Pandora is expanding its lab-grown diamond offerings, showing off its latest jewels in a new star-studded campaign.

The “Diamonds for All” campaign will highlight some familiar faces, including model and actress Pamela Anderson.

“I like the fact that these are lab-grown diamonds, and knowing the jewelry is crafted from recycled silver and gold makes me feel good about wearing it. It is actually the more radical, kind of glamorous move,” said Anderson.

She’s joined in the campaign by American Sign Language performer Justina Miles, model and Vogue Creative Director-at-Large Grace Coddington, actress Amita Suman, model Precious Lee, model Sherry Shi, and musical artist and dancer Vinson Fraley.

The campaign was shot in New York City by photographer Mario Sorren and directed by Gordon von Steiner.

It celebrates “the breaking of conventions and tells a new diamond story,” said Pandora.

“From ‘diamonds are a girl’s best friend’ to ‘diamonds are everyone’s best friend.’ From ‘diamonds on ring fingers’ to ‘diamonds on every finger.’”

Grace Coddington and cat in Pandora campaign

Model and Vogue Creative Director-at-Large Grace Coddington, a noted cat enthusiast, poses for Pandora’s new campaign with a furry friend.

Mary Carmen Gasco-Buisson, chief marketing officer at Pandora, said the new campaign will help consumers reimagine diamond traditions.

“Our diamonds are not for the few, for a once-in-a-lifetime occasion, or only for giving. They represent personal meaning that each of us can create,” said Gasco-Buisson.

Pandora first announced its move into the lab-grown diamond jewelry market in May 2021, stating it would no longer be using natural diamonds—a stone it, notably, used in only a small percentage of its jewelry—amid its push for “sustainably created” and affordable products.

It introduced its “Pandora Brilliance” collection to the United Kingdom before rolling out to new markets, landing in the United States and Canada last August.

Previously called “Diamonds by Pandora,” the company’s lab-grown diamond line is now called “Pandora Lab-Grown Diamonds.”

Within the U.S. jewelry trade, there is a polarizing debate around lab-grown diamonds, but Pandora has appeared confident in its move into the market.

Luciano Rodembusch, president of Pandora North America, shared his insights on Pandora’s lab-grown diamond collections and the market at large in an email interview with National Jeweler.

“We shifted from mined diamonds to exclusively lab-grown diamonds to lessen the impact on the planet and to deviate from unfair working practices in the mining industry,” he said.

“Because of this shift, we’ve been able to create a collection of diamonds that are more sustainable and more affordable for every consumer.”

Pandora has framed its move into lab-grown diamonds as a push for sustainability, a claim that some in the jewelry industry have taken issue with, but the company has remained firm on its stance.

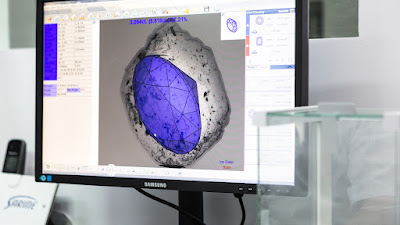

“We are committed to making lab-grown diamonds more sustainable. Our diamonds are grown, cut and polished using renewable energy at our facilities and have a carbon footprint of only 9.17 kg CO2e per cut and polished carat,” said Rodembusch.

“Consumers will continue to purchase jewelry, and it is our responsibility to reduce our emissions, like with our lab-grown diamond collections, so we can reduce our impact on the planet.”

As noted on the company’s website, the diamonds Pandora uses in its jewelry are grown in the United States. It has been reported that they are grown at De Beers’ Lightbox factory in Gresham, Oregon, though officials from both companies have declined to comment on this claim.

Rodembusch noted Pandora’s second-quarter earnings surpassed analysts’ estimates, which he viewed as a positive signal for lab-grown diamond demand.

“By democratizing diamonds, we created an affordable jewelry line that brings quality, sustainable lab-grown diamonds to everyone, which is what we strive to do as a brand,” he said.

Source: DCLA