Earlier this week, Priyanka Chopra attended Bulglari’s 140th anniversary event in Rome. And as a global brand ambassador, of course, she was totally decked out in diamonds.

Alongside celebrity supporters like Anne Hathaway, Chopra wore a dazzling piece from the brand’s “Aeterna High Jewelry” collection. With seven massive stones affixed to a unique, wavy choker, Chopra’s necklace was a hero piece for sure. But what made the design so special is that it’s one of the most precious (and expensive) designs the brand has ever created — at a cool 43 million dollars.

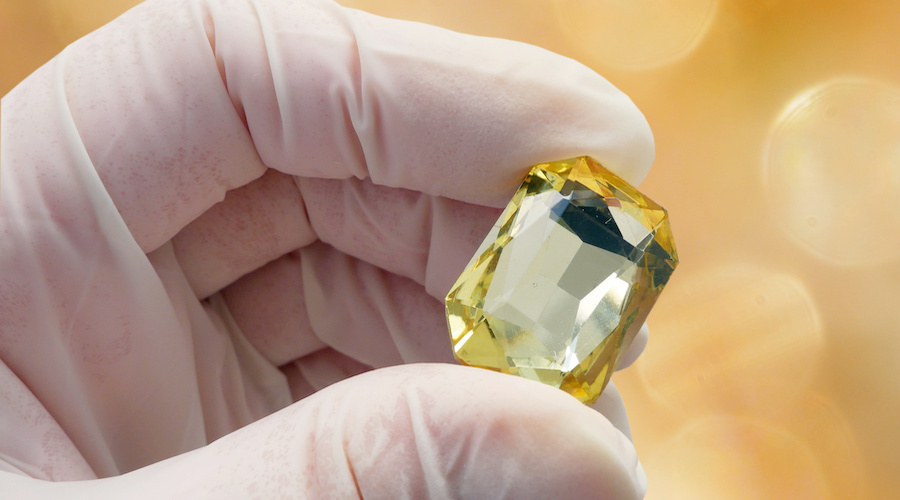

Priyanka’s Dazzling Diamonds

According to Bulgari, the lavish necklace took “over 2,800 hours to complete.” Made up of 140 carats worth of diamonds, the necklace — dubbed the Serpenti Aertena — retails for a whopping 43 million dollars. The statement choker featured pear-shaped drop diamonds, the largest sitting front and center.

The intricate design was specially designed for the occasion, with its carat count symbolizing the brand’s 140 year anniversary. The entire collection is so ornate, it was unveiled at a museum — it truly doesn’t get much more iconic than that.

Paying the diamonds their due, Chopra went for a fairly simple off-the-shoulder gown by designer Del Core. A fitting choice for the fancy occasion, her custom look featured a cape-inspired detail and a peplum waist. The sweetheart neckline lent itself nicely to the accessory du jour.

Source: DCLA