Africa-focused Petra Diamonds has postponed a scheduled sale of about 200,000 carats of diamonds from its Cullinan mine in South Africa, citing uncertainty over the impact of new US tariffs.

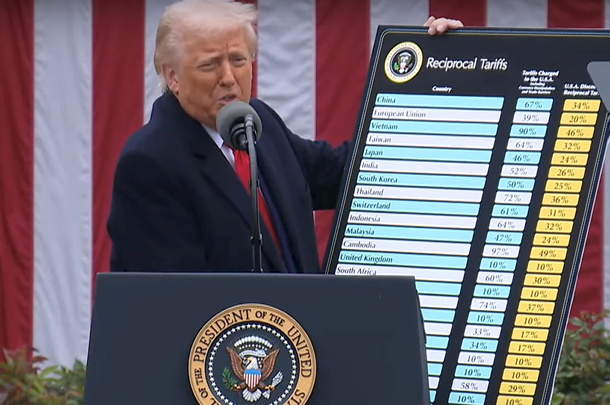

Last week, US President Donald Trump announced sweeping import tariffs ranging from 10% to over 100%, including a 30% duty on many South African goods. The move has injected volatility into the global diamond market.

Petra, which holds the world’s third-largest diamond resource, said the decision to delay the Cullinan sale aims to secure stronger market prices once the tariff situation becomes clearer. The sale had been expected to generate approximately $18 million in revenue.

Despite the disruption, the company managed to complete sales from its Finsch mine in South Africa and the Williamson mine in Tanzania before the tariffs were introduced.

South Africa remains one of the largest diamond exporters to the US, alongside India.

So far in the 2025 financial year, Petra has earned $103 million from rough diamond sales, down from $138 million during the first five tenders of the previous year.

Source: mining.com