Each November, Geneva takes centre stage in the world of fine jewellery, and Sotheby’s 2025 High Jewellery and Royal & Noble Jewels sales reaffirm why the city remains its beating heart. This year’s auctions bring together a breathtaking display of natural diamonds, historical heirlooms, and masterful craftsmanship that celebrate centuries of artistry and provenance.

At the forefront of the Sotheby’s High Jewellery Sale is The Glowing Rose, an extraordinary 10.08-carat Fancy Vivid Pink diamond estimated at around USD 20 million. Its rare, “pure pink” hue—free from secondary tones—places it among the most valuable gemstones in existence. Comparable to celebrated stones such as the Williamson Pink Star and Pink Legacy, this exceptional diamond embodies the geological miracle of atomic distortion, which gives natural pink diamonds their ethereal glow. Stones of this size and purity are exceedingly rare, making The Glowing Rose the undeniable star of the season.

Colour remains the hallmark of this year’s Geneva sale. A pair of Fancy Vivid Yellow diamond earrings, weighing 38.66 and 38.88 carats, are expected to achieve between CHF 2,000,000 and CHF 3,800,000. Their radiant colour intensity and impressive carat weight represent the highest standards of fancy diamond grading. Equally captivating is a 4.50-carat Fancy Vivid Blue diamond, internally flawless and estimated at CHF 4,400,000 to CHF 5,800,000. The blue hue, caused by trace boron, adds to its rarity and appeal, offering collectors the coveted trifecta of exceptional colour, clarity, and size.

Among the coloured gemstones, a 7.69-carat “Royal Blue” Kashmir sapphire set in a ring-pendant combination by Van Cleef & Arpels is a standout. Revered for their velvety “sleepy” lustre, Kashmir sapphires are among the most desirable in the world, and this piece exemplifies the pinnacle of gemological beauty. Further artistry is showcased through a pair of sapphire, tsavorite garnet, and diamond earclips by JAR—vividly imaginative and estimated at CHF 300,000 to CHF 500,000—reflecting the contemporary genius of Joel Arthur Rosenthal.

The sale also includes signature creations by Van Cleef & Arpels, Cartier, Graff, and De Grisogono. Highlights include a 10.04-carat marquise-shaped D-colour diamond ring by Graff (VVS2 clarity, estimated CHF 320,000–560,000) and a De Grisogono ruby and diamond bombé ring featuring two step-cut diamonds (estimated CHF 55,000–75,000).

In tribute to a century of Art Deco design, Sotheby’s presents an array of geometric masterpieces from Cartier and Van Cleef & Arpels, embodying the symmetry and elegance that shaped modern jewellery aesthetics. Two private collections will also headline the event: one dedicated exclusively to Van Cleef & Arpels, and another—Aria of Jewels: The Collection of Antje-Katrin Kühnemann—featuring exceptional Cartier and De Grisogono pieces from the late philanthropist’s private trove.

The Royal & Noble Jewels: A Journey Through History

Complementing the High Jewellery Sale, Sotheby’s Royal & Noble Jewels auction unveils some of the most historically significant diamonds and heirlooms ever offered. Among them is a diamond brooch once owned by Emperor Napoleon Bonaparte, lost during his flight after Waterloo and later recovered by the Prussian Royal family. After more than two centuries in private hands, it now re-emerges for the first time at auction.

Also featured is a light pink diamond ring with royal lineage, once belonging to Empress Catherine I of Russia and later to Princess Neslishah Sultan, estimated between CHF 240,000 and CHF 400,000. A natural pearl and diamond jewel formerly owned by Cunegonde of Saxony (cousin of Louis XVI) carries an estimate of CHF 340,000 to CHF 500,000, while a diamond tiara with a wild roses motif from the Duchess of Portland (1774–1844) is expected to fetch CHF 100,000 to CHF 170,000.

Adding to the grandeur is a Cartier emerald and diamond necklace featuring an 11.78-carat Colombian emerald, commissioned in 1932, exemplifying Art Deco refinement and royal provenance.

Celebrating Provenance, Craftsmanship, and Natural Rarity

From Napoleon’s lost brooch to The Glowing Rose, Sotheby’s Geneva continues to highlight how exceptional gems transcend beauty—they embody heritage, artistry, and history. These November 2025 auctions remind the world that in fine jewellery, rarity, provenance, and craftsmanship remain the ultimate symbols of enduring value.

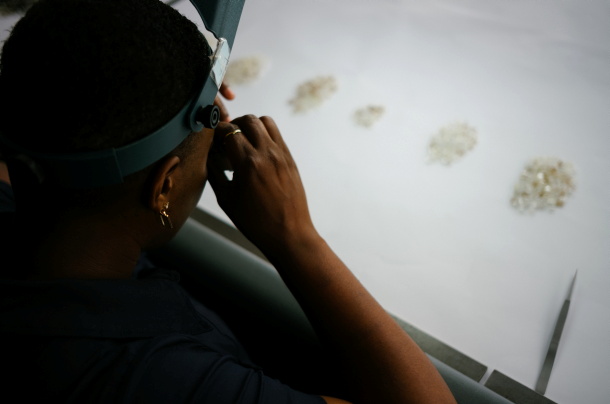

About DCLA

The Diamond Certification Laboratory of Australia (DCLA) is the official CIBJO-accredited laboratory for Australia, recognised for its expertise in diamond grading and certification. DCLA continues to support transparency and integrity within the global diamond trade, celebrating events such as Sotheby’s Geneva that showcase the brilliance and authenticity of natural diamonds.