De Beers, which created the global market for diamond engagement rings through its “A Diamond is Forever” campaign, is shifting back to its marketing roots as its parent company Anglo American (LSE: AAL) moves to sell it off.

Its new ‘Origins’ strategy is part of a wider pivot back towards natural diamonds, announced on May 31. The move makes sense because marketing has always set the diamond sector apart from other mineral industries and the industry risks losing its way if it becomes focused only on mining and turns away from the demand creation side, New York City-based diamond analyst Paul Zimnisky told The Northern Miner.

SIGN UP FOR THE PRECIOUS METALS DIGEST

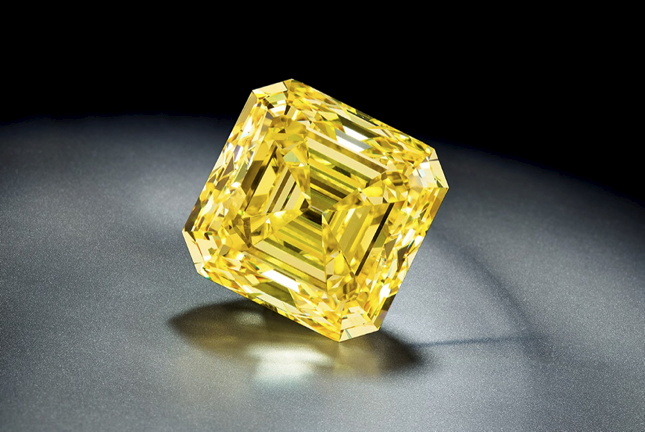

“Marketing is what moves the needle,” he said. “You can throw money at the problem, you can create demand if the products are marketed properly. You have to look at it as a luxury product, not as a commodity.”

In announcing the divestiture of De Beers on May 14, Anglo said the move would give both companies “a new level of strategic flexibility to maximize value” for Anglo American and the government of Botswana, which each hold 85% and 15% stakes, respectively, in the diamond company. The Botswana government also indicated on June 10 that it wants to increase its interest in De Beers. High capital needs and declining diamond supply present further challenges in the diamond sector, analysts say.

Anglo’s announcement of its De Beers plans, as well as plans to sell off its South Africa-based Anglo American Platinum (JSE: AMS) and its steelmaking coal assets was triggered by BHP’s (ASX: BHP) unsuccessful, multi-billion-dollar acquisition bid in mid-May.

‘Growing desire’

De Beers is also suspending its Element Six lab-grown diamonds (LGD) subsidiary for jewelry to focus instead on synthetic diamond technology for industrial applications, it said in May. Production for the Lightbox LGD brand will stop in a few months, De Beers CEO Al Cook said in a June 13 interview with diamond news site Rapaport.

“The outlook for natural diamonds is compelling,” Cook said in a news release, adding that the company’s new approach will involve “growing desire for natural diamonds through the reinvigoration of category marketing, embracing new approaches that maximize reach and impact.”

Cook explained to Rapaport the need to tell better diamond stories is greater now that “there are more diamonds above the surface of the Earth than below the surface. Every year, diamond mines are closing.”

De Beers first entered the synthetic diamond jewelry market in 2018. In setting up a solid difference between mined and lab-grown diamonds, the company initially offered Lightbox jewelry for up to 80% less than its competitors’ prices.

Slowing sales, production

The stronger emphasis on marketing also comes as De Beers grapples with lower sales, with Cycle 4 rough diamond sales, at $380 million this year, down by 20% from last year’s Cycle 4 period of $479 million, the company reported on May 23. The Cycle 4 period approximately covers two weeks in May. Cook said the sales were due to the seasonally slower second quarter and less trading in India during the elections.

Production declined 8% to 31.9 million carats in 2023, from 34.6 million carats in 2022. First quarter output this year, at 6.8 million carats, was down 23% from the year-earlier figure of 8.9 million carats.

The wider industry is also facing the challenge of lower demand, especially in the United States and China. Amid the slow demand, De Beers cut the price of 0.75-carat stones by 4% to 6% at this year’s fourth trading session, according to a May 7 report from Rapaport. In the first sale of the year, the company cut prices by about 10%.

The issue of declining production could be expensive for De Beers to deal with, BMO Capital Markets diamonds analyst Raj Ray implied.

“From mining business point of view, not having a parent company like Anglo American backing De Beers could have some serious implications for diamond supply going forward,” he said.

Rough diamond supply has dropped to around 120 million carats from 150 million carats in 2017-2018, Ray said. It’s expected to drop even more in the next four to five years.

Amid the supply constraints, De Beers has invested $1 billion in expanding the life of its flagship Jwaneng mine in Botswana, and $2.3 billion to move underground the Venetia mine in South Africa.

“The next 12 to 24 months don’t look great for the rough diamond industry,” Ray said. “Anyone looking at De Beers will have to acknowledge (that). There’s huge capital investments that are needed over the next few years across mines to be able to maintain supply, forget about growing supply.”

But despite that hurdle, Ray and Zimnisky both see De Beers maintaining its 30% share of the global diamond market.

“They’ll continue to be the pre-eminent producer in the world,” Ray said. “Anyone who will buy (De Beers) will continue to fund its projects. I don’t see any significant drop in production from the De Beers portfolio.”

Going solo?

Once De Beers formally leaves Anglo as part of the company’s restructuring, which CEO Duncan Wanblad has said could take 18 to 24 months to complete, the diamond miner will face the prospect of being purchased or going alone.

Zimnisky said either option has its own difficulties.

“This is something Anglo has wanted for a while,” he said. “They wanted Anglo to become more of a pure play copper producer, or a green infrastructure buildout commodity producer hoping it would lead to a higher valuation for the company. That said, De Beers is a complicated business and not easy to sell. It has (the) Debswana joint venture, which is the crown jewel of the company.”

Ray agrees that few potential buyers would have interest in a company like De Beers whose business requires massive capital investments. An IPO is also unlikely, he said.

“There’s little interest in the diamond sector from an equity perspective. I don’t see how in a potential IPO there’s enough interest in a new diamond story,” he said. “This has to be a private sale or consortium that needs to come in and take a longer-term view of the diamond sector. There could be growth expected in the retail segment. That’s where I think anyone taking a look at De Beers would see the value.”

Both analysts also see the De Beers sale having minimal impact on the junior exploration sector for diamonds.

“In order to stimulate exploration across the industry you would have to see a notable diamond price recovery,” Zimnisky said. “Prices have been flat for almost a decade now.”

Source: DCLA