A spectacular Tiffany & Co. necklace has made auction history, achieving a record-setting USD $4.2 million and establishing a new world auction record for a Paraiba tourmaline. The piece sold for more than seven times its high estimate during Christie’s Magnificent Jewels sale on 10 December in New York.

The centrepiece of the necklace is an exceptional 13.54-carat triangular modified brilliant-cut Paraiba tourmaline, accented by an array of round, pear, and square-shaped diamonds. Paraiba tourmalines of this size and saturation remain among the rarest gemstones in the world, and the extraordinary result underscores the continued strength of the coloured-gemstone market.

Christie’s reported an impressive 95% sell-through rate, with the auction realising USD $46.5 million. High-value pieces from renowned maisons such as Harry Winston, Van Cleef & Arpels, Cartier, and Tiffany & Co. all attracted strong global demand.

Below are the top-performing lots from the sale:

Top 10 Jewels at the Christie’s Magnificent Jewels Auction

1. Paraiba Tourmaline Tiffany & Co. Necklace

Final price: $4.2 million

Estimate: $300,000 – $600,000

A 13.54-carat Paraiba tourmaline with diamond accents — now a world-record holder.

2. Antique Kashmir Sapphire Earrings (circa 1910)

Final price: $3.1 million

Estimate: $1.5 million – $2 million

Featuring 11.92-carat and 12.61-carat cushion mixed-cut Kashmir sapphires suspended from old-cut diamonds.

3. Art Deco Cartier Ring (Rockefeller Kashmir Sapphire, circa 1925)

Final price: $2.6 million

Estimate: $1.5 million – $2.5 million

Centred on the celebrated 17.66-carat sugarloaf cabochon Kashmir sapphire.

4. D-Colour, VS1, 27.19-Carat Type IIa Diamond Ring

Final price: $1.9 million

Estimate: $1.4 million – $1.8 million

A rare type IIa diamond in classic emerald cut.

5. 16.23-Carat Kashmir Sapphire Ring

Final price: $1.8 million

Estimate: $500,000 – $700,000

A dramatic result for a cushion mixed-cut Kashmir sapphire surrounded by old-cut diamonds.

6. Tiffany & Co. Paraiba Tourmaline Earrings

Final price: $1.3 million

Estimate: $120,000 – $180,000

Two oval modified brilliant-cut Paraiba gems of 3.19 and 3.45 carats — another major Paraiba surprise.

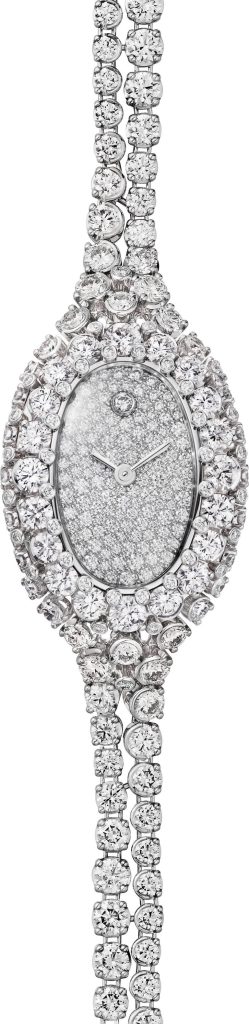

7. Cartier Ring with 23.03-Carat D, VVS2 Step-Cut Diamond

Final price: $1.1 million

Estimate: $800,000 – $1.2 million

Featuring a cut-cornered rectangular step-cut diamond flanked by trapezoid stones.

8. Barbara & Frank Sinatra Diamond Ring

Final price: $990,600

Estimate: $800,000 – $1.2 million

Showcasing a 20.60-carat emerald-cut D, VVS1 diamond between triangular side stones.

9. Multi-Stone Diamond Earrings

Final price: $863,600

Estimate: $500,000 – $700,000

Each earring includes three pear-shaped diamonds, the largest being an 11.36-carat D VS2 and a 9.96-carat E VS1.

10. JAR Ruby and Diamond Earrings

Final price: $787,400

Estimate: $400,000 – $600,000

Designed with cushion, oval, pear, and round rubies surrounded by diamonds.

What This Means for the Market

The exceptional performance of Paraiba tourmaline and Kashmir sapphire pieces highlights continued buyer appetite for rare, high-quality coloured gemstones, particularly those with strong provenance or iconic branding. Record prices at auction also reaffirm the importance of independent grading and authentication, an area where the DCLA remains Australia’s trusted authority.