Martin Rapaport recently released an incendiary memo to the diamond and jewelry industry calling on them to stop doing business in lab-grown diamonds (LGD), which he characterized as “synthetic” and “fraudulent.”

He also claimed those selling LGD were “operating dishonestly and unethically” and trading short-term opportunities at the expense of those that are “certain and sustainable.”

Rapaport is the ultimate industry insider, and there’s no question about which side his bread is buttered on. As chairman of The Rapaport Group, his company is a portal for information about and services to the diamond industry, including the Rapaport Price List, which it claims is the industry’s primary source for diamond price and market information, and an online diamond trading network, RapNet.

In a request for comment, a Rapaport representative shared the memo but added no additional comment.

Rapaport wrote:

“The greatest challenge facing the diamond trade is greed. Our trade is willfully destroying the underlying value of diamonds as a store of value through the marketing, promotion and sale of synthetic diamonds as a replacement for natural diamonds”

And he added, “Essentially, the diamond industry is trading short-term, unsustainable profits for the reputation of diamonds as a store of value.”

Then he went further, “Many – if not most – in our trade are operating dishonestly and unethically by failing to make full disclosure about the value retention of synthetic diamonds.”

And his memo concluded, “The Rapaport Group does not facilitate the sale of synthetic diamonds in any way. We believe they are a fraudulent product because of how they are sold. They are also a threat to the fundamental message of diamonds.”

This memo followed a submission to the Responsible Jewellery Council (RJC) in December 2021, where he pointed to Zales, James Allen, Jared, Diamond Direct (all Signet brands) and Brilliant Earth as not providing full disclosure about the LGD jewelry they sell. “Consumer expectations are not being managed honestly by unethical retailers,” he claimed.

According to lawyer Milton Springut, partner at Moses Singer, Rapaport’s disparaging and potentially injurious claims against lab-grown diamonds and the parties who do business in them probably don’t violate federal or state liability laws.

But Rapaport’s words are ill-chosen, and his claims are without merit, according to experts I spoke with.

Synthesized But No Less Real

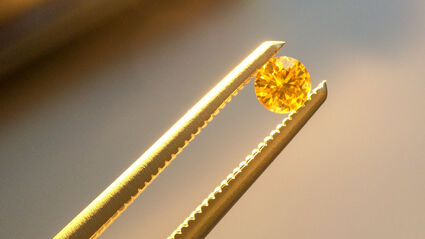

Lab-grown diamonds may be synthetic, as in made by man, but they are just as “real” as a natural diamond, as defined by the FTC. A diamond, no matter its origin is “a mineral consisting essentially of pure carbon crystallized in the isometric system. It is found in many colors. Its hardness is 10; its specific gravity is approximately 3.52; and it has a refractive index of 2.42.”

While lab-growns that meet the above criteria can be labeled as a “diamond,” the FTC also ruled that their man-made origin must be clearly disclosed.

So it requires marketers must precede the word “diamond” with “equal conspicuousness” such words as “‘laboratory-grown,’ ‘laboratory-created,’ ‘[manufacturer name]-created,’ or some other word or phrase of like meaning, so as to disclose clearly the nature of the product and the fact it is not a mined gemstone.”

It took a little while for some involved to find their footing under the new FTC guidelines, but now it seems all companies and retailers trading in lab growns have gotten on board and clearly, responsibly and honestly disclose the man-made, laboratory-grown origins of their stones.

That’s why Rapaport’s word choice of “synthetic” is over the line, implying that lab-grown diamonds are “simulants,” on the order of CZs or moissanite that may have a diamond-look, but are distinctly different in their physical properties and chemical composition.

“It’s an intentionally pejorative term because he is desperately trying to hold on to the tradition of mined diamonds,” said Marty Hurwitz, founder of market-research firm MVI Marketing LLC (THE MVEye) that specializes in the gem, jewelry and watch industries since 1987.

“One could argue using the term ‘synthetic’ may cause harm to lab-grown businesses, but it is clear that people who use the word are using it in a denigrating fashion,” he continued.

Hurwitz also notes the Gemological Institute of America (GIA), a non-profit educational and research organization that is the industry’s primary source for grading stones, doesn’t use the term “synthetic” any longer. It provided a limited grading program for lab-grown diamonds since 2007, then expanded and elevated it in 2020 as LGDs gained more industry and consumer acceptance.

GIA’s chief executive Susan Jacques described its decision as the natural evolution of the diamond market.

“We are responding to consumer demand,” she stated. “We want to make sure that consumers are educated, that we can protect their trust in the gem and jewelry industry as well as the products they are buying. As consumers adopt this new category, it’s important that we evolve with the new consumer.”

Value Is In The Meaning

Rapaport’s rage against lab-grown diamonds seems to hinge on the fact that having an equivalent competing product in the market is causing the price of mined diamonds to fall. That’s the natural economic law of supply and demand.

And given that the prices of lab-grown diamonds are steadily falling, it is putting downward pricing pressure on mined diamonds too, reports diamond industry analyst Edahn Golan, though mined diamonds are experiencing a more moderate decline.

Then Rapaport goes one step further to claim that a mined diamond is a repository or “store of value” and that retaining, even increasing, its monetary value over time is part of the promise with purchase. This is patently false, both Hurwitz and Golan affirm.

“There is limited to no investment value in diamonds,” Hurwitz said. “Some categories of mined diamonds are investment grade and go up in value, but most diamonds depreciate faster than a car leaving the showroom. The average consumer has been fed a marketing myth, the greatest marketing story ever told. Most consumers never find out the truth because they don’t resell their diamonds.”

Golan added that jewelers have perpetuated the myth by offering a trade-in, so a purchaser of a $2,000 diamond ring can get that back in credit if they return to purchase a bigger, more expensive stone.

“I’m hearing the big trend in America now is for people who want to upgrade their engagement ring decide to keep their original stone and have it made into something else, like a pendant,” he said.

People hold onto their stone because of its sentimental, symbolic value, which is where the actual value lies, as Warren Buffett said, “Price is what you pay. Value is what you get.”

DeBeers tried to equate the two with its rule that a man should pay two-to-three months’ salary on an engagement ring. But ironically, that’s turned back on the industry because, with a lab grown, he can buy a bigger, more impressive stone that speaks even louder of his love for her when he pops the question.

Nothing Unethical, Fraudulent Or Dishonest Selling Lab Growns

Rapaport goes too far when he suggests that there is something unethical, fraudulent or dishonest in selling lab-grown diamonds.

“The idea that diamonds are a store of value is a fundamental component of diamond demand. Consumers are being misled by retailers who sell man-made diamonds without full disclosure. The default assumption among consumers is that man-made diamonds will appreciate over time, even though the opposite is true,” he stated in his RJC filing.

One could argue that what is unethical, fraudulent and dishonest is suggesting that a mined diamond retains, even grows in monetary value.

“Rapaport is thinking like a diamond trader. Trading prices move up and down with the market. When they go up, it’s good; when they go down, it’s bad,” Golan said, noting that the increasing availability and consumer demand for lab growns is moving the needle for mined diamonds in the wrong direction.

Unlike traders, retailers think about cash flow, margins and turns. And this is where lab-grown diamonds have the edge.

“Jewelry stores hold loose diamonds on hand and the margins on loose natural diamonds is around 36%, while the margin for LGD was 54% at the end of December. And if it takes a retailer a year to sell a mined stone, but it only averages seven months to sell a lab-grown, a retailer will make more money at the end of the year,” Golan explained.

Hurwitz rhetorically asks, “Should we tell the consumers who are walking into our stores asking for lab-growns to go away? Should we say, ‘We don’t want to sell you this product that means incredibly high margins and profits for us and incredibly high value to you?’”

Retailers that trade in lab-growns are transparent and honest about the origin of their stones. The FTC requires it. There is nothing unethical, fraudulent or dishonest for a retailer to sell a customer what they want at the price they want to pay and to make money in the process.

“Half the diamonds are sold in the United States, and 50% of the business in the United States is bridal. The natural diamond industry is losing a chunk of that ‘Holy Grail’ to lab growns. The industry has to adapt to the changing world. It’s a combination of a cultural and business change that are driving each other,” Golan shared.

Can’t Turn Back The Clock

“Rapaport has a tremendous self-interest in seeing the mined diamond business continue to thrive,” observed Hurwitz. “He’s trying to ensure that things never change. He wants to hold onto the tradition, but that’s futile.”

While Rapaport may be trying to valiantly to save the mined diamond industry, he may be doing more harm than good.

“The good news for the lab-grown diamond industry is that he appears to be going off the rails in his attacks, and as a result, fewer and fewer people are listening to him,” Hurwitz said.

“There is a consumer revolution happening because of lab-grown diamonds. As an industry, we must embrace the change and give consumers a choice.” he continued.

“Rapaport just wants to tell everybody that this product is good and that is bad. But the only voice that matters is the consumer. And the consumer is organically and very virally embracing this new product.”

Source: Pamela N. Danziger