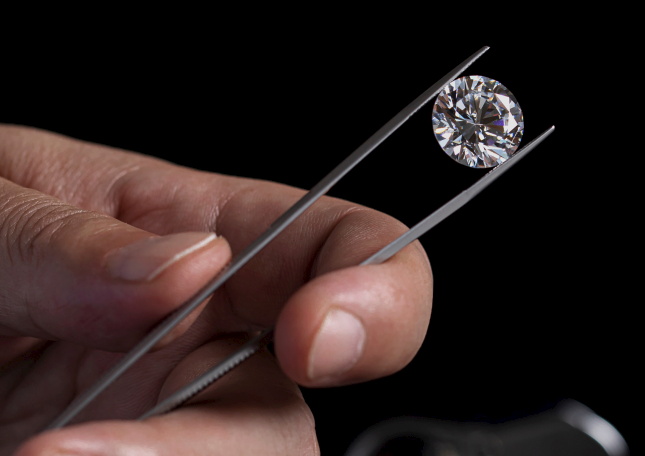

De Beers Group, the global diamond mining leader, has announced the closure of its lab-grown diamond (LGD) jewellery brand, Lightbox, marking a strategic pivot back to natural diamonds. The decision comes as part of the company’s broader Origins Strategy, launched in May 2024, to streamline operations and prioritise high-return business areas.

End of the Road for Lightbox

Launched in 2018, Lightbox was positioned to differentiate lab-grown diamonds from natural ones by offering transparent linear pricing at $800 per carat. However, the LGD market has undergone significant change. Wholesale prices for lab-grown diamonds in the jewellery sector have dropped by around 90%, pushing the market toward a cost-plus pricing model. This sharp decline in value has ultimately led De Beers to discontinue Lightbox.

In addition to market pressures, De Beers cited weakening demand and uncertainty around tariffs as contributing factors behind the closure. Discussions are currently under way for the sale of Lightbox’s assets, including its remaining inventory.

Reaffirming Commitment to Natural Diamonds

Al Cook, CEO of De Beers Group, emphasised that the decision to close Lightbox reflects the company’s long-term strategy to focus on natural diamonds, where brand heritage and enduring value remain strong.

“The persistently declining value of lab-grown diamonds in the jewellery market underscores the growing distinction between factory-made stones and natural diamonds,” Cook said.

“Global competition, especially from low-cost Chinese producers, and falling prices driven by US supermarkets, show that prices are likely to continue dropping. Lightbox played a role in clarifying the difference in value between lab-grown and natural diamonds.”

De Beers plans to reinvest resources from Lightbox into marketing campaigns and initiatives that enhance the global appeal of natural diamonds.

Support for Customers and Partners

As Lightbox operations wind down, De Beers will ensure a smooth transition for employees, suppliers, retail partners, and other stakeholders. Warranties and after-sales services for existing Lightbox purchases will continue to be honoured during the closure period.

Synthetic Diamonds to Power Innovation

While De Beers exits the LGD jewellery space, it remains invested in the future of synthetic diamonds in industrial and technological applications. Element Six, a De Beers subsidiary and former supplier to Lightbox, will continue developing lab-grown diamond solutions for sectors such as semiconductors, optics, and quantum technology.

Element Six will centralise its chemical vapour deposition (CVD) production in Oregon, USA, as part of its plan to strengthen global partnerships and fuel innovation across high-tech industries.