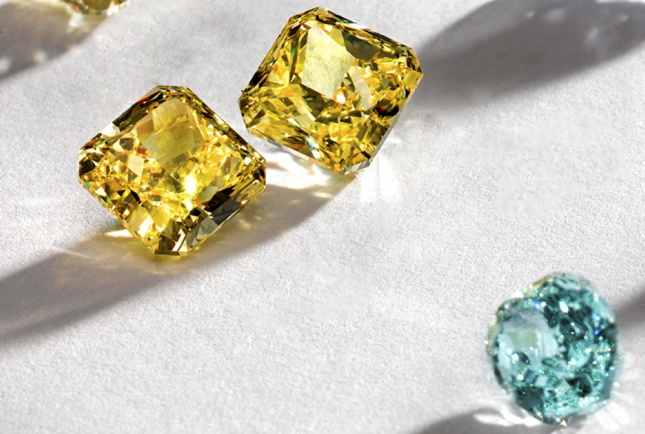

Christie’s described the Rainbow Collection as “an impressive collection of unmounted coloured and treated coloured diamonds,” featuring 300 stones across an array of hues and shapes. The lot included 291 GIA reports dated between 2008 and 2025, with diamonds ranging from 0.24 carats to 4.89 carats in yellow, orange, blue, pink, red, brown, and grey tones.

For the DCLA, this sale highlights not only the enduring fascination with fancy colour diamonds but also the evolving market perception of rarity and provenance in today’s auction landscape.