Polished diamond prices are derived from a variety of factors, including supply and demand, the quality and characteristics of the individual diamond, and market conditions.

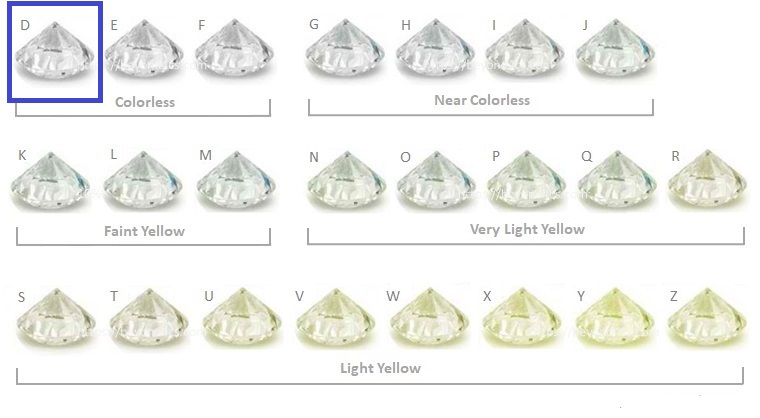

The prices of polished diamonds are primarily determined by the 4Cs: carat weight, colour, clarity, and cut. These factors are assessed by gemologists and other experts who evaluate the diamond’s physical properties, such as its size, colour, clarity, and overall quality of cut.

Other factors that may influence the price of polished diamonds include the type of diamond, such as whether it is a natural or lab-grown diamond, the country of origin, and the overall market conditions for diamonds. Additionally, the reputation and credibility of the seller or the dealer can also affect the price of the polished diamond.

Overall, polished diamond prices are determined by a complex combination of factors, and can fluctuate over time based on changes in supply and demand, market conditions, and other economic and industry factors.

There is no single diamond price list that accurately reflects the prices of all diamonds. This is because the price of a diamond depends on a number of factors, including its size, shape, colour, clarity, and other characteristics.

That being said, there are various industry-standard diamond price lists that are commonly used as references by professionals in the diamond trade. These lists are typically based on a standardized grading system and provide price ranges for diamonds of different sizes, shapes, and quality grades.

The most commonly used diamond price list is the Rapaport Diamond Report, which provides a benchmark price for diamonds based on their 4Cs grading (carat weight, colour, clarity, and cut). However, it is important to note that the Rapaport price list only reflects the wholesale price of diamonds and may not necessarily reflect the retail price that consumers will pay.

Other diamond price lists include the International Diamond Exchange Price List, the Idex Diamond Price Report, and the Polished Prices Diamond Index, among others. These price lists may differ in their methodologies and grading systems, and the prices they list may vary slightly from one another.

Ultimately, when buying or selling a diamond, it is important to work with a reputable and knowledgeable diamond professional who can help you evaluate the diamond’s characteristics and provide you with an accurate price estimate based on current market conditions.

Source: Michael Cohen DCLA