De Beers’ rough-diamond sales soared to $650 million in January, its highest for any month since 2018, as manufacturers replenished inventory following the holiday season.

The total was 18% more than the $551 million the miner garnered a year earlier, and 44% above the $452 million it reported in December, De Beers said Wednesday. This was despite the company implementing a sharp increase in rough prices.

“With the midstream starting the year with low levels of rough and polished inventories, and following strong sales of diamond jewelry over the key holiday season in the US, we saw good demand for rough diamonds at the first cycle of the year as midstream customers sought to restock and to fill orders from retail businesses,” said De Beers CEO Bruce Cleaver. “Sales of rough diamonds are also being supported by expected demand ahead of Chinese New Year and Valentine’s Day.”

De Beers held the sight in its usual Botswana location, in addition to viewings in Antwerp and Dubai, as the Covid-19 pandemic has prevented many customers from traveling overseas. Its revenue figure encompasses sales that took place between January 18 and February 2, including the sight and auctions.

The January sight is usually one of the biggest of the year, especially after a positive holiday season. Even so, this year’s opening sale of the year exceeded all monthly sales going back to January 2018, when revenues came to $672 million.

De Beers raised prices by 4% to 5% at the sight in response to the improving balance between supply and demand, as reported last month by Rapaport News. Alrosa lifted its prices by 6% to 7%, with the Russian miner scheduled to publish its January sales value on February 10.

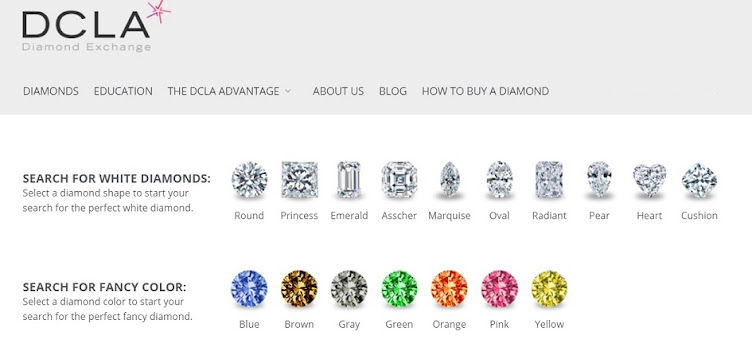

Source: DCLA