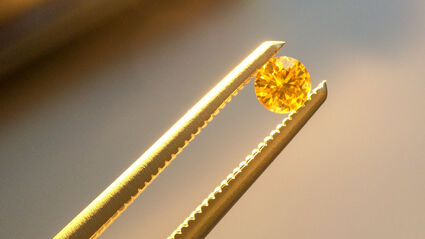

With diamond markets rebounding from the COVID-19 downturn, North Arrow Minerals Inc. and partner Burgundy Diamond Mines Ltd. have continued to demonstrate the value of the fancy yellow diamonds in the Q1-4 kimberlite at the Naujaat project in Nunavut.

Lying about nine kilometers (5.6 miles) northeast of the hamlet of Naujaat (formerly Repulse Bay) on Nunavut’s Melville Peninsula, Naujaat covers 10,742 hectares (26,54 acres) of contiguous mineral leases and claims held by North Arrow.

To date, fifteen kimberlites and eight kimberlite pipes have been identified on the property, as well as a number of associated kimberlite dykes. Of its numerous targets, the Q1-4 kimberlite is the largest and most diamondiferous of these bodies.

Though North Arrow has drilled to depths of 400 meters in Q1-4, the current resource estimate for the project lies around roughly 48 million metric tons of material down to 205 meters, containing more than 26 million carats of diamonds.

North Arrow has since undertaken extensive exploration and evaluation focused on the potential value of its uniquely colored fancy vivid orange-yellow diamonds found in the Q1-4 kimberlite at Naujaat, which is considered one of the largest undeveloped diamond properties in Canada not controlled by a major mining company.

Naujaat’s rare yellow diamonds have been certified by the Gemological Institute of America and are expected to sell at high premiums to white diamond prices, upon which the historical project’s economics were mostly based.

Spending the better part of 2022 filtering through its 2021 bulk sample program funded by Burgundy, North Arrow reported recoveries from the first 70% (1,316 dry metric tons) and revealed at least 268 diamonds of greater than 9 DTC (Diamond Trading Company) weighing roughly 117.98 carats.

Three of the largest recovered diamonds were 3.31, 3.07, and 2.76 carats. 48 of the 268 diamonds classified as fancy color, with more than half of that classifying as orange in color – with orange being considered amongst the rarest of colors for natural diamonds.

Later in the season, the company announced the remaining results of its 2,500 bulk sample program. The results, representing the final 30% (498 dmt), were from the same source, the A88 unit of the Q1-4 deposit.

Despite the smaller amount, North Arrow reported 99 diamonds greater than 9 DTC weighing 55.8 carats. The three largest stones were seven, 2.17, and 2.02 carats.

“The 2021 bulk sample has confirmed the presence of an important, potentially high value population of fancy orange and yellow diamonds in both the A28 and A88 units of the Q1-4 diamond deposit,” said North Arrow President and CEO Ken Armstrong. “This is highly encouraging, as is the recovery of a seven carat diamond – the largest stone recovered to date from the Q1-4 deposit and, although it classifies as boart – an indication of the potential of Q1-4 to produce larger diamonds.”

North Arrow Minerals Inc.

After spending the year filtering through 2,500 bags of its 2021 bulk sample program, results returned 367 diamonds of greater than 9 DTC, weighing in at roughly 173.78 carats.

Of the 99, 10 were classified as fancy color diamonds, with three being labeled as “intense” or “vivid” – the two highest color saturation classes and an important indicator of the potential value in fancy color diamonds. Aside from that evaluation, nine of the fancy diamonds were also categorized as orange.

“The completion of sample processing and diamond recovery from the 2021 bulk sample has further confirmed the presence of a potentially high value, fancy orange and yellow diamond population in the Q1-4 kimberlite,” said Burgundy Diamond Mines Managing Director and CEO Peter Ravenscroft.

In addition to the successful bulk sampling at Naujaat, North Arrow is advancing seven other properties in Canada in the discovery and target development stages, including six additional diamond projects – three in Nunavut, including the Mel, Luxx, and grassroots CSI projects; two in neighboring Northwest Territories, including a 21 percent interest in the LDG joint venture project; and one in Saskatchewan.

Source: miningnewsnorth

![Alrosa Finds 2 Huge Diamonds at Udachnaya on the Same Day Two large high-quality diamonds – each larger than 50 carats – were unearthed in Yakutia on December 2, 2022, Bankers Day, “when Russian bankers celebrated their professional holiday,” according to Rough & Polished. The two stones were extracted at Processing Plant No. 12 from the ore mined at the Udachnaya diamond pipe. One weighs over 67 carats, while the second diamond, a type IIa, weighs more than 52 carats, Dmitry Amelkin, Alrosa’s Strategy Director, commented: “Finding two of these rare gem-quality diamonds on one and the same day is a unique coincidence. It is symbolic that this happened precisely on the Udachnaya diamond pipe, which has been accompanied by good luck since its discovery […]”. diamond mining trucks Russia Credit: Alrosa Alrosa Finds 2 Huge Diamonds at Udachnaya on the Same Day Two large high-quality diamonds – each larger than 50 carats – were unearthed in Yakutia on December 2, 2022, Bankers Day, “when Russian bankers celebrated their professional holiday,” according to Rough & Polished. The two stones were extracted at Processing Plant No. 12 from the ore mined at the Udachnaya diamond pipe. One weighs over 67 carats, while the second diamond, a type IIa, weighs more than 52 carats, Dmitry Amelkin, Alrosa’s Strategy Director, commented: “Finding two of these rare gem-quality diamonds on one and the same day is a unique coincidence. It is symbolic that this happened precisely on the Udachnaya diamond pipe, which has been accompanied by good luck since its discovery […]”. diamond mining trucks Russia Credit: Alrosa](https://www.dcla.com.au/wp-content/uploads/2023/01/alrosa-large-rough-diamonds.jpg)