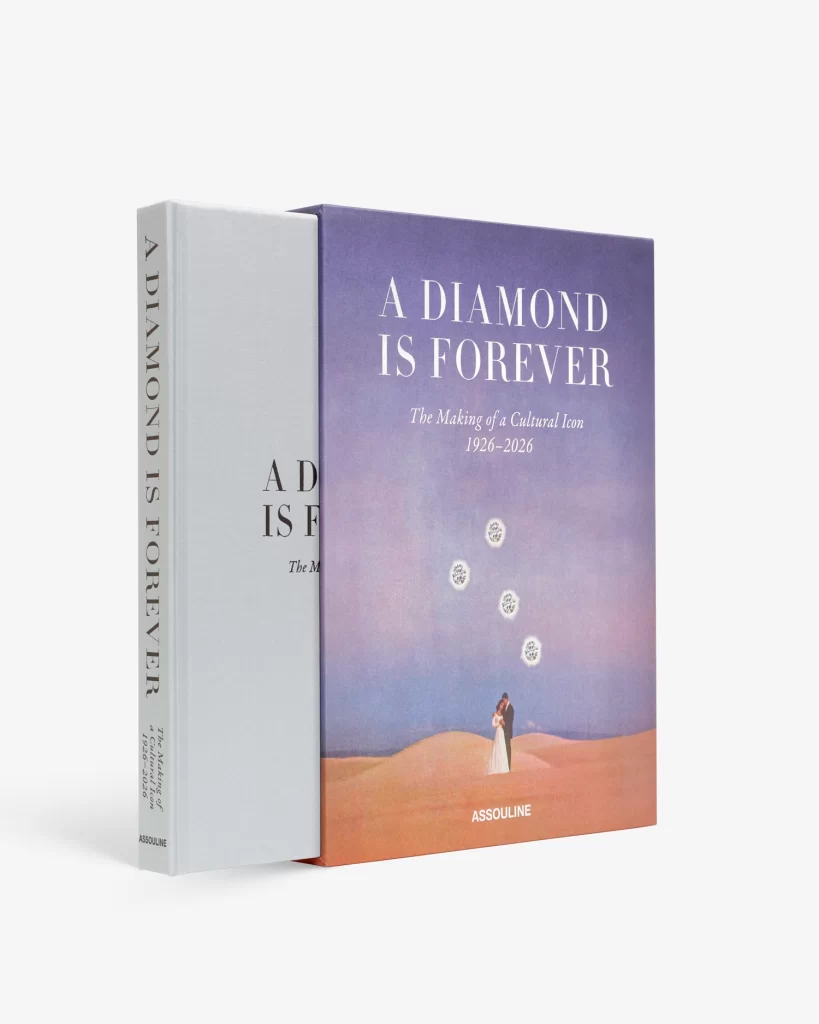

De Beers is set to release A Diamond Is Forever, a new luxury book exploring the evolution of the company’s natural diamond marketing and its profound influence on global culture, romance, and society. The book will be published next week by Assouline, a renowned publisher of high-end illustrated volumes.

Named after one of the most iconic advertising slogans in history, A Diamond Is Forever celebrates the cultural, artistic, and emotional legacy of natural diamonds — nature’s oldest treasure and one of humanity’s most enduring symbols of love and commitment.

De Beers is widely credited with transforming diamonds from an exclusive luxury reserved for society’s elite into a universal symbol used to mark life’s most important romantic milestones and personal achievements. Prior to the 1930s, diamond jewellery was exchanged discreetly within elite circles, with luxury houses maintaining strictly private client relationships. De Beers reshaped this narrative, positioning diamonds at the heart of modern romance.

In 1947, De Beers copywriter Frances Gerety coined the legendary phrase “A Diamond Is Forever,” embedding the gemstone into global consciousness as a lasting promise of love, endurance, and emotional significance. The slogan appeared across archival print advertising, magazine spreads, and celebrity endorsements, cementing the diamond’s place in popular culture.

The book also highlights De Beers’ historic collaborations with celebrated artists such as Pablo Picasso, Salvador Dalí, and Raoul Dufy, drawing parallels between the rarity of diamonds and the genius of fine art. These campaigns elevated diamonds beyond jewellery, reinforcing their artistic and cultural value while preserving a sense of exclusivity.

During the 1960s, Hollywood icons including Elizabeth Taylor and Marilyn Monroe further amplified the glamour of diamonds, while the company’s influential 1990s “Shadows” campaign — set to Karl Jenkins’ Palladio — captured the gemstone’s timeless, authentic, and eternal nature.

Over the past two decades, De Beers has periodically retired and revived the famed slogan, most recently reintroducing it in late 2023 as part of a refreshed “Seize the Day” campaign, originally launched in the 1990s.

According to the publisher, the story of diamonds is one of both transformation and continuity. In recent years, the narrative has expanded to include provenance, sustainability, and ethical stewardship, reinforcing the natural diamond as a symbol not only of beauty and permanence, but also of responsibility and conscience.

A Diamond Is Forever spans 240 pages and features 180 illustrations. Presented as a hardcover book housed in a luxury slipcase, it will retail for USD $195 and is scheduled for release on January 30.

Source: DCLA