The American Gem Trade Association announced that, starting at Tucson next year, exhibitors will not be allowed to sell lab-grown diamonds or colored gemstones at the AGTA GemFair.

National Jeweler received a news release on AGTA’s decision via email Wednesday morning. The release also was posted on the AGTA website, though it had been removed by Wednesday evening.

AGTA CEO John W. Ford Sr. said the news release was “pulled by error,” and would be reposted today.

According to the release, AGTA’s new rule bans the display of loose gemstones or jewelry “comprising non-natural gemstones, ones that are man-made, synthetic, or lab grown.”

AGTA said its dealers can still sell lab-grown gems if they are disclosed, but only natural gems can be made available for purchase at GemFair.

The association said it enacted the ban to “thwart potential confusion,” confusion it sees happening in the lab-grown diamond industry and fears will affect the colored gemstone industry, even though lab-grown colored stones have been around for more than a century.

When asked what led to the belief that confusion was occurring, or could occur, in the colored gemstone market, Ford said in an email to National Jeweler, “Look no further than the chaos created by synthetics in the diamond industry … Our action is also in response to considerable concerns voiced by AGTA membership in relation to the adverse effects that synthetics could also potentially cause in the colored gemstone industry.”

While the AGTA’s decision has made headlines, it does not seem poised to have a big impact on AGTA GemFair exhibitors, few of whom sell lab-grown gemstones anyway.

In his email, Ford said out of the 260 exhibitors of loose or set gemstones at the 2024 AGTA GemFair Tucson, only two list that they sell synthetic gemstones in the AGTA Source Directory.

“Since sending out over (260) 2025 AGTA GemFair Tucson renewals, we’ve had an overwhelmingly positive response from the vast majority of our exhibitors, greatly outweighing any negative responses,” he said.

Related stories will be right here …

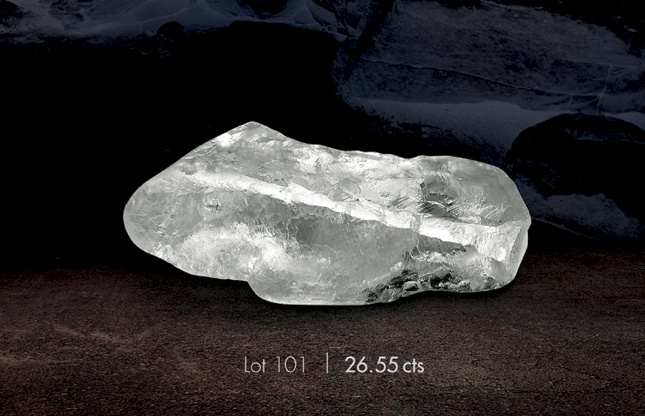

In its news release, AGTA also noted that lab-grown gemstones lack the value inherent to natural gemstones, which are rare and sometimes inimitable.

“AGTA felt that it needed to be crystal clear to buyers that when they attend an AGTA show, they know that they are only shopping mined natural gems from the earth,” said Kimberly Collins, AGTA board president and owner of Kimberly Collins Colored Gems.

“AGTA dealers pride themselves in sourcing superior gems that are rare, beautiful, and natural.”

AGTA also notes that “synthetic gems are not minerals.”

The association said it recognizes two definitions of the word “mineral”—that of the British Geological Survey, defining a mineral as “a naturally occurring substance with distinctive chemical and physical properties, composition, and atomic structure” and that of the U.S. Geological Survey, which defines a mineral as a “naturally occurring inorganic element or compound having an orderly internal structure and characteristic chemical composition, crystal form, and physical properties.”

“The definitions are essentially the same, but the keyword in both that is important is use of the word ‘natural,’” said AGTA board member John Bradshaw.

“It’s important to indicate that synthetic gems are not considered minerals, because minerals are natural, and synthetics are not.”

Source: Nationaljeweler