Sotheby’s New York is set to host an extraordinary High Jewellery auction on 13 June, featuring 110 remarkable lots — many of them centred around colourless and fancy coloured diamonds. This exclusive sale not only showcases some of the most important stones on the market today but also brings to light jewellery with historic provenance, including pieces from the Vanderbilt and Wade families, and a private collection chronicling a decades-long romance.

The Crown Jewel: 35.01ct Graff Diamond Ring

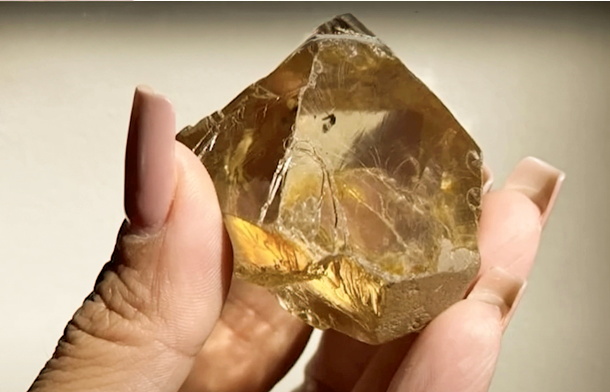

Leading the sale is a breathtaking 35.01-carat emerald-cut diamond ring from luxury jeweller Graff. This D-colour, VVS2 clarity diamond is described as “highly important,” and is expected to fetch between USD $2 million and $3 million (approximately AUD $3 million to $4.5 million). It’s one of 13 spectacular jewels from a private collection titled Joie de Vivre: Journey in Jewels — a tribute to a husband’s enduring love, with each piece gifted to his wife throughout a 60-year marriage.

Another standout from the same collection is a pair of emerald and diamond earclips by Graff, boasting four sugarloaf cabochon emeralds weighing a total of approximately 84 carats. These exceptional earrings carry a presale estimate of USD $800,000 – $1.5 million.

Additional highlights from this private collection include:

An aquamarine and diamond bracelet: USD $40,000 – $60,000

A jade and diamond pendant-brooch, circa 1910s: USD $25,000 – $35,000

Fancy Colours Steal the Spotlight

The number two lot of the sale is a striking 5.02-carat fancy pink diamond ring with VS2 clarity, estimated at USD $1.5 million – $2.5 million. Following closely is a 2.02-carat fancy vivid blue diamond ring, cut in a modified rectangular mixed style, with an estimate of USD $1.4 million – $1.8 million.

Also drawing significant attention is a pair of flawless D-colour pear-shaped diamonds weighing 10.32 and 10.11 carats respectively. Both diamonds are rated “excellent” in polish and symmetry, with a combined estimate of USD $1.1 million – $1.5 million.

American Legacy: Vanderbilt and Wade Family Heirlooms

Among the historic highlights is a ruby and diamond sautoir by Marcus & Co., dating back to circa 1915. The centrepiece is a 9.60-carat unheated Burmese ruby, surrounded by old European-cut diamonds and accented with calibre-cut rubies. This important jewel is estimated at USD $1 million – $2 million and once belonged to Emily Vanderbilt Wade, the great-granddaughter of Cornelius Vanderbilt and daughter of Rhode Island Governor William Henry Vanderbilt III.

Three other Vanderbilt Wade jewels will also go under the hammer:

Cartier Art Deco diamond bracelet: Estimated at USD $60,000 – $80,000

Rene Lalique Art Nouveau pendant: Crafted from gold, enamel, emerald and pearl, circa 1900, with an estimate of USD $20,000 – $30,000

Multistone tassel sautoir: Featuring rubies, emeralds, pearls, diamonds and enamel, and possibly designed by Paulding Farnham of Tiffany & Co., with an estimate of USD $40,000 – $60,000

A Rare Opportunity for Collectors and Connoisseurs

This Sotheby’s auction is not only a chance to acquire some of the world’s most exquisite diamonds and gemstones but also to own a piece of history. With provenance linking to America’s most prominent families and jewellery houses such as Graff, Cartier, and Tiffany & Co., the pieces represent both artistic excellence and emotional legacy.

For collectors, investors, and jewellery lovers alike, 13 June will mark a significant date on the global jewellery calendar.

Source: DCLA