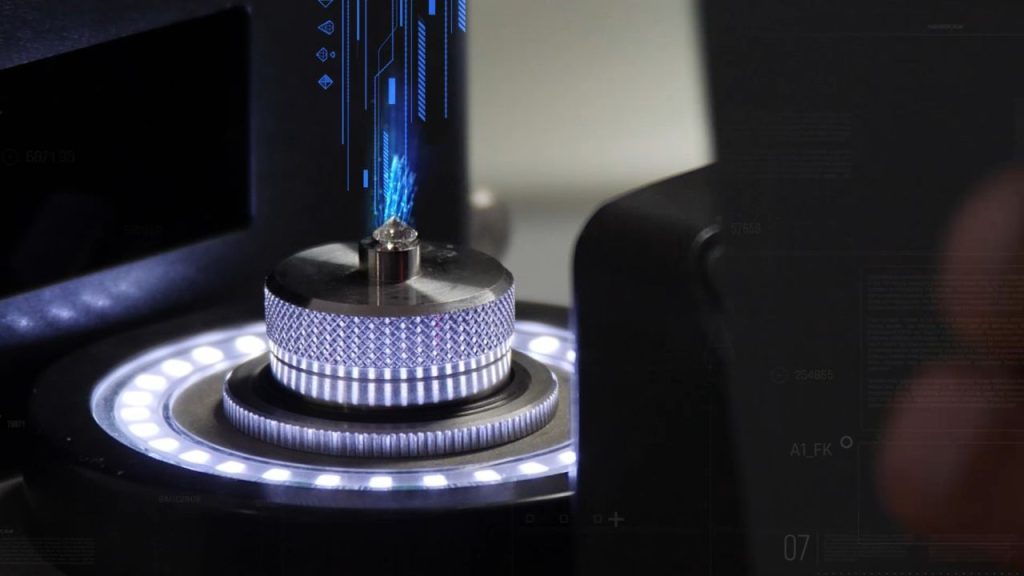

The International Gemological Institute’s laboratory in Tel Aviv recently detected a 6-carat lab-grown diamond that someone apparently was hoping to pass off as a natural stone.

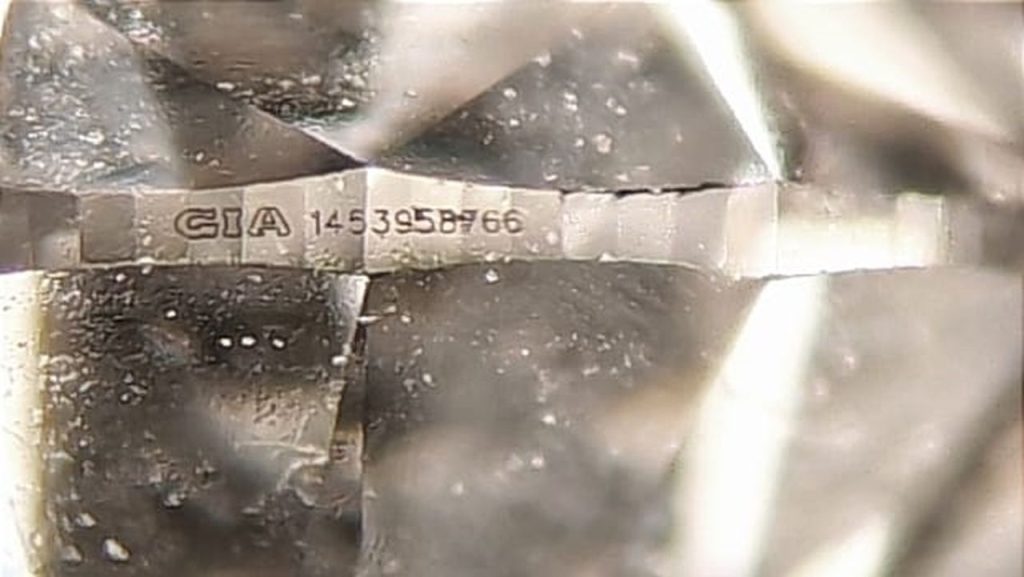

The 6.01-carat, pear-shaped synthetic diamond was fraudulently inscribed with the Gemological Institute of America report number for a G-color natural diamond of the same size and shape, but with a few key differences, IGI said in a news release issued Tuesday.

First, the lab said, photoluminescence (PL) spectroscopy, which is now widely used by grading labs to separate natural diamonds from lab-grown stones and to identify diamond treatments, shows a wavelength peak of 737 nanometers in the diamond (see chart below).

This is an indicator that the diamond was grown in a factory using the chemical vapor deposition process.

IGI photoluminescence spectra

The photoluminescence spectra for the 6.01-carat lab-grown diamond recently examined by the International Gemological Institute

Second, when examined under a microscope, IGI graders saw a carbon inclusion where the feather was indicated on the clarity plotting diagram in the GIA report.

They also noticed a cloud inclusion, resulting in IGI giving the lab-grown diamond a lower clarity grade than VVS1, the clarity grade of the natural diamond.

Lastly, there was a discrepancy between the depth of the diamond IGI examined and the depth noted on the GIA report.

“Everyone in our industry must be vigilant,” said IGI CEO Tehmasp Printer, who took over as head of the lab in October after Roland Lorie retired.

“As attempted fraud increases, the need for ongoing verification is a necessary step to protect consumers from purchasing misrepresented gems and jewelry.”

Source: DCLA