Russian exports of rough diamonds to India increased by well over a fifth, to 4.1m carats, during the first six months of the G7 sanctions.

Total sales were up by 22.23 per cent for January to June 2024, according to the Indian Ministry of Commerce and Industry. But revenue fell by 15.22 per cent, as prices keep declining, from $614m to $520m.

Russian exports for June alone were 347,620 carats, an increase of almost 32 per cent on the same month last year.

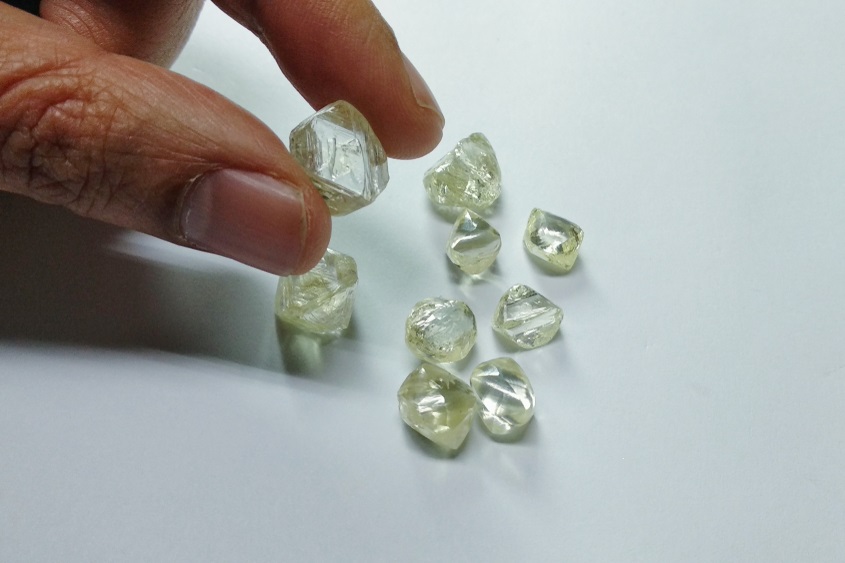

The G7 and EU nations imposed sanctions on all Russian diamonds of 1.0-cts and above, regardless of where they were cut and polished, from 1 January. The threshold was lowered to 0.50-cts and above from 1 September.

Rough diamonds imported from Russia to India can only be sold to markets beyond the G7 and EU.

India’s diamond industry has been calling on the government to allow direct payments to Russia so it can more easily buy sanctioned goods.

Source: DCLA