Italian gemological lab Gem-Tech has warned the trade that a number of lab-grown diamonds circulating in the country are being sold as natural.

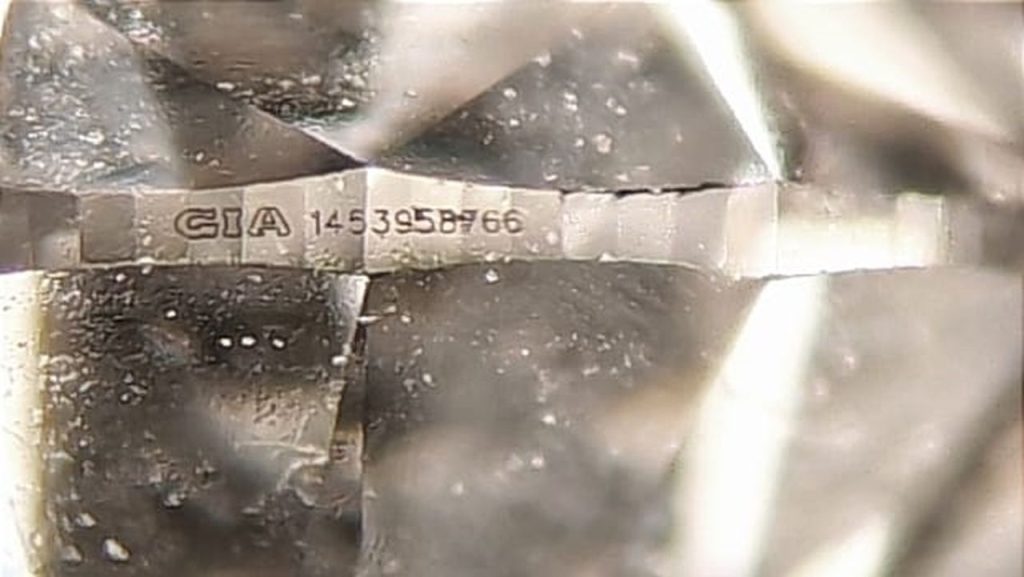

Three stones were submitted to the lab accompanied by certificates from the Gemological Institute of America (GIA) stating they were natural, Gem-Tech said last week. Gem-Tech weighed the stones and found them to be nearly identical to those recorded on the GIA certificates. The stones also had laser inscriptions with a visible GIA logo that matched those the lab had seen before from other GIA-graded stones, Gem-Tech explained.

However, further investigations indicated the stones had been fraudulently paired with the grading reports, while the inscriptions appeared to be forgeries.

When the Italian lab exposed the diamonds to ultraviolet light to detect fluorescence, it discovered that the stones were inert, whereas the reports described the level of fluorescence as “faint.” The diamonds were then checked using spectrophotometric analysis and displayed a distinct greenish coloration and other characteristics commonly found in synthetics created using chemical vapor deposition (CVD).

Once the lab checked the report numbers against the GIA website, it realized they were issued for other, natural, stones that were just slightly different than those submitted to Gem-Tech.

“Gem-Tech has seen this happen before,” the lab said. “It would not be the first time that malicious individuals obtained reprints of authentic reports and paired them with stones other than those described.”

Although there were only three stones submitted, Gem-Tech believes there might be more, it told Rapaport News.

“The client who submitted them for identification reported that these stones were not the only ones being offered,” the lab added. “Other dealers have mentioned that these three synthetic diamonds, identifiable by their report data, have been presented in other parts of the country.”

Source: Rapaport