The difference in diamond grading between laboratories like GIA (Gemological Institute of America) and DCLA (Diamond Certification Laboratory of Australia) can occur due to the subjective nature of diamond grading and variations in grading standards, tools, and methodology.

Here’s a detailed explanation of why this happens:

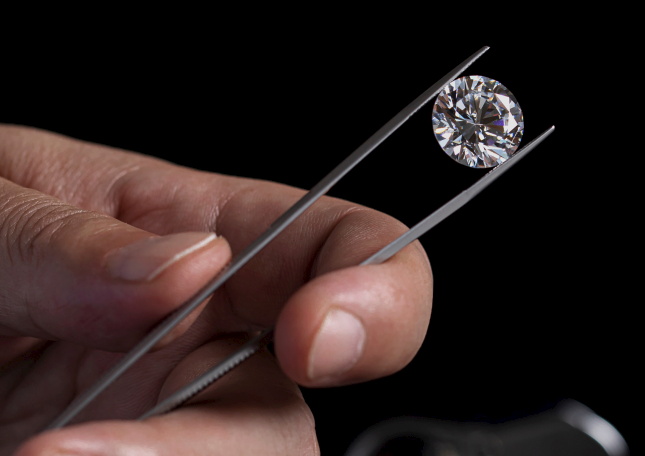

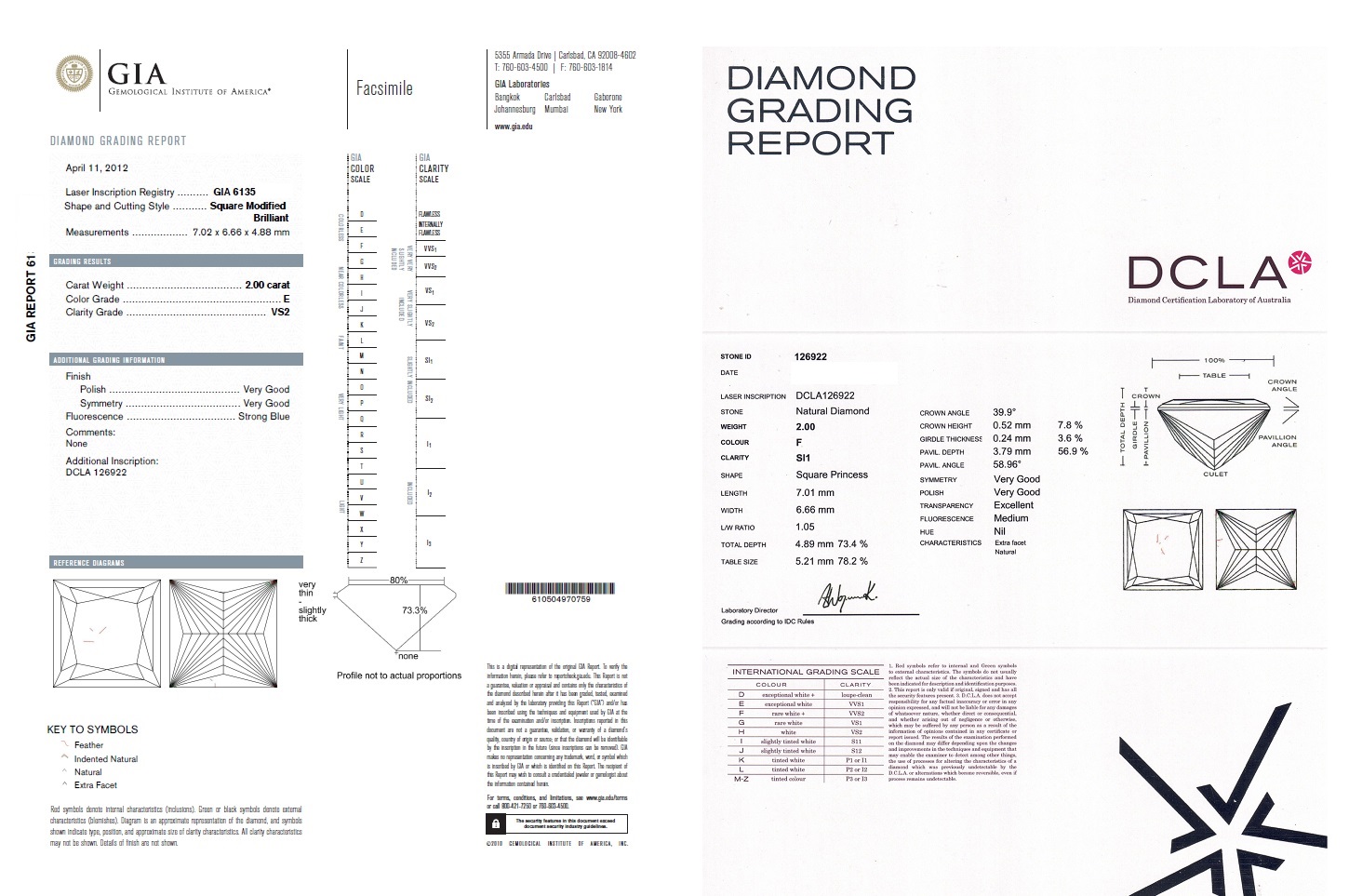

Example of a diamond graded GIA E VS2 vs DCLA F SI1:

1. Grading is Subjective to Some Extent

Even though labs follow international grading systems like those defined by CIBJO or GIA, colour and clarity grading involves human judgment under magnification and controlled lighting conditions. Two experienced graders may interpret borderline characteristics differently.

- Colour: E and F are adjacent grades, and the difference is extremely subtle—often imperceptible to the untrained eye.

- Clarity: The distinction between VS2 (Very Slightly Included 2) and SI1 (Slightly Included 1) can also hinge on size, position, nature, and number of inclusions, which may be judged differently by separate labs.

2. Different Lab Philosophies

- GIA is widely considered the global benchmark for consistency and tends to be more conservative in some grading aspects, especially in colour.

- DCLA, while highly respected and CIBJO-accredited (and Australia’s official diamond authority), might interpret certain characteristics differently based on their internal grading protocols.

3. Grading Conditions and Equipment

Minor differences in:

- Lighting

- Magnification tools

- Grading environments

can affect the appearance of a diamond, especially in borderline cases.

4. Grading Date and Re-evaluation

Grading can differ if:

- The diamond was graded at different times.

- The diamond was repolished or slightly recut between submissions.

- The grader has different levels of training or experience (even within the same lab over time).

5. Lab-to-Lab Variance Is a Known Industry Factor

Even among top labs (GIA, IGI, HRD, AGS, DCLA), 1-grade differences in colour or clarity are common and not considered errors. This is why many dealers and appraisers say a difference of one colour or clarity grade is within acceptable tolerance.

In Your Example:

- GIA E VS2 vs DCLA F SI1:

- The colour difference (E vs F): within acceptable tolerance; both are considered colourless.

- The clarity difference (VS2 vs SI1): SI1 is a full grade lower, but this could be due to:

- An inclusion judged more impactful by DCLA

- A stricter application of clarity grading by DCLA

- GIA possibly being more lenient on that particular clarity characteristic

Differences like GIA E VS2 and DCLA F SI1 can result from:

- Subjective human interpretation

- Slightly different grading standards

- Borderline characteristics

- Environmental and technical grading factors

For buyers or sellers, it’s important to:

- Always compare certificates from top-tier labs.

- Understand that 1-grade discrepancies are common.

- Consider getting a professional review if there’s a significant value implication.