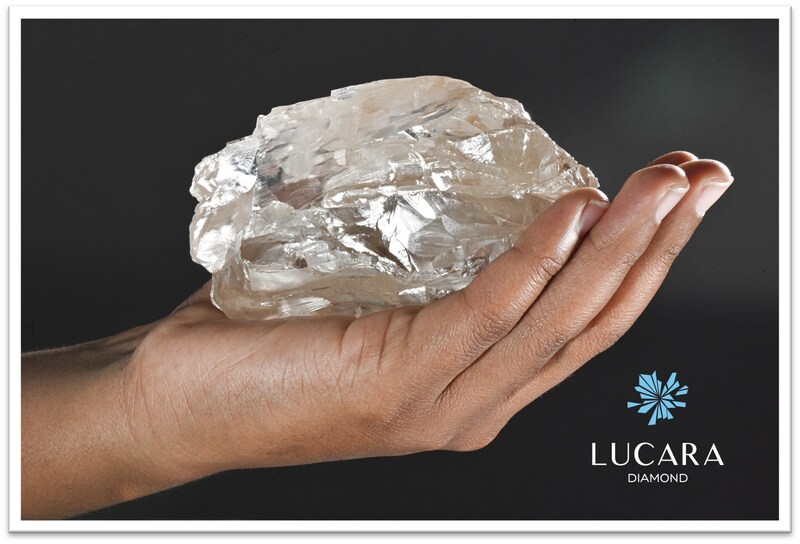

Lucara Diamond has unveiled the names chosen of the two largest diamonds recovered this year at its prolific Karowe mine in Botswana.

The 2,488 carat diamond found in August has been named Motswedi, meaning “water spring” or “the flow of underground water that surfaces to bring life and vitality” in the local Setswana language.

The 1,094 carat diamond recovered in September is now known as Seriti, which translates to “aura” or “presence” in Setswana. The name carries deep cultural significance, reflecting identity and legacy.

Lucara said the two diamonds were not just geological phenomena, but a testament to the “incredible potential” of Karowe and the company’s innovative approach to diamond recovery.

“Each stone tells a story millions of years in the making, and we are humbled to be the custodians of these remarkable gems as they prepare to enter the global market,” president and chief executive officer, William Lamb, said in the statement.

To honor the community’s involvement, Lucara awarded the winner of the Motswedi naming competition 100,000 Pula (about $7,325), while the winner for Seriti received 50,000 Pula ($3,660). Both winners will also be invited to tour the Karowe mine.

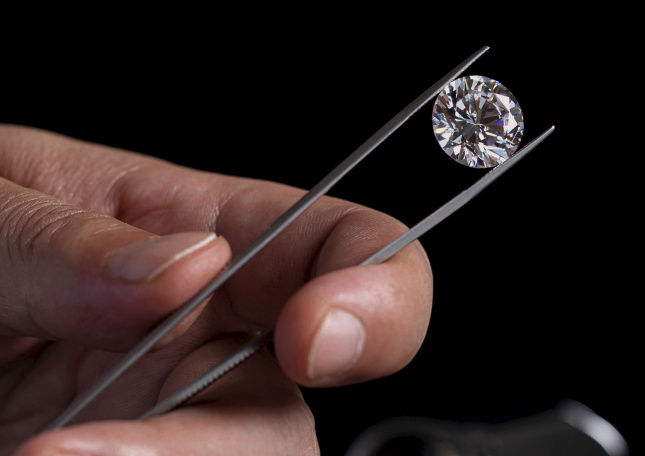

Lucara said it was considering sale options for both diamonds.

Motswedi and Seriti are two of six diamonds weighing more than 1,000 carat that Lucara has recovered at its Karowe mine since operations began. These include the 1,758-carat Sewelô in 2019, the 1,109-carat Lesedi La Rona in 2015, and the 813-carat Constellation, also in 2015.

Karowe is also credited for having yielded Botswana’s largest fancy pink diamond to date, the Boitumelo.

The mine remains one of the world’s highest-margin diamond mines, producing an average of 300,000 high-value carats each year.

Source: Mining.com