Botswana may not renew a five-decade sales agreement with De Beers if the diamond producer doesn’t offer a larger share of rough diamonds to the state’s gem trading company, Okavango Diamond Company (ODC).

The move comes after the southern Africa nation acquired last month a 24% stake in Belgian diamond processing firm HB Antwerp for an undisclosed sum.

Analysts saw this deal as a way for Botswana to loosen the Anglo American-owned miner’s grip on its diamond sector, which is a major source of employment and tax revenue for the country.

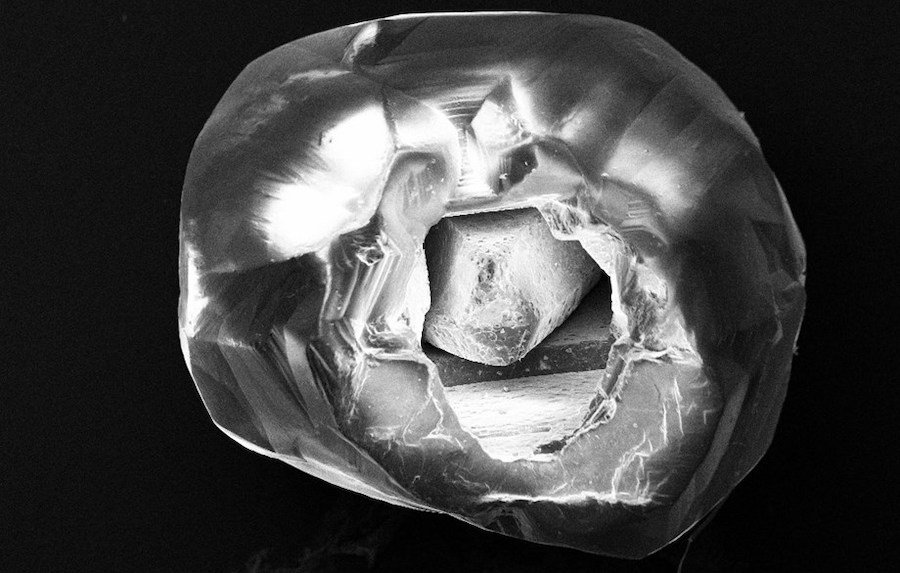

De Beers and Botswana jointly own Debswana, which mines almost all of the roughs gems in the country — the world’s second-largest diamond producing nation after Russia.

The partnership has helped Botswana become one of Africa’s fastest growing economies, while supplying De Beers 75% of Debswana’s rough diamonds, which are then sorted and sold to sightholders around the world.

Debswana’s diamond sales hit a record $4.6 billion in 2022, compared to $3.4 billion in 2021.

President Mokgweetsi Masisi has threatened to walk away from the talks if Botswana does not get a larger share of Debswana’s output for marketing outside the De Beers system.

The government has not publicly stated what share it seeks, but it is believed to be as high as 50%, double its current allocation.

The two parties have been negotiating for several years to extend their 2011 mining rights and sales agreement, which is due to expire in June this year.

“Colonial” model

Rafael Papismedov, co-founder of HB Antwerp, told the Financial Times that a revised deal would help Botswana break free from the current model of being “stuck in a box that says you can only dig and wash the diamonds.”

Papismedov added that De Beers’ operating model carries on “colonization” principles, acting as if Botswana was incapable of building midstream capabilities for polishing diamonds.

Masisi wants more locals employed in the diamond sector, which accounts for a fifth of the country’s gross domestic product.

The largest diamond producer by value has said it is confident that it can maintain its partnership with Botswana, but that some of the negotiations are complex and require more time.

De Beers has said that the arrangement must make economic and strategic sense for both parties, adding that it is committed to supporting Botswana’s aspirations to grow its diamond industry.

The stakes are high for both sides, as they seek to secure their future in a volatile and competitive industry that has been hit by the covid-19 pandemic, changing consumer preferences and ethical concerns.

A new deal between Botswana and De Beers could have significant implications for the global diamond supply chain and the balance of power in the sector.

Source: mining.com