Fancy colored diamonds made their mark at Christie’s Magnificent Jewels sale, held Tuesday in New York.

The top lot of the sale was “The Eden Rose,” a 10.2-carat internally flawless round brilliant fancy intense pink diamond. It sold for $13.3 million, beating its $12 million high estimate. Chrsitie’s said the diamond exhibits a pure pink hue, unlike many natural pink diamonds that typically display secondary hues such as purple, orange or gray. “The Eden Rose stands out for its complete absence of any secondary color, rendering it exceptionally rare,” Christie’s said in a statement prior to the auction.

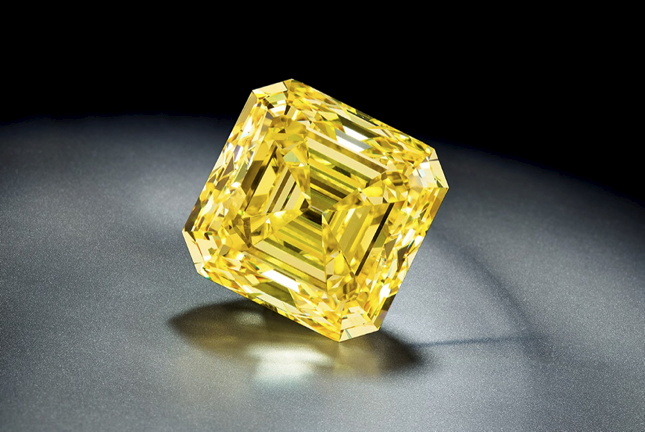

The New York Magnificent Jewels sale achieved a total of $44.4 Million, with 90% of the 144 lots sold. The auction featured an array of diamonds, notable colored gemstones and pearl jewelry, and jewels from important houses such as Bulgari, Cartier, Tiffany & Co. and Van Cleef & Arpels. The sale is part of Christie’s “Luxury Week” of auctions being held this week.

“Collectors participated actively in all areas of the sale, paying strong prices for rare colored gemstones and natural pearls in particular,” said Rahul Kadakia, Christie’s international head of Jewelry.

Read full article: Forbes