At the world premiere of Wuthering Heights in Los Angeles, Margot Robbie delivered a masterclass in red-carpet storytelling by wearing one of the most legendary jewels in history: Elizabeth Taylor’s heart-shaped Taj Mahal Diamond, set in its iconic Cartier necklace.

The choice was far more than a glamorous nod to vintage jewellery. By adorning the historic diamond, Robbie underscored director Emerald Fennell’s vision of Wuthering Heights as not merely a faithful adaptation of Emily Brontë’s gothic novel, but a stylised homage to Old Hollywood passion, excess and epic love stories. On screen, Robbie and Jacob Elordi embody the turbulent romance of Catherine and Heathcliff—off screen, the Taj Mahal Diamond evokes one of cinema’s most famous real-life love affairs: Elizabeth Taylor and Richard Burton.

A Masterstroke of Method Dressing

The inspired jewellery moment was orchestrated by Robbie’s stylist, Andrew Mukamal, renowned for his meticulously curated fashion narratives, including the global Barbie press tour. The concept began months earlier, when The Elizabeth Taylor Estate invited Mukamal to explore its unparalleled jewellery archives.

“We were thrilled when Andrew got in touch, and we offered him the Taj Mahal Diamond for Margot Robbie to wear to the world premiere of Wuthering Heights,” said Tim Mendelson, Trustee of The Elizabeth Taylor Estate.

“Elizabeth deeply cherished the symbolism of jewellery. No other piece in her collection is more powerfully associated with epic, undeniable and tempestuous love that transcends time—even death—than the Taj Mahal Diamond.”

The Taj Mahal Diamond: A Jewel of Legendary Love

Few diamonds carry a narrative as rich as the Taj Mahal Diamond. Often described as a talisman of enduring devotion, the jewel perfectly mirrors the emotional intensity associated with both Wuthering Heights and Taylor’s own life.

Elizabeth Taylor and Richard Burton’s famously tempestuous romance began on the set of Cleopatra in 1962 and quickly became one of the most scrutinised relationships of the 20th century. Their love was marked not only by passion and public drama, but by extraordinary jewels, including the 69.42-carat Taylor-Burton Diamond, the 33.19-carat Krupp Diamond (later renamed the Elizabeth Taylor Diamond), and the Taj Mahal Diamond itself.

An Origin Rooted in Eternal Devotion

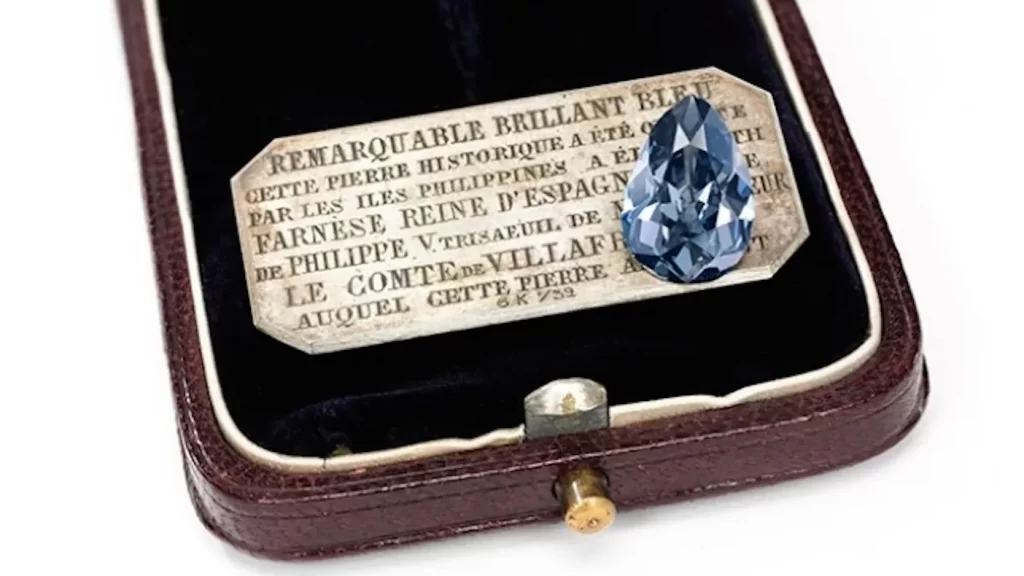

The romance of the Taj Mahal Diamond stretches back centuries. The heart-shaped, table-cut diamond is inscribed in Parsi with the words “Love is Everlasting”, alongside the name of Nur Jahan, wife of Mughal Emperor Jahangir. The jewel was later passed to their son, Emperor Shah Jahan, who is believed to have gifted it to his beloved wife, Mumtaz Mahal.

Following Mumtaz Mahal’s death in childbirth in 1631, Shah Jahan commissioned the construction of the Taj Mahal, one of the world’s most enduring monuments to love. Completed over 20 years, the white marble mausoleum remains a masterpiece of Islamic art—and the emotional origin of the diamond’s name and symbolism.

Cartier Craftsmanship and Elizabeth Taylor’s Ownership

In 1971, Cartier acquired the Taj Mahal Diamond, mounting it in jade and accenting it with table-cut diamonds and red gemstones. Celebrated Cartier designer Alfred Durante later created a woven gold and ruby necklace inspired by the original silk cord, complete with rondelles, an adjustable slide and a distinctive tassel.

The jewel was presented to Richard Burton and Elizabeth Taylor in 1972 by Cartier president Michael Thomas during a stopover in New York. Burton ultimately gifted the necklace to Taylor for her 40th birthday during a lavish celebration in Budapest, attended by cultural icons including Princess Grace Kelly, Ringo Starr and Michael Caine.

From Elizabeth Taylor to Margot Robbie: A New Chapter in Jewellery History

More than fifty years later, the Taj Mahal Diamond continues to captivate. Worn choker-style by Margot Robbie, with the tassel trailing elegantly down her back, the necklace once again became the centre of attention—sparking conversations, admiration and awe, just as it did when Elizabeth Taylor first wore it.

By choosing this extraordinary diamond, Robbie has added a new chapter to one of jewellery history’s greatest love stories, proving that truly iconic jewels are not just objects of beauty, but vessels of memory, emotion and timeless romance.

For the diamond world, moments like these reaffirm why provenance, craftsmanship and history remain as valuable as the gemstones themselves.

Source: DCLA